Not long ago, mining on Cartha/0xMarkets (SN35) was mostly for whales. You needed $100,000+ to lock into vaults and qualify for meaningful rewards.

That’s changed.

Now, anyone can participate with almost any amount of capital (even ~$5) by providing liquidity to Cartha’s markets and earning incentives in return. No GPUs. No mining rigs. No command line (BTCLi). Just USDC, a wallet, and a browser.

If you’ve ever wanted exposure to Bittensor mining rewards without running infrastructure, this is one of the simplest entry points in the ecosystem.

What Is Cartha (SN35)?

Cartha (SN35) is a Bittensor subnet powering 0xMarkets, a decentralized perpetual futures DEX where users can trade:

- Forex pairs

- Crypto

- Commodities

- and other leveraged markets

Instead of rewarding miners for compute, SN35 rewards liquidity providers for helping the platform function efficiently.

This means “mining” on Cartha doesn’t involve GPUs. It’s essentially liquidity provision and Bittensor incentives.

How Mining Works on SN35

The easiest way to participate is through federated mining.

As a federated miner, you provide liquidity by locking USDC into vaults on Base Mainnet. That liquidity supports traders on 0xMarkets and you get paid for it.

Your rewards come in two ways:

1) Trading Fees

Liquidity providers (LPs) earn a proportional share of real trading activity.

- 50% of trading fees go to LPs

2) ALPHA Emissions

On top of fees, you also earn SN35 ALPHA token emissions, based on:

- your deposit size

- how long you lock funds

- vault performance

So you earn fees and emissions at the same time.

Why This Is Interesting

This is one of the few subnets where you can earn Bittensor incentives without technical setup.

Key benefits include:

- Earn yield from real trading activity

- Non-custodial: your funds stay in smart contracts, not with a third party

- Simple setup: no hardware, no CLI, no node running

If you’re stacking stablecoins anyway, it’s a straightforward way to put them to work.

Requirements to Get Started

To mine on Cartha, you need:

- An EVM wallet (MetaMask, Rabby, Coinbase Wallet, etc.)

- Wallet connected to Base Mainnet

- Some ETH on Base for gas (usually low)

- USDC on Base

- A principal miner hotkey (SS58 address, starts with “5”)

- A Bittensor coldkey to claim ALPHA rewards

- You can create this via Talisman or Bittensor CLI

Step-by-Step: How to Start Mining as a Federated Miner

Step 1: Set Up Your Wallet

- Add Base Mainnet to your wallet

- Bridge USDC to Base if needed

- Generate your coldkey

Step 2: Visit the Cartha Interface

Go to: https://cartha.finance

- Connect your wallet

- Switch network to Base Mainnet

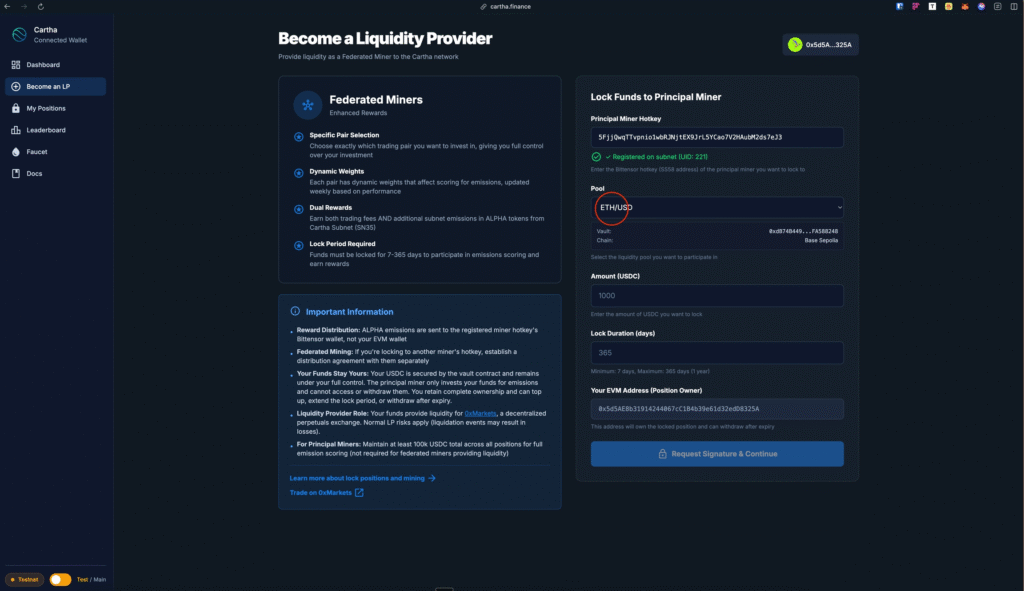

Step 3: Choose a Pool + Principal Miner

- Select a market vault (BTC/USD, ETH/USD, etc.)

- Paste the principal miner hotkey (from leaderboard/dashboard)

- Enter your USDC amount

- Choose your lock duration (7–365 days)

- Approve USDC — First, approve the vault contract to spend your USDC. Confirm in your wallet (requires a small gas fee in ETH). After approval, confirm the second transaction to lock your USDC in the vault.

- Once confirmed, your liquidity begins earning.

Longer locks = higher deposit score and larger share of rewards.

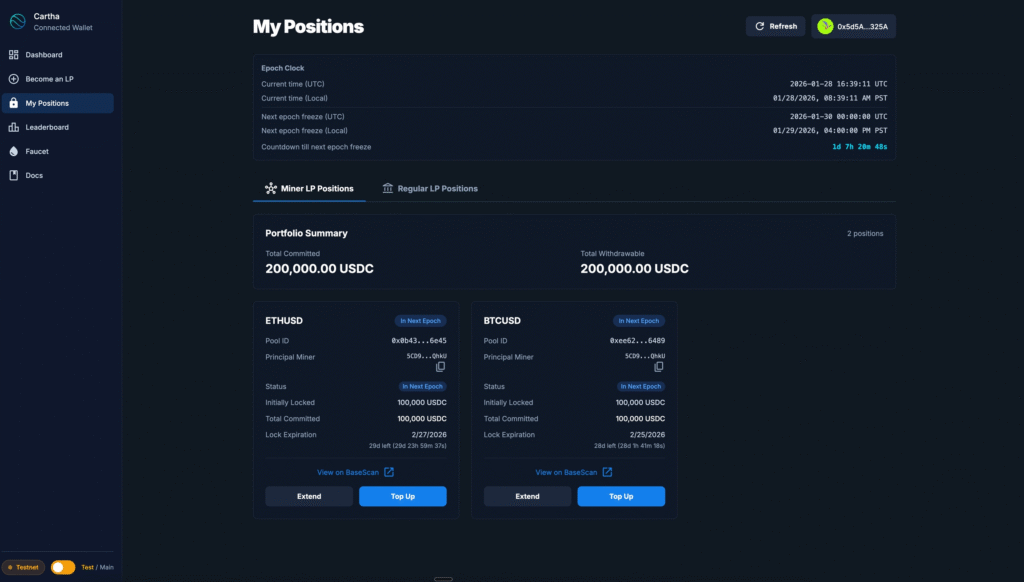

Step 5: Monitor Your Position

In your dashboard, you can track:

- earnings estimates (24h/7d)

- vault performance

- total rewards accumulated

You can also:

- top up your position

- extend your lock period

- withdraw after expiry

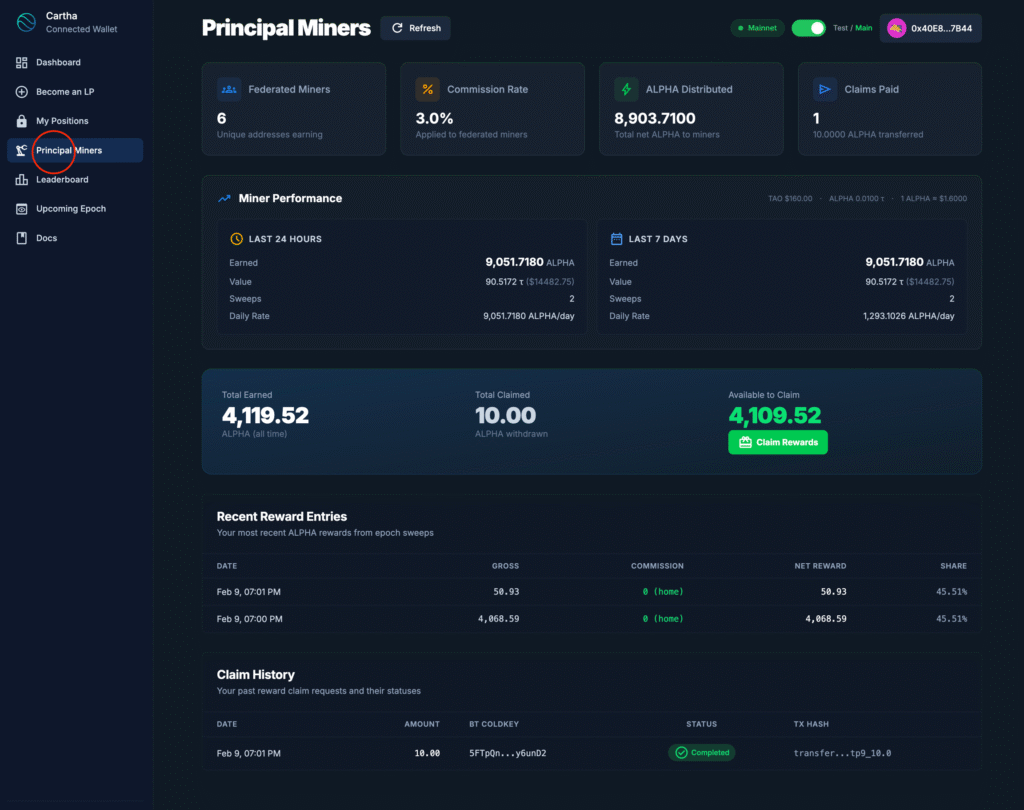

Step 6: Claim Your Rewards

Rewards run on weekly epochs (Friday–Thursday UTC).

To claim:

- enter your Bittensor coldkey

- sign with your wallet

- claim ALPHA rewards (after principal miner commission, often ~3%)

Risks

This is still DeFi. Risks include:

- smart contract risk

- market risk and liquidity conditions

- yield fluctuation (fees depend on volume)

- vault-specific performance risk

Always do your own research (DYOR) and only lock funds you’re comfortable with.

If you have stablecoins sitting idle, you can now deposit any amount, support real trading on 0xMarkets, and earn fees/ALPHA emissions as a federated miner.

Start here: https://cartha.finance

Check docs for more information: https://docs.0xmarkets.io/cartha/federated-miner-guide

Be the first to comment