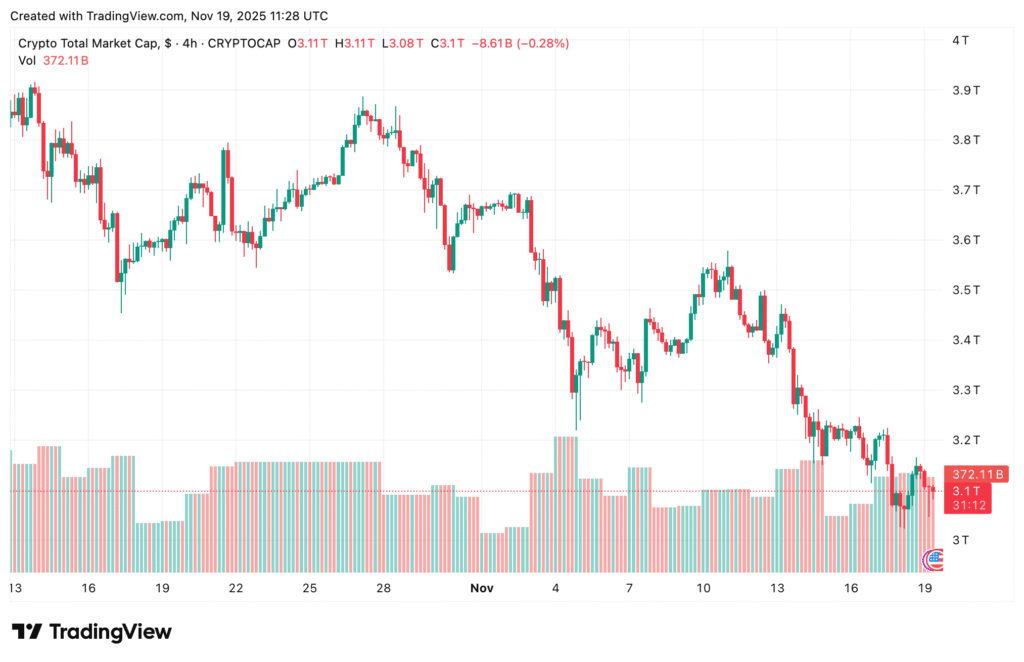

Patterns repeat with almost poetic consistency in crypto. Whenever Bitcoin takes a hit, everything else is pulled down with it. This week is no different. Bitcoin is trading at $93,193, recovering from a dip below $90,000, while Ethereum sits at $3,122. Even high-potential altcoins such as Bittensor’s TAO at $331.91 have followed the same downward trajectory.

This synchronized slump has become a familiar November theme. It is not a sign of collapse. It is a sign of consolidation.

The truth is simple. Crypto’s hyper-correlation always appears near cycle turning points. When everything drops together, it usually means everything is about to rise separately.

We are moving toward that moment now.

The Correlation: A Signal of Strength, Not Weakness

Bitcoin’s recent twenty percent decline from its $126,000 peak dragged Ethereum down more than thirty five percent. TAO and similar assets followed suit.

Institutional flows amplified the sell pressure. Bitcoin ETFs saw $1.15 billion in outflows in recent weeks as large holders secured profits.

Yet the market is not breaking. It is resetting.

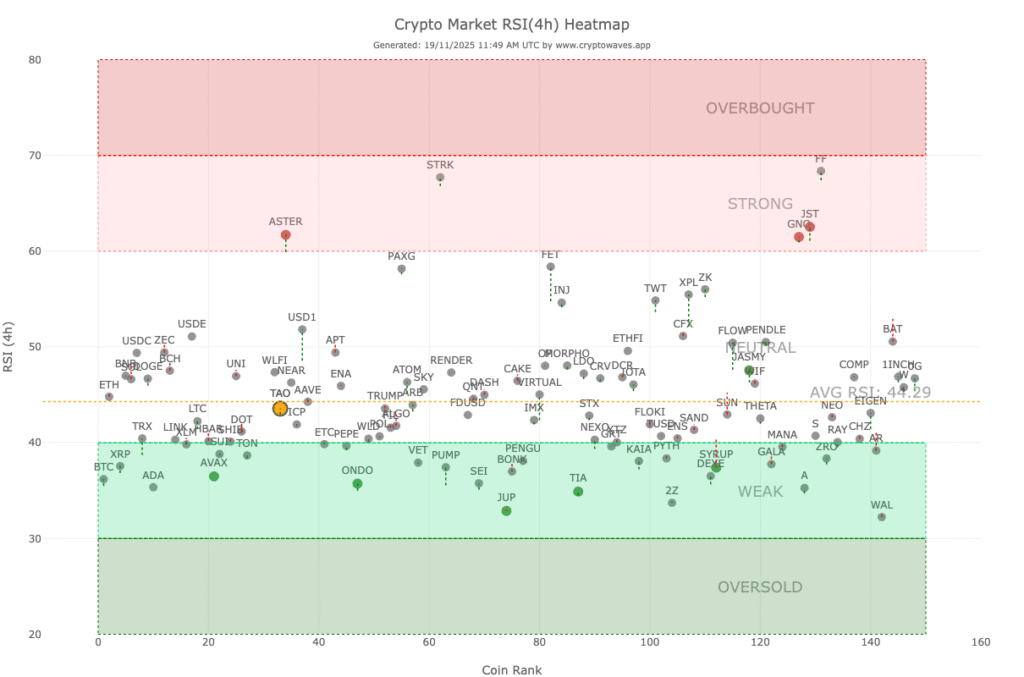

Historically, altcoins rally when Bitcoin stabilizes at a major support level, and that level is now near $90,000. Correlation coefficients between BTC and top altcoins have hovered around 0.9 throughout the month. In previous cycles, this level preceded large decouplings, including the rally that ignited the 2021 DeFi breakout.

The current correction is clearing leverage, removing weak positions and preparing the market for renewed inflows.

Rays of Hope: Catalysts Already Forming

November has been weighed down by tariff discussions, equity market jitters and post-halving uncertainty. Even so, several clear catalysts have emerged.

Technical Momentum Has Returned

Bitcoin reclaimed $93,000 after briefly falling below $90,000, a strong sign that long-term buyers have stepped in. Ethereum continues to hold above $3,000, supported by upgrades introduced through the Fusaka hard fork.

TAO, which maintains a correlation above 0.85 with BTC, is well positioned to rebound strongly once Bitcoin’s range stabilizes.

Macro Tailwinds Are Building

Analysts expect a strong Q4 finish. Several forecasts project Bitcoin ending the year roughly fifty percent higher than current levels. Comments surrounding softer Federal Reserve policy and potential rate cuts could inject liquidity back into risk assets. Ethereum’s staking yields near 4.5 percent continue to attract sidelined capital.

Regulatory sentiment is also improving as more crypto ETF proposals move closer to approval.

On-Chain Data Shows Underlying Strength

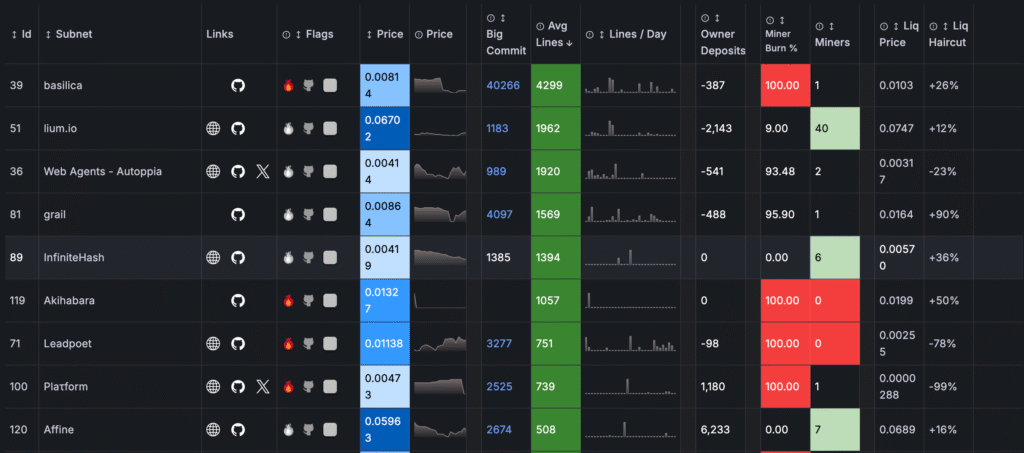

Ethereum active addresses increased 15 percent over the past week. TAO’s subnet activity, which tracks commits, rose despite market weakness. Large Bitcoin holders added 5,000 BTC last week alone. These accumulations often precede recovery phases.

Key Market Snapshot

| Asset | Current Price (Nov 19, 2025) | YTD Peak | Distance from Peak | Correlation to BTC (30-day) |

|---|---|---|---|---|

| BTC | $93,193 | $126,000 | -26% | 1.00 |

| ETH | $3,122 | $4,800 | -35% | 0.92 |

| TAO | $331.91 | $750 | -56% | 0.87 |

Data pulled from real-time market feeds and on-chain correlation metrics.

The Altcoin Avalanche: TAO Poised to Lead

If Bitcoin and Ethereum are the anchors of the market, TAO is the high-beta asset ready to surge when correlations break. As the native token of Bittensor, TAO secures a protocol where global participants contribute compute tasks and earn rewards. In bullish phases, its utility becomes visible quickly.

Global spending on machine intelligence is projected to reach $200 billion in 2026. TAO benefits directly from this trend since its compute economy is driven by real usage rather than speculation.

Given these fundamentals, TAO is positioned for significant upside once Bitcoin finishes its consolidation. Several analysts expect the possibility of five-fold appreciation as liquidity flows rotate into high-utility assets.

Previous cycles show what happens next. After the 2018 downturn, Ethereum rallied more than one hundred times. Current indicators resemble similar setups, including oversold RSI readings, increasing volume on positive days, and a reset in market capitalization that leaves fundamentals intact.

The question is no longer whether a rebound is coming. It is when.

Final Call: Prepare for the Bounce

Crypto’s correlation phase is temporary. Decoupling always returns. While the market wrestles with uncertainty, the underlying metrics point clearly upward.

Institutional positions are rebuilding. Technical indicators are stabilizing. Network activity remains strong.

The groundwork for a recovery is already in motion.

For holders of TAO, ETH, and other quality altcoins, this moment represents the classic opportunity: buying into fear before confidence returns.

The turnaround begins soon. The only question is who will be positioned when it accelerates.

Disclaimer: This article is for educational purposes only. Always conduct your own research.

Be the first to comment