Synth is preparing to launch Synth HFT (High-Frequency Trading) in Q4 2025, marking a major evolution in its decentralized forecasting network.

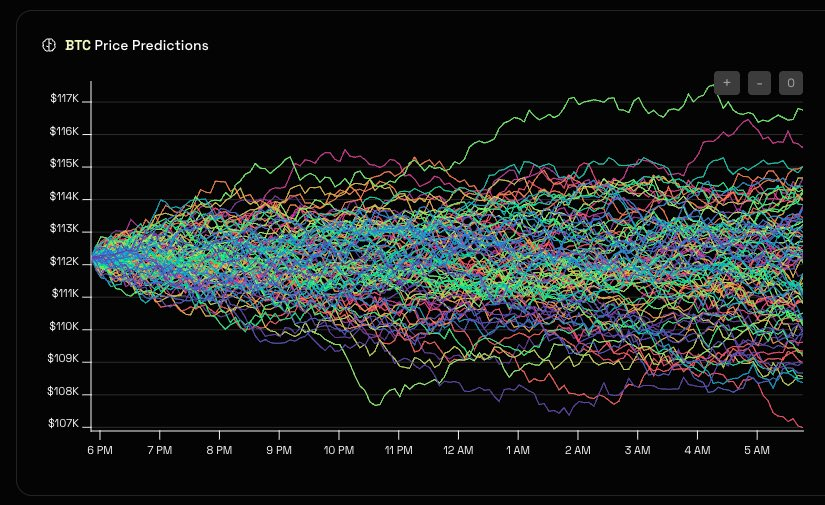

The subnet introduces 1-hour forecasting lead, designed for high-frequency trading applications where short-term precision and rapid adaptability are crucial.

By extending its existing 24-hour forecasting framework, Synth HFT captures short-term market volatility with greater accuracy – enabling faster, more dynamic strategies across platforms like Polymarket, Kalshi, and Limitless.

Multi-Timescale Forecasting System

With the launch of Synth HFT, the network is transitioning into a multi-timescale forecasting model. To support this shift, miner emissions will be evenly split (50/50) between the current 24-hour forecasts and the new 1-hour HFT forecasts.

This update, set to go live Friday (October 17), ensures both systems remain incentivized during the transition and reinforces Synth’s goal of combining long- and short-term predictive intelligence under one cohesive network.

Strategic Buyback Initiative

In addition to this, Synth is deploying a strategic buyback program funded by its six-figure treasury. The team will begin purchasing the network’s subnet token ($ALPHA) in the coming days, using profits to strengthen the $ALPHA and improve long-term value retention.

Over time, the treasury will continue to grow through additional profits, positioning Synth to secure higher emissions ahead of the halving and maintain sustainable ecosystem growth.

Predicting What Others Miss

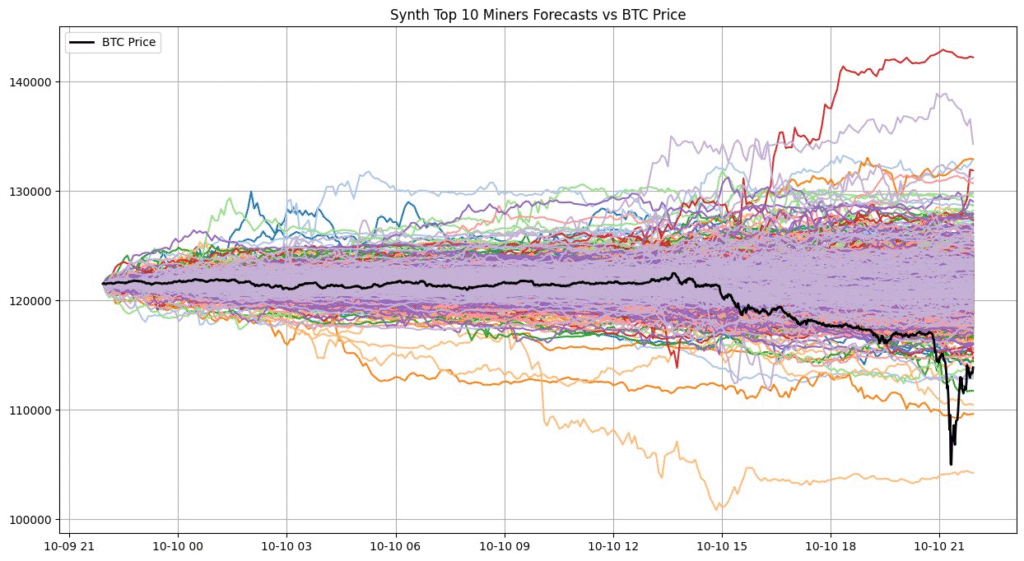

During last week’s sharp market downturn, Synth’s AI models assigned a 1–2% probability of a crash 24 hours in advance while traditional models such as Generalized Autoregressive Conditional Heteroskedasticity (GARCH) and implied volatility surfaces saw almost zero risk.

Data from Synth’s top-performing models showed several forecast paths correctly capturing the extreme downside move that eventually occurred. This highlights the network’s ability to detect rare, non-linear risk events that conventional models typically overlook.

For traders and protocols, this kind of foresight provides a real advantage — allowing them to manage exposure and adjust positions before volatility strikes.

Adaptive Intelligence

Synth’s forecasting system isn’t fixed or biased toward predicting constant risk. Models are continually scored and penalized when they overstate or understate volatility. This means forecasts adjust dynamically to reflect actual market conditions lowering volatility predictions during calm periods and increasing them when genuine risks appear.

This adaptive scoring keeps the network grounded in real-time market behavior, ensuring its forecasts remain accurate and credible.

A Step Toward Global Market Intelligence

Synth HFT isn’t just an upgrade, it’s a step toward creating the world’s most comprehensive network of synthetic pricing models. By merging decentralized forecasting with high-frequency trading intelligence, Synth is shaping a future where data-driven foresight becomes the standard across global markets.

As markets grow more unpredictable, tools like Synth’s multi-timescale forecasting could become indispensable, not just for traders, but for anyone seeking a clearer view of future’s financial landscape.

Be the first to comment