Contributor: School of Crypto

Wrapped tokens have become an essential part of the crypto ecosystem. Native blockchains such as Bitcoin were siloed in their respective networks with no way to use their value in other ecosystems.

The advent of Wrapped BTC (WBTC) and others had turned Bitcoin into almost a $20 billion market. Then, LIDO staked ETH created a whole new market called liquid staking. This took wrapped Ethereum tokens and transformed them into yield-bearing assets that people could easily custody. Now, liquid staked tokens throughout crypto make up over a $72 billion market cap. These wrapped tokens have been heavily utilized in DeFi protocols like lending, borrowing, staking, farming, and other derivatives.

Bittensor’s native token TAO has a similar blockchain that’s not as accessible as an Ethereum-based network. Builders from across the network are introducing wrapped-TAO solutions for people outside of the blockchain to acquire in an easier fashion.

As of today, there are five wrapped TAO tokens for people to utilize: Wrapped TAO (wTAO) on Ethereum, Staked TAO (sTAO), TensorPlex TAO (tTAO), Wrapped TAO (wTAO) on Solana, xTAO, and vTAO.

Alongside the wrapped TAO tokens, there is another roadblock getting in the way of liquidity flowing into the ecosystem: subnet alpha tokens.

Some of these projects with wrapped TAO solutions have also introduced wrapped subnet tokens so crypto users can acquire and trade them in other non-Bittensor blockchains.

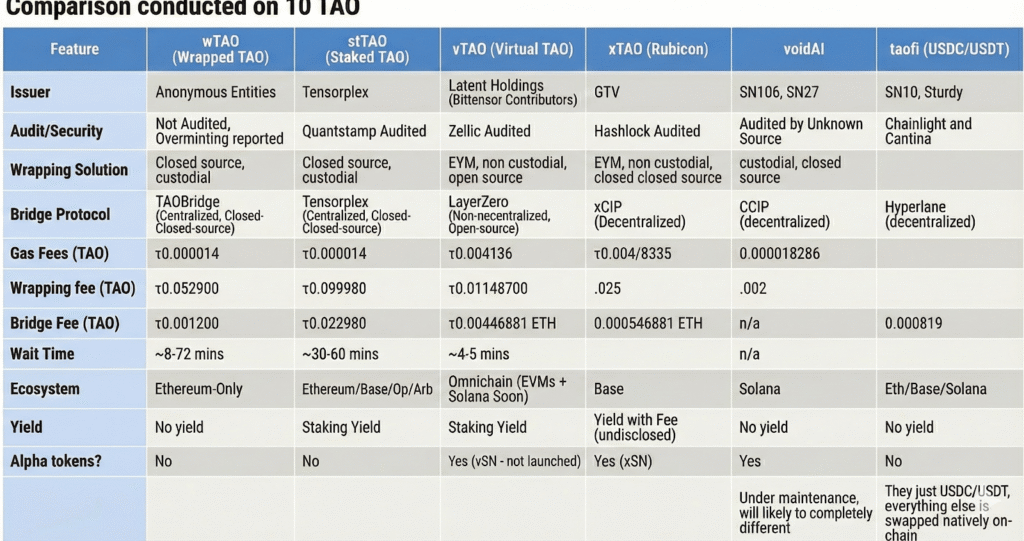

Let’s analyse all the options and weigh each of their pros and cons in accordance to its fees, bridge routes, staking capabilities, team, decentralisation, and more.

Wrapped TAO (wTAO) on Ethereum

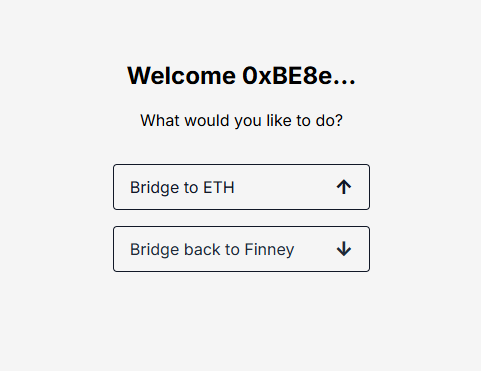

The first TAO token to officially be wrapped was Wrapped TAO, on the Ethereum blockchain. The anonymous developer Creative Builds, introduced taobridge.xyz on January 30th, 2023 as the first-ever bridge for TAO (onto Ethereum).

Years later, over 107,000 wTAO tokens have been minted. The Uniswap wTAO/ETH liquidity pool currently has over $3 million in TVL. wTAO has millions of dollars in 24-hour volume. The code is closed-source and fully custodial product with no disclosed audits having been conducted.

TAO bridged to wTAO is not staked and bears no yield for the holder. Creative Builds himself purposely did not introduce the staking feature based on the fact that “it would be the only thing incentivizing people to bridge back to the main chain.” The bridge therefore retains the yield from all TAO deposited.

Wrapped TAO is currently the highest TVL wrapped token in the Bittensor ecosystem with the most circulating supply.

The bridge is strictly for TAO without any subnet alpha functionality.

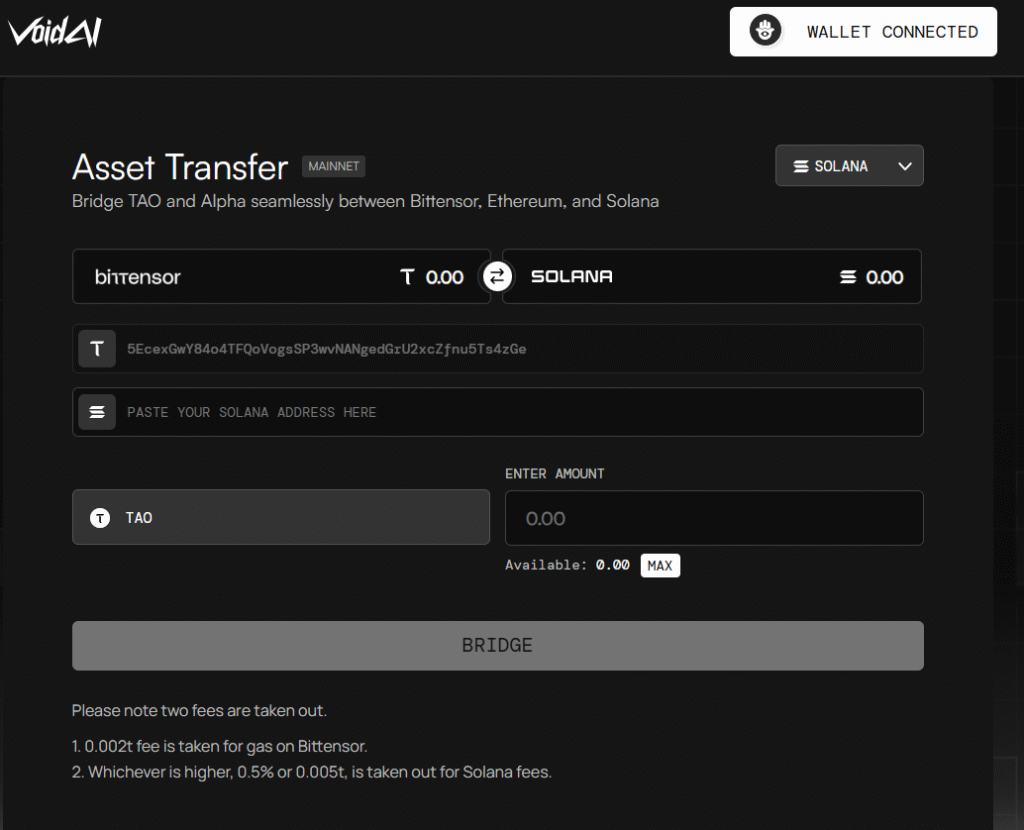

Wrapped TAO (wTAO) on Solana and Ethereum (VoidAI)

VoidAI was the first project to build a bridge between Solana and Bittensor back in March, 2025. This brought TAO onto the popular Solana blockchain. Recently the wTAO/USDC pool on the AMM Raydium reached $5,000,000 in transaction volume after the first week of November.

In July of this year, VoidAI created an automated smart contract bridge between Bittensor and Solana to remove manual steps and ensure that transfers were trust-minimised.

VoidAI received an audit a little over a month ago, which was announced on a Mark Jeffrey Hashrate episode in October. Although the report is not public, they stated that the report came back with no vulnerabilities revealed.

Last month VoidAI announced an addition to their bridge extending functionality to the Ethereum blockchain. In December the team will be incorporating the CCIP integration from Chainlink so their bridge will go from being chain-specific to useable across all CCIP-supported networks. This will fuel interoperability scaling to the next level.

The bridge is currently under construction and will be opened this week, according to their Discord.

Analysing deposit and withdrawal extrinsics, it appears the wrapped tokens are signed by keys and not managed via TAO-native smart contracts. This suggests the wrapped TAO and subnet tokens are likely custodial. TaoDaily is still waiting to hear back from the VoidAI team to confirm or clarify.

Currently, staking yield with VoidAI’s wrapped tokens is not passed to the user. However, users can provide liquidity in their wTAO/USDC pool earning fees up to 688% APR as a post last month illustrated.

VoidAI allows users to swap wTAO for any subnet token. The pools are located on one of Solana’s most popular AMMs, Raydium.

Most of the subnet pools have very little liquidity in them. Based on that fact, there may be an issue in trading with size and users may experience high slippage until more liquidity is present.

However, the team recently came out with a new update and direction of the operation addressing this liquidity crunch. They will be using some of the collected protocol fees to provide more liquidity into their subnet pools.

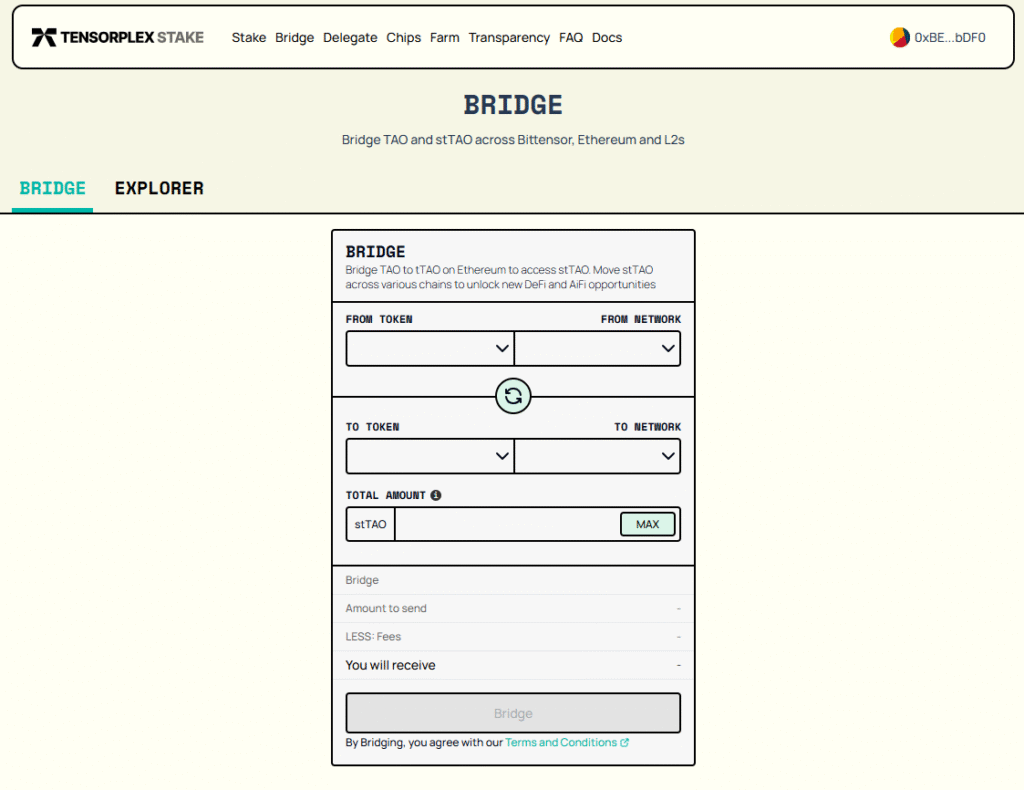

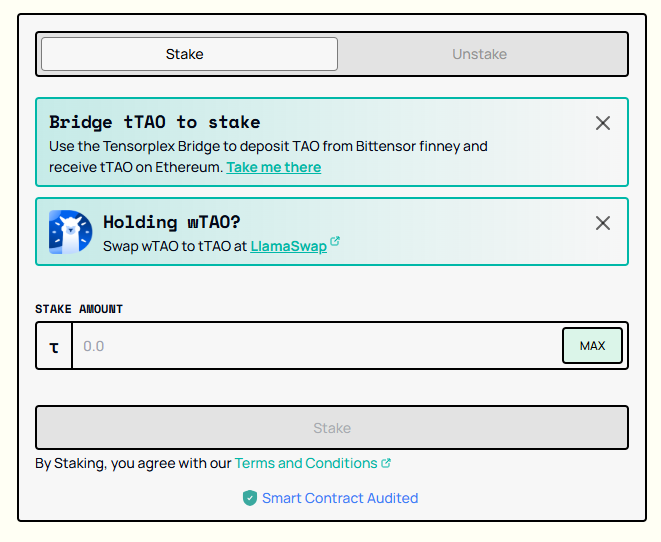

TensorPlex TAO (tTAO) and Staked TAO (sTAO)

TensorPlex, creator of subnet 52, provides two types of wrapped TAO tokens: TensorPlex TAO (tTAO) and Staked TAO (sTAO).

TensorPlex was the first provider of a liquid-staked TAO (sTAO) product. TensorPlex Labs has a goal to build foundational railways for open source A.I. development and apps on the Bittensor network.

They provide a closed source, custodial bridge that allows users to transfer their native TAO into tTAO. The bridge has been audited by a couple of firms with the reports published.

Quantstamp conducted a thorough review of the bridge’s overall architecture and smart contracts. Then they used Zellic to conduct a security assessment of the bridge’s relay infrastructure in order to expose any vulnerabilities.

Once native TAO is bridged to tTAO, it can be deposited and staked on their staking page. This converts tTAO to stTAO, allowing holders to retain yield on their TAO deposits. stTAO’s contracts were audited by Quantstamp. The current APY of stTAO is 22.30% in accordance to their Transparency Dashboard, and should match the root APY on Bittensor.

There are 1,010 current tTAO stakers with a total of $3.2 million TVL. Like wTAO, tTAO and sTAO are fully custodial, which means the native tokens are in the possession of TensorPlex’s bridge infrastructure.

TensorPlex currently does not offer wrapped alpha tokens.

Project Rubicon (xTAO)

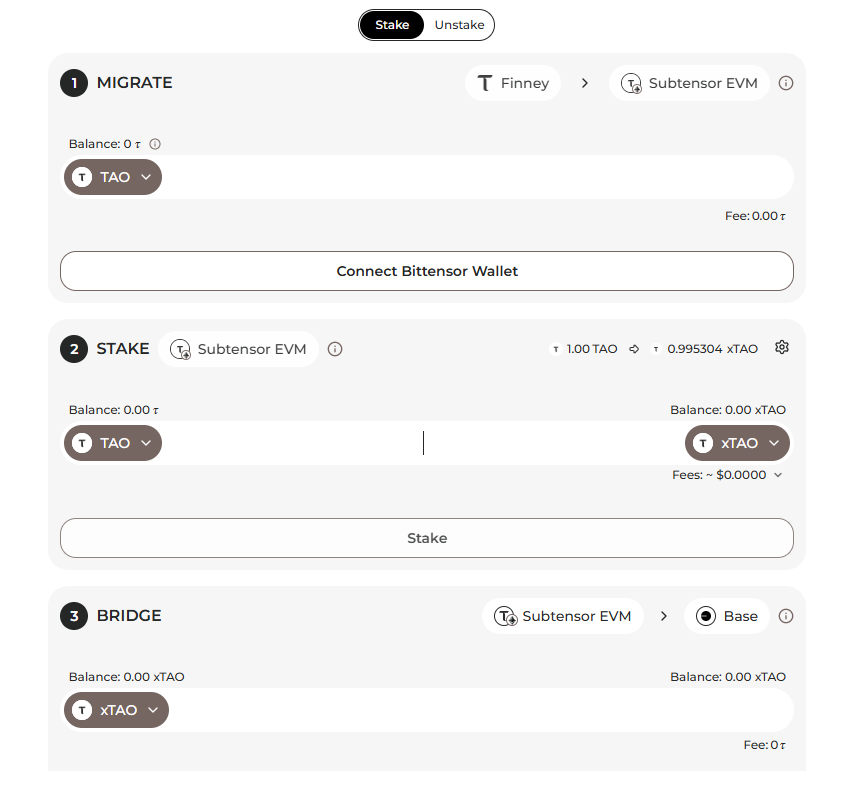

Project Rubicon, brought to you by GTAO Ventures (GTV), launched last month. They provide a liquid-staking solution called xTAO.

Users are able to migrate, stake, and bridge their TAO and subnet alpha via the Rubicon bridge interface. After sending TAO (or alpha) to the Bittensor EVM, users can wrap and stake for xTAO and xAlpha. These wrapped tokens can be bridged to Ethereum, Base, Optimism, or Arbitrum, all while retaining staking yield.

In a press release on November 17th, GTAO Ventures announced they have added and deployed liquidity for 17 of the most popular subnet tokens on their platform including Top 10 projects such as Ridges, Affine, Chutes, Lium, Vanta, Targon, Templar, Gradients, and Iota.

Partnering with some of the mentioned subnets, GTV has seeded liquidity and deployed $300k of liquidity to USDC pools with each of the wrapped tokens; making transactions feasible for users with standard slippage.

Visit the Aerodrome liquidity pool page, and search for one of the listed subnets on the press release. Then swap your USDC on Base for your favorite subnet alpha token

The Rubicon bridge has had a couple of audits conducted by Hashlock in October; one being a penetration report and the other being a Smart Contract audit report. As with VoidAI, Rubicon utilizies Chainlink’s CCIP to bridge.

The smart contract code for xTAO and xALPHA is closed source and reportedly non-custodial.

Virtual TAO (vTAO)

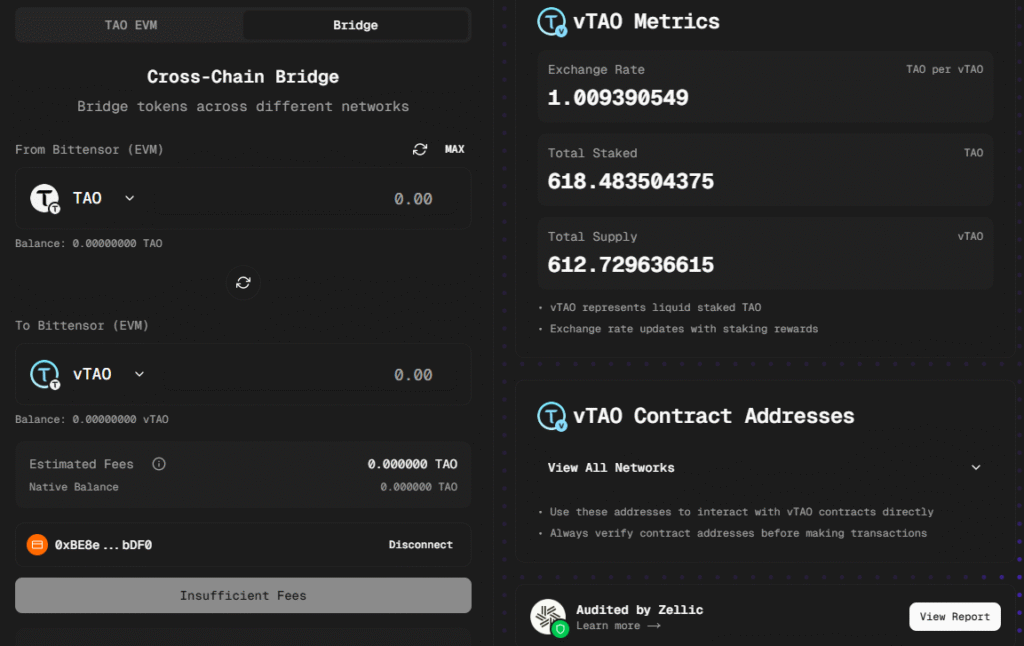

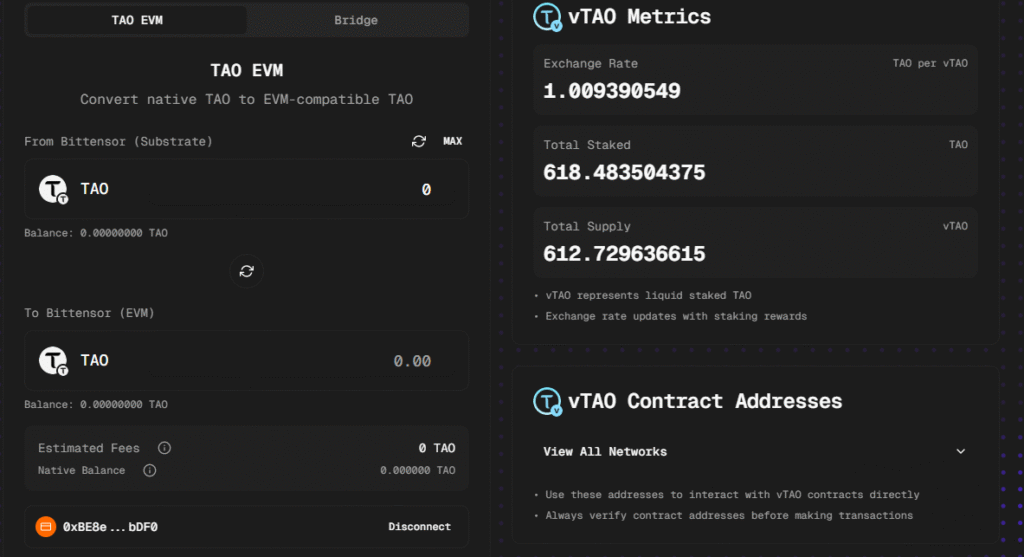

TAOApp, the popular destination for charts, explorers, analytics, and staking came out with the liquid staking TAO product Virtual TAO, or vTAO, in October of this year.

vTAO is officially the first non-custodial TAO product on the market that’s fully owned by the user. The liquid staked TAO token is also the first to be built with open source code.

vTAO has been fully audited by Zellic. Zellic specifically examined the vTAO contract’s security, logic, and code quality. No high severity issues were uncovered in the audit.

Users simply transfer their TAO to the Bittensor EVM, then wrap and stake it for vTAO. vTAO can then be bridged Cross-Chain to Base, Ethereum, Arbitrum, and more. . There are currently over 600 TAO wrapped and staked to vTAO.

The team has plans of integrating Solana soon and subnet alpha tokens even sooner.

The team is also adding vTAO support to Morpho, the popular crypto lending application. vTAO would have it’s sights on being a fully lendable and collateral asset while in the background accruing yield for the user.

Tao.app is also awaiting a second audit completion. Once the audit comes back, it will provide wrapped alpha subnet tokens to the community.

USDC to EVM TAO and Alpha (Taofi)

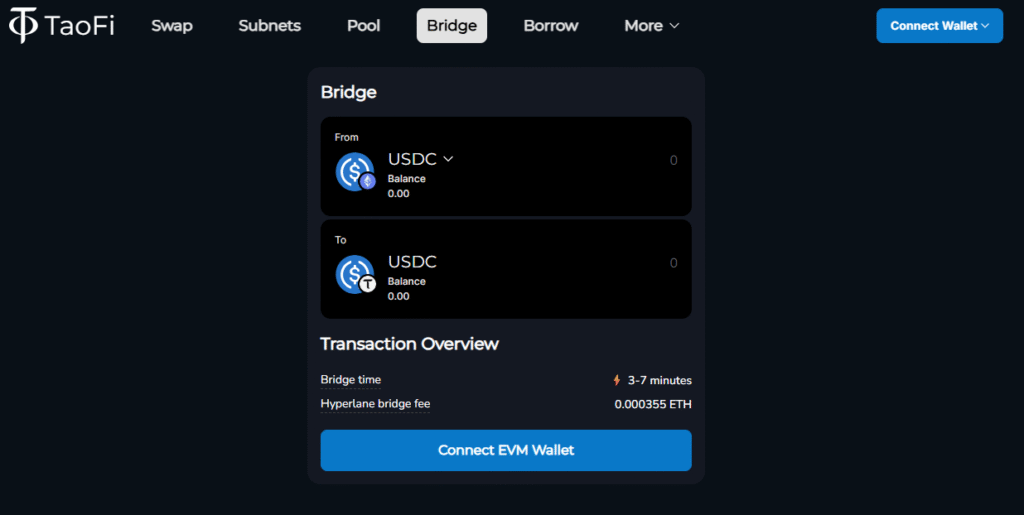

TaoFi, developed by contributors from the Sturdy protocol and Bittensor’s Subnet 10 (Swap), launched in early 2025 as a DeFi suite for the Bittensor ecosystem. It enables easy access to TAO and subnet alpha tokens via cross-chain bridges, swaps, and staking, connecting Base, Solana, Ethereum to the Bittensor EVM.

Users bridge native TAO to Bittensor EVM using a Hyperlane-powered, trust-minimised bridge. Users can bridge a minimum of $100 USDC from Ethereum/Base and include 0.01 TAO for destination gas. On Bittensor EVM, TAO can be staked to sTAO, a liquid-staked token earning native yields.

For subnet alphas, TaoFi offers single-transaction cross-chain swaps from Base: swap USDC, bridge to Bittensor EVM, exchange for TAO in liquidity pools, and convert to subnet tokens via EVM precompiles while all being automated. The alpha subnet tokens are auto-staked to Sturdy Validator for rewards. Liquidity comes from Uniswap V3 on Bittensor EVM.

The platform has been audited by Chainlight and Spearbit Cantina for security and bridges, with clean reports and partial open-source code on GitHub; it relies on Hyperlane for decentralization.

The team has plans for an upcoming Morpho borrowing integration for sTAO as collateral. TaoFi ultimately simplifies external access to Bittensor liquidity without full custody risks.

Conclusion

The wrapped TAO and subnet alpha token landscape has rapidly evolved from Creative Builds’ pioneering wTAO bridge in early 2023 to a diverse ecosystem of solutions spanning multiple blockchains today.

Each option presents distinct trade-offs. Creative Builds’ wTAO maintains dominance with over 107,000 tokens minted and $3 million in Uniswap liquidity, but remains custodial without staking. TensorPlex offers the most mature staking product with sTAO’s 22.30% APY and dual audits, though it’s also custodial.

For users prioritizing decentralization, vTAO stands alone as the only non-custodial, open-source option with broad chain support and plans for Morpho lending integration. They will also offer wrapped alpha subnet tokens to potentially be one of the most well-rounded wrapping solutions in Bittensor.

Meanwhile, Project Rubicon’s xTAO delivers the most comprehensive subnet alpha access with 17 tokens backed by $300,000 in liquidity dispersed among its pools. They also provide staking yield for users with TAO and subnet alpha tokens.

v0idAI bridges TAO to Solana with upcoming Chainlink CCIP integration for cross-chain messaging. They also provide a bridging solution to the Ethereum blockchain as well. TaoFi does a good job simplifying the onboarding experience through Hyperlane-powered bridges and automated subnet token swaps from Base.

The advent of these wrapped solutions signals growing demand for TAO liquidity across DeFi. As Chainlink integrations roll out and platforms like Morpho add lending support, wrapped TAO products will likely play an increasingly critical role in connecting Bittensor’s AI infrastructure to the broader crypto economy.

Be the first to comment