Synth has taken a major step forward in proving its market edge, reporting a 110% profit over four weeks in live Polymarket trading. Synth, grounded on Bittensor’s Subnet 50, is a tool that generates probabilistic, AI-driven cryptocurrency price forecasts to power smarter trading and decentralized finance applications.

With just a $2,000 test account, Synth executed approximately 12,000 trades totaling $500,000 in volume, validating the real-world strength of its probabilistic data models.

But beyond the numbers, this experiment served a deeper purpose — to test whether Synth’s advanced price distribution forecasts could identify an edge in volatile markets and execute profitably. The result was a resounding yes — with key lessons learned that now power the next phase of development: Synth HFT.

Testing Synth’s Probabilistic Edge

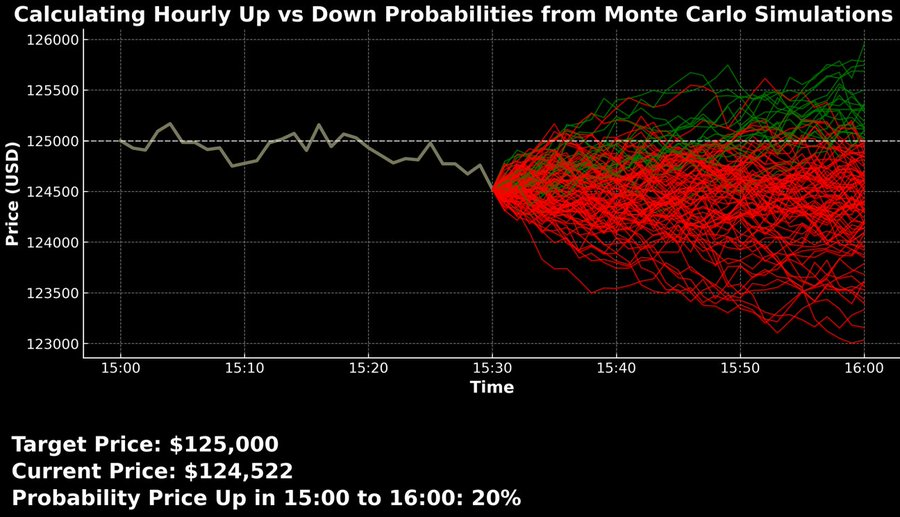

The team focused their testing on Polymarket’s “Hourly Up vs Down” markets, where participants predict whether Bitcoin’s price will finish an hour higher or lower than it began.

While Synth isn’t designed to make directional calls like a trader, these markets offered the perfect testing ground for volatility and probability distribution modeling — two areas central to Synth’s technology.

Using Monte Carlo simulations, Synth modeled how small changes in volatility or kurtosis (the sharpness of a price distribution) could dramatically shift the probability of an “up” or “down” outcome.

This proved crucial, as the slightest edge — even a 0.5% improvement in return per trade — would have doubled total profitability.

Here’s what the team discovered:

a. Synth’s 24-hour forecasts could be adapted to short-term, hourly markets with surprising effectiveness.

b. Taker trades (market orders) performed better than maker trades, especially in low-stake, fast-paced environments.

c. The model successfully generated consistent profits when run at scale and monitored closely.

However, as stakes and competition increased, Synth encountered the limits of its 24-hour framework. Market makers with high-speed systems demanded finer temporal resolution — more frequent updates, faster reaction times, and deeper modeling of short-term volatility.

This realization paved the way for the next major evolution: Synth HFT.

Introducing Synth HFT, the High-Frequency Intelligence for Real-Time Markets

The new Synth HFT (High-Frequency Trading) initiative is being developed to transform Synth’s forecasting engine into a real-time data layer for traders, funds, and AI agents operating in fast-moving markets.

Synth HFT upgrades the core model in several key ways:

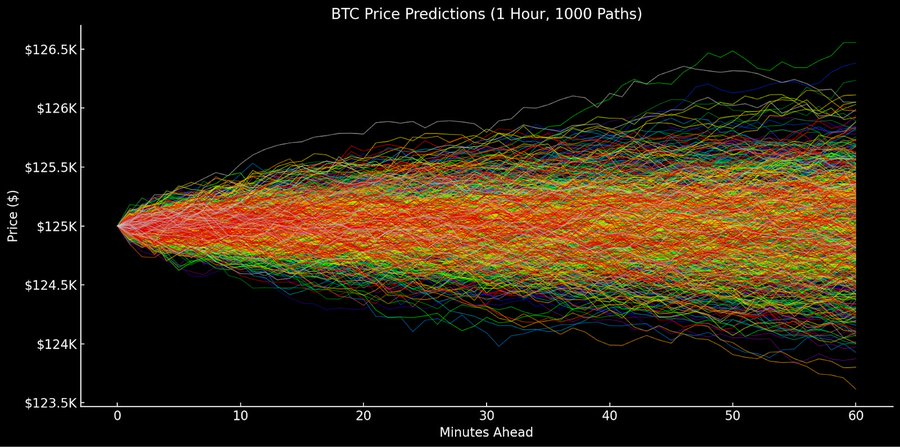

a. Forecast horizon shortened from 24 hours to 1 hour

b. Prediction intervals refined from 5 minutes to 1 minute

c. Update frequency boosted from 1 hour to every 2 minutes

d. Simulation density expanded from 100 to 1,000 paths for richer probabilistic accuracy

e. Market focus shifted toward prediction and options markets, where volatility sensitivity drives value

These improvements make Synth HFT capable of modeling the rapid micro-movements that define short-term trading, allowing traders to capture opportunities that traditional models miss.

Why This Matters for the Future of Trading

Prediction markets and crypto derivatives are two of the fastest-growing sectors in decentralized finance. They demand precision, speed, and data depth — the exact capabilities Synth HFT is engineered to deliver.

By introducing high-frequency forecasting with rapid updates and dense simulations, Synth is positioning itself as the intelligence backbone for decentralized trading — a system that can scale from small retail traders to institutional-level strategies operating across markets with $100 million+ daily volume.

Synth’s roadmap for HFT extends beyond data innovation. The project aims to:

a. Scale team operations and bring on top quant researchers and engineers.

b. Launch a strategic buyback wallet, ensuring consistent support for the Synth’s Alpha token.

c. Use all trading revenue to strengthen subnet economics and reinforce Synth’s standing as a top 10 subnet in the Bittensor ecosystem.

From Research to Execution

The experiment on Polymarket demonstrated that Synth’s probabilistic modeling is not just theoretical — it performs in real markets with measurable success.

The path from data science to live trading execution is complex, but Synth has proven its infrastructure can navigate both sides: research-driven precision and execution-level profitability.

The upcoming rollout of Synth HFT will extend that success to broader, higher-frequency markets, ensuring that the subnet continues to evolve alongside the most advanced trading infrastructures in DeFi.

In time, Synth plans to provide public access to its live trading protocol, allowing the community to verify its edge firsthand and track the evolution of a new class of decentralized trading intelligence.

Final Thoughts

Synth’s 110% return marks more than just a successful test — it signals a turning point in the intersection of AI modeling and decentralized finance.

As Synth transitions into the high-frequency era, it is building not only a profitable trading framework but also the foundation of a data infrastructure layer that can power the next generation of on-chain intelligence.

Synth’s mission remains clear: it is to prove that probabilistic modeling, decentralized execution, and transparent incentives can outperform even the fastest centralized trading systems.

Useful Resources

Website: https://www.synthdata.co

X (Formerly Twitter): https://x.com/SynthdataCo

Discord: https://discord.gg/TtS4F2ZY

Be the first to comment