Financial institutions are dealing with failure points that, by now, are well-quantified. Weak anti-money-laundering programs have led to $321 billion in fines over the past fifteen years. Across the United States and Canada, institutions spend roughly $61 billion per year on compliance processes and independent testing.

Globally, financial crime is estimated to cause $2 trillion in economic harm annually, while the United States alone records around $450 billion in fraud losses every year. Regulators have added pressure with over $315 billion in penalties for sanctions and AML failures during the same period.

Yet, at this scale, most institutions still test their systems with small static samples and internal synthetic identities. Internal teams seldom create enough variations that would represent real-world attempts at evasion.

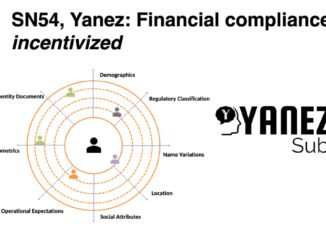

They lack the adversarial logic required to expose blind spots, and testing cycles tend to occur only a few times a year. Yanez MIID (Subnet 54) exists to address that gap directly by generating identity variations designed to challenge screening, onboarding, and monitoring systems under real conditions.

What MIID Actually Solves

Most often, banks and fintechs, along with their KYC vendors, rely on internal engineers to create a small number of fake profiles—a slow process that pulls developers away from the core systems. These internal datasets rarely include the thousands of identity changes that real sanctioned individuals or fraud networks use. MIID replaces these small static samples with continuous identity generation at scale.

Name variation is the focus of the subnet’s early phase, since name manipulation is so common in sanctions evasion. A single sanctioned name can take a multitude of forms once phonetic changes, spelling variations, character swaps, transliteration drift, and structural rearrangements are applied. MIID automatically generates such variations and assesses the response of screening systems.

This reward function incentivizes responsiveness, the number of valid variations up to a prescribed cap, and the quality of similarity. As was stated in the video provided below, top miners make around $20 per day, which works out to roughly 0.06 Tao, but this is subject to variation as the subnet emission changes. The subnet is going to expand far beyond name variations.

Case One: Sponsor Bank, Third-Party Risk Blindness

As one major sponsor bank in the United States, identified by its conservative compliance posture and general reliability, summed up its situation: “We are flying blind.” Sponsor banks license services like payments, cards, and account access to third-party fintech programs. These programs rely on the bank’s license, and the bank is responsible for their compliance. Yet, the standard oversight method is a long questionnaire that asks, for example, whether a fintech partner performs sanctions screening with a simple “Yes/No.”

This all has real-world consequences. In the past two years, there have been 13 enforcement actions against sponsor banks for lack of adequate oversight over the screening systems of their partners. The bank in this case operates with over 100 different fintech partners with different logics and risk controls for each.

Yanez worked with them to set a benchmark of the bank’s internal sanctions-screening capability. MIID-generated identities were then used to test partners against that benchmark. Those performing below the line would enter improvement plans monitored through Yanez’s platform.

Case Two: Document Verification Provider, Printed and Screen-Capture Attacks

Document verification systems are particularly vulnerable to image capture-based attacks where an attacker submits a photo of a printed document, a photo of a document displayed on the screen, or an image distorted through angles, glare, curvature, or inconsistent cropping. Conventional document verification pipelines rely on templates or ML models that were not trained on these edge-case distortions.

Creating high-quality training data is expensive. Most of the top providers spend approximately $500,000 every year acquiring or synthesizing the data for such edge conditions. The work is slow, highly manual, and seldom covers enough variation in the real world to be effective.

MIID creates distorted document variants from a single real capture. These variants challenge the verification systems and give examples for training that in any other case would take several months to develop. Early versions of these models already work and are designed to scale further as MIID expands.

The provider in this case is in procurement for a $50,000 POC. If it succeeds, the contract expands to $250,000 per year, with multi-year potential. This provider is one among roughly 100 identity-verification vendors globally who face similar data shortages.

Case Three: Global Orchestration Layer, Coverage Gaps They Could Not See

A globally deployed identity-verification orchestration platform came to Yanez with a question they could not answer for themselves: “Which regions do their four screening vendors actually cover with reliable sanctions and PEP data?” Their customers range from border-security agencies, online gaming firms, to banks, fintechs, and consumer platforms. They operate in nearly every non-sanctioned country.

MIID testing did indeed find that PEP coverage was weak in one major region. The product manager in charge of that region responded with a straightforward assessment: “We didn’t know it sucked so much.” The finding reset their vendor-management plan, showing which providers worked and where the gaps lay. It indicated which vendors needed escalation or replacement. It also proved that MIID could create complete jurisdictional datasets besides test datasets.

A consulting firm had presented a plan to deliver similar coverage assurance for $400,000 per year. The orchestration platform chose Yanez instead, at roughly 10% of that cost, with a multi-year agreement already in place.

Inside the MIID Subnet: How It Works and Why It Matters

The MIID subnet uses the Bittensor network to distribute identity generation across global miners. Miners produce variations of identities, validators evaluate them in real time, and rewards are directly related to usefulness. Because identities behave differently across languages and regions, a distributed network is much better suited to generating realistic variations than a centralized team.

The subnet is already being designed for broader data types. Location obfuscation is part of the future phase, which includes manipulation through IP, region, and geographic distortion.

Closing

These three cases—representing sponsor banking, document verification, and global orchestration—present various systems failing for the very same reason: identity testing, to date, has not kept pace with evasion tactics. MIID provides the missing foundation. It uncovers weaknesses through synthetic but realistic identity variations and provides institutions with a measurable way to assess their defences.

Numerical data behind these cases indicates that the need in the market is immediate: over $321 billion in fines, $61 billion in annual compliance cost, $2 trillion in global crime impact, $450 billion in U.S. fraud losses, 13 enforcement actions, hundreds of partner programs, and multi-hundred-thousand-dollar contracts all point in the same direction: systems need testing that reflects how criminals actually operate. MIID is built to provide just that.

Be the first to comment