Contributor: LadyofTAO

October 9, 2025 — Yuma, a subsidiary of Digital Currency Group (DCG) and a core contributor to the Bittensor decentralized AI network, has launched Yuma Asset Management, a new division supported by a $10 million seed investment from DCG. The move provides institutional investors with a rare, professionally managed entry point into the decentralized AI (deAI) ecosystem.

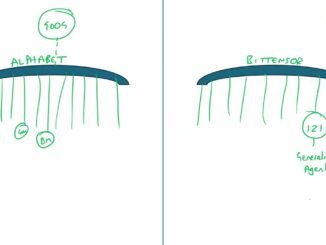

The platform will focus on subnet tokens, Bittensor’s native asset class, offering simplified exposure through two fund products:

The Subnet Composite Fund, which mirrors a broad, market-cap-weighted index of all active subnets, and The Large Cap Subnets Fund, which targets top-performing AI networks on Bittensor.

Yuma also announced the addition of Geoff Schvey (COO) and Jeff Schvey (CTO) to its leadership team — both seasoned founders and long-time contributors to the $TAO ecosystem.

“We’re launching two products today that offer easy access to over 100 subnet tokens on Bittensor,” said Jeff Schvey, Yuma’s newly appointed CTO. “The Subnet Composite Fund offers broad exposure — think of it like the NASDAQ Composite — while the Large Cap Subnet Fund gives targeted exposure to the top performers, similar to the Dow Jones. We handle the hard stuff for you: buying, secure key management, and rebalancing.”

These funds are designed to remove the technical hurdles that have previously kept institutional capital on the sidelines of decentralized AI.

“Subnet tokens are a new frontier in digital assets, backed by $TAO, and they give investors a unique opportunity to ride the next wave of AI innovation,” added Barry Silbert, CEO of both Yuma and DCG. “We believe decentralized AI could be as transformative as Bitcoin.”

Each Bittensor subnet represents a decentralized AI service — from fraud detection to image analysis — operated by independent teams. The pairing of $TAO liquidity with subnet-specific emissions allows subnet tokens to reward useful AI contributions.

With the launch of Yuma Asset Management, the firm is laying the foundation for regulated, institution-friendly access to one of the most rapidly evolving sectors in Web3.

Be the first to comment