Note: We really loved this piece and wanted to repost it here for visibility. Full credit to the original author (Quinten).

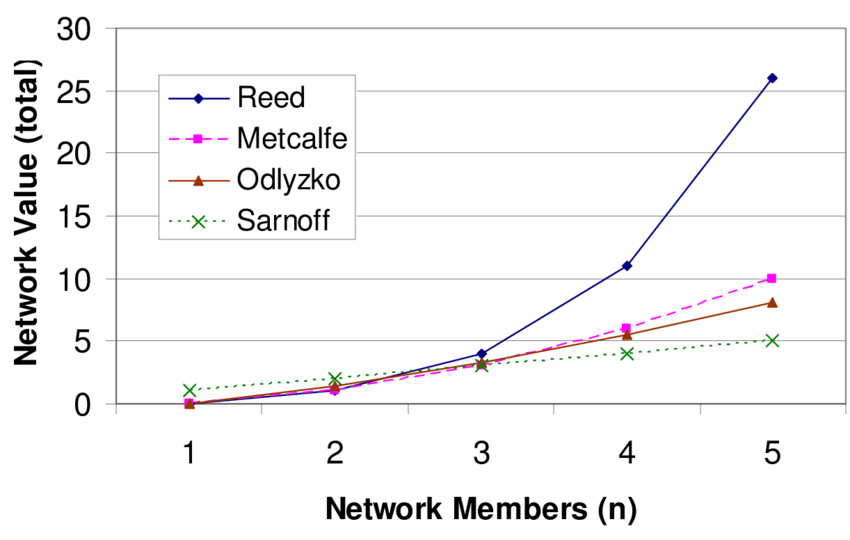

The most fascinating thing about $TAO is that its path should follow Reed’s Law, and not Metcalfe’s Law like $BTC. Bitcoin reached a trillion-dollar market cap in 2021. That’s only 12 years after its genesis block. In theory, $TAO should do it in less than 12 years.

Metcalfe’s Law: this economic law says that a network’s value grows proportionally to the square of its number of users, and applied to #Bitcoin, it means that as more people use and hold Bitcoin, its overall market value increases exponentially.

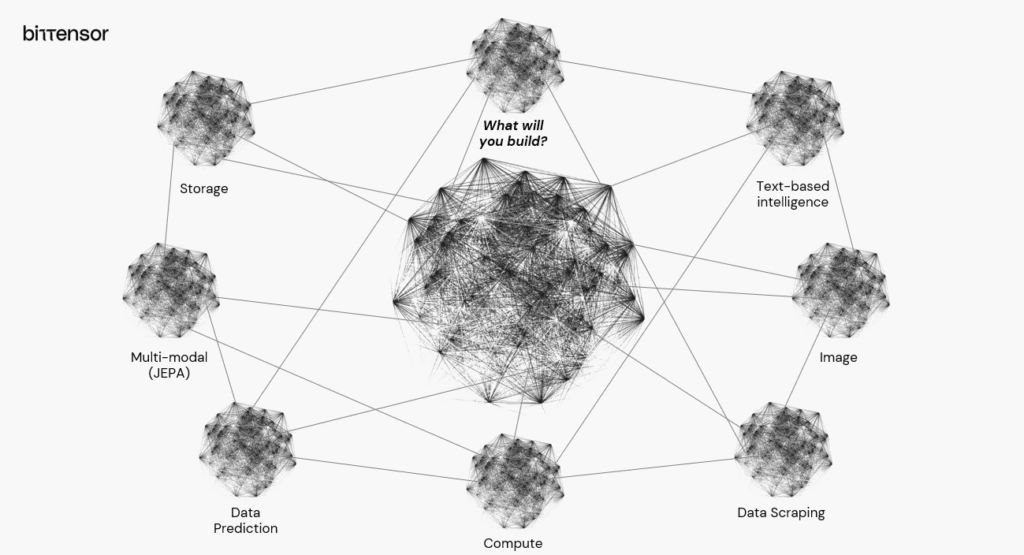

Reed’s Law: This law says that the value of a network grows exponentially with the number of user groups or sub-networks, and applied to Bittensor, it means that its 128 subnets exponentially amplify the network’s total value – basically a network effect of network effects.

So, in theory, the network should go up in value faster than Bitcoin. In my opinion, the bet on Bittensor is asymmetrical. I believe this is going to be a trillion-dollar network. The art of investing is picking the projects that have the potential to become a trillion-dollar company, and of which the odds for this to happen are high. In my opinion, in crypto, we have Ethereum, Chainlink, and Bittensor as the main contenders to become trillion-dollar assets.

The rest miss something. For example, $BNB’s existing market is too small, and $SOL doesn’t have the first-mover advantage and is not overtaking $ETH. On top of all this, Bittensor brilliantly ensures there is enormous economic incentive for the best AI projects to build on its network as a subnet. And since right now there are only 128 subnet spots, it’s a Hunger Games-style competition to keep a subnet spot – because when a new team comes in and pays the $TAO fee, the least-performing subnet is out.

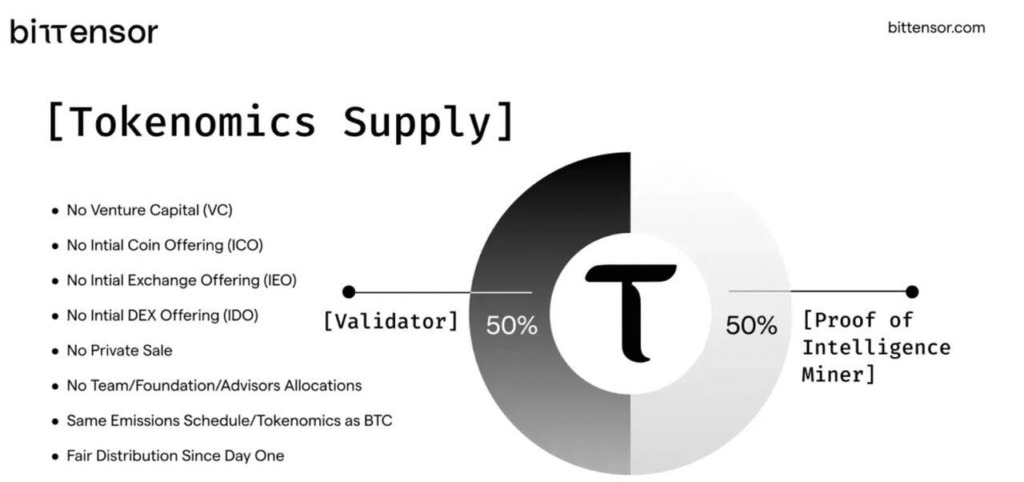

Over time, the number of subnets will increase, but for now they keep it tight so there are more rewards for the subnets, and quality goes up dramatically because of the competition. They all earn a part of the newly mined $TAO (emission). The tokenomics are based on $BTC’s model, with a max supply of 21 million $TAO and a halving every ~4 years.

Conclusion: I believe $TAO is one of the only assets in crypto that has the potential to become a trillion-dollar market cap token. And I believe it will do so in less than 12 years – the amount of time $BTC needed. Bittensor is now 4 years old.

Calculations show us that $TAO is on track – following Reed’s Law curve – to become a trillion-dollar asset by 2030 or 2031. It has all the ingredients: first-mover advantage in decentralized AI, a genius “Hunger Games” competition model, an economic incentives model, the right tokenomics, and more. Everything about this project is genius and brilliantly thought out.

Be the first to comment