Contributor: Crypto Pilote

I – Halving is coming

You’ve probably seen it everywhere: the TAO halving is happening this week. Daily emissions will be cut from 7,200 TAO to 3,600 TAO per day, marking a milestone in the history of the Bittensor ecosystem.

At the same time, adoption of TAO continues to accelerate. New subnets are going live, products are being shipped, and some of these networks are already generating real revenues. This combination, falling supply and growing real-world usage, has sparked intense discussion, but also a lot of misunderstanding about what this event actually means.

In this article, we’ll break down the core mechanics behind the halving and analyze the real on-chain and network data that could influence TAO’s price.

II – Understanding Network Emissions

A) How emissions are calculated

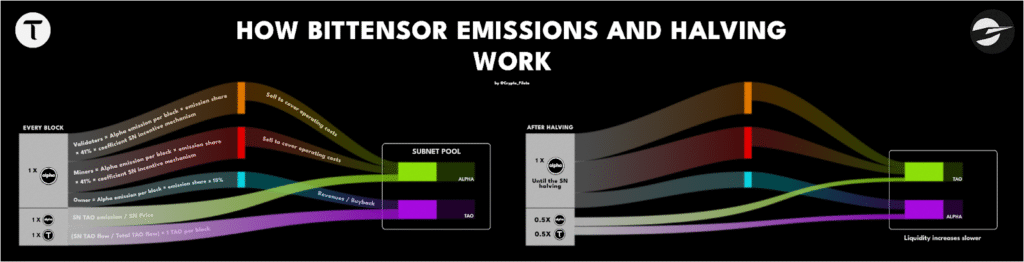

First, let’s start with the basics. Every block (around 12 seconds), the network distributes rewards into the subnet pools and to participants. For each block, the system issues 1 TAO to subnet liquidity pools and 2 units of alpha: one goes into the subnet pool and the other is distributed to participants such as miners, validators, and stakers.

In simple terms, each block currently introduces 1 TAO + 2 alpha into the ecosystem.

The TAO part of emissions is what will be cut in half in December 2025. To understand what this really implies for supply, liquidity, and price dynamics, we need to look deeper into how these mechanics work in practice.

B) Emission for SN Pools

TAO

As explained earlier, at every block, subnet (SN) pools receive TAO and alpha to maintain liquidity without distorting pool prices. Since mid-2025, the share each subnet receives depends on its TAO flow.

The allocation is:

TAO to subnet = (Subnet TAO flow / Total network TAO flow) × TAO emission per block

To reduce noise and manipulation, TAO flow is smoothed using a 30-day EMA.

Key points:

- Flow = TAO staked − TAO unstaked (root selling is excluded)

- After the halving, emissions drop from 1 TAO to 0.5 TAO per block

- Emissions cannot be negative: if flow is negative, the subnet receives 0 emission

ALPHA

The alpha injected into a subnet pool is calculated as:

Alpha emission in SN pool = TAO emission of the SN / Price of the SN

This mechanism continuously increases liquidity in subnet pools, making it easier for new buyers to enter and for neurons to sell alpha to cover operating costs.

At the same time, participants receive a separate alpha emission.

From this additional alpha, miners receive 41%. Their individual rewards then depend on the incentive mechanism (IM) of the subnet, such as winner-takes-all, podium-style, or equal-weight distribution.

Miner rewards = alpha emission per block × SN popularity (emission share) × 41% × coefficient subnet incentive mechanism

At this point, it is important to understand that participants (and therefore miners) are compensated exclusively in alpha. This means that the upcoming halving will not choke miners by reducing their inflow. It will only affect the pool depth, which will be filled more slowly. Better yet, since emissions are based on flow, miners are incentivized to hold their alpha rather than convert it to TAO, as doing so would reduce overall emissions and, consequently, their rewards.

C) Halving of SN

SNs also undergo halving, but not simultaneously. SNs were launched in early 2025. They follow the TAO emission schedule, but slightly faster due to the additional alpha distributed to participants on top of what is in the pool. Halving for most SNs will occur in 2–3 years, when the supply reaches 10.5 million.

D) Other flows that can influence price and emissions

In the participants’ portion of the emission, the SN owner receives 18%, which can be used to buy back alpha. If the SN generates revenue, it means they have real customers using their alpha token, thereby creating an inflow. If they also generate revenue in other currencies, they can conduct buybacks, which further generates TAO flow. This supports the alpha price, which is beneficial for miners by increasing their potential profitability.

III – Direct impact on SN and TAOflow synergy

Less liquidity in pools, less TAO outflow

The first impact of this halving is that liquidity in SN pools will increase more slowly, which reinforces the TAO flow effect. Lower liquidity means each trade will have fewer counterparties, allowing SNs with revenue (and/or buybacks) to maintain their price more easily, as every purchase pushes the price higher to find a match. It occurs at an ideal time, as major SNs begin deploying their products and attracting external customers. In addition, bridge solutions like those provided by Taofi, VoidAI, @gtaoventures / Chainlink will bring a wave of new buyers ready to invest in the next intelligence layer.

This could trigger a virtuous cycle:

- Miners may choose to hold their alpha to benefit from potential price appreciation.

- Their structural costs, measured in alpha, effectively decrease as the price rises (e.g., $1,000 costs at $10/alpha → 100 alpha sell pressure; $1,000 costs at $20/alpha due to scarcity → 50 alpha sell pressure).

- Reduced selling also leads to more inflow, further increasing TAO flow and boosting emission on the SN.

- With higher rewards in alpha, more new miners could be attracted, pushing the network to new horizons and increasing Bittensor’s overall appeal. This will reinforce competition and attract more customers.

- Customers purchase alpha to use the products, pushing prices higher in a thinner liquidity context.

IV – Anti-fragile system

The Halving, far from being a simple supply adjustment, is part of an overarching dynamic of antifragility envisioned by the Const team from the outset. Every mechanism within Bittensor is deeply competitive and designed to extract the best of global intelligence.

This antifragility is embodied in several key pillars:

- Subnet model allows anyone to launch a specialized AI project

- Deregnistration system ensures efficiency by continuously pruning projects that fail to gain consensus (making Bittensor stronger, not just resilient)

- TAO Flow exponentially rewards projects that generate real value and revenue.

Every update, every functional building block, does not just make Bittensor robust against shocks; it makes the network better because of competition and stress, ensuring the continuous growth of the network’s overall intelligence and efficiency.

Be the first to comment