If one of the earliest institutional Bitcoin investors starts publicly paying attention to a project, it’s usually not random speculative play.

That’s the core message of this video (watch below): Barry Silbert (founder of Digital Currency Group) has been quietly positioned in Bittensor ($TAO) since 2021.

This isn’t a “TAO is pumping” kind of video, but one that addresses fundamentals and long-term conviction.

Who Is Barry Silbert, and Why Does He Matter?

Barry Silbert is the founder of Digital Currency Group (DCG), one of the most influential investment firms in crypto history.

DCG has been an early investor in major companies like:

- Coinbase

- Grayscale

- Genesis

- Ledger

They’re not retail. They don’t chase hype. Their whole brand is spotting paradigm shifts early.

So when Silbert shows interest in Bittensor, it’s not because he wants a quick flip. It’s because he believes something structural is happening.

Grayscale’s Move: A Major Signal for Institutional Attention

The second big catalyst mentioned in the video is Grayscale.

Grayscale filed an initial S-1 for a Bittensor Trust, which is seen as a step toward turning TAO into an ETP-style product.

Even though this happened in December 2025, it’s still a meaningful milestone.

Why?

Because Grayscale doesn’t build trust products for random tokens. They do it for assets they believe can attract institutional demand.

So now, you have:

- DCG backing TAO early

- Grayscale pushing TAO toward a more “Wall Street-friendly” structure

That combination alone is enough to raise eyebrows.

What Bittensor Actually Is (In Simple Terms)

The video explains Bittensor like this:

- Bitcoin is a decentralized network for money.

- Bittensor is a decentralized network for intelligence.

Instead of mining blocks, miners in Bittensor contribute AI models. Those models compete to solve tasks and generate useful outputs, and they get rewarded in TAO tokens.

So if you build something valuable, you don’t just get users, you also get emissions.

That’s the entire model:

Open competition + useful intelligence + token incentives.

Why People Call TAO “Bitcoin for AI”

The comparison isn’t about price action.

It’s about philosophy.

Both Bitcoin and Bittensor share similar fundamentals:

- Fixed supply: 21 million

- Rewards decrease over time

- Network incentivizes contribution through scarcity

But the difference is what they reward:

- Bitcoin rewards security

- Bittensor rewards useful intelligence

That’s why the “Bitcoin for AI” narrative has stuck. Not because it sounds cool, but because the design logic is similar.

Subnets: The Engine Behind Bittensor’s Growth

The video also breaks down one of the most important parts of Bittensor:

Subnets.

A subnet is basically a specialized market inside the network.

Each subnet focuses on one niche problem such as:

- text prompting

- predictive modeling

- image generation

- storage

- analytics

- map reduce compute

- etc…

Instead of forcing one AI model to do everything, Bittensor creates a network where many specialized subnets compete and evolve independently.

That’s why TAO feels like an ecosystem, not a single product.

The “Early Internet” Argument (And Why It Matters)

The creator compares Bittensor to the early days of the internet.

Back then, people couldn’t imagine:

- social media

- streaming

- e-commerce

- online businesses becoming global giants

Most people dismissed it because they couldn’t see where it was going.

And the video argues that decentralized AI is at that same stage today. Still misunderstood. Still early. Still dismissed.

But quietly becoming foundational.

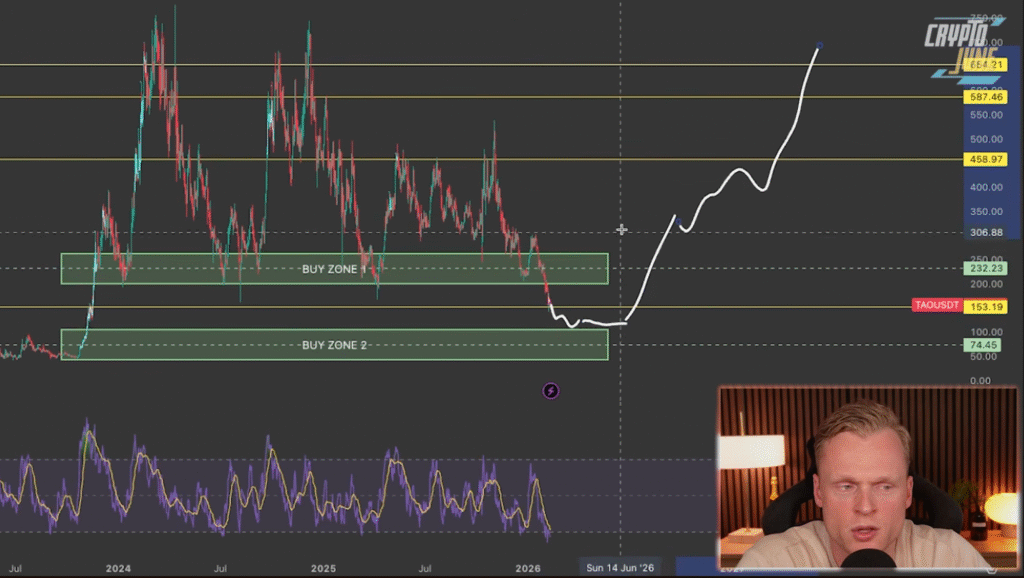

The Investor’s Strategy: Buy Zones

Beyond the TAO thesis, the video also covers a basic investment framework: buy zones.

The creator explains that instead of trying to time the bottom perfectly, they set predefined levels where they’ll buy.

That way, fear doesn’t control decisions.

The logic is simple:

- If price drops into buy zone 1 → buy some

- If it drops further into buy zone 2 → buy more

- Average entry improves over time

- Avoid panic decisions

It’s basically a structured version of DCA.

Final Take: The Smart Money Thesis Is Getting Loud

The video ends with one major point: Barry Silbert doesn’t chase narratives, he finds trends that reshape industries.

So if he’s paying attention to Bittensor, the market should at least stop pretending TAO is “just another AI coin.”

Between DCG’s early investment and Grayscale moving toward an institutional wrapper, the signal is obvious:

TAO is becoming a serious long-term asset in the AI and crypto category.

The only question is whether people will realize it early…

Or wait until it’s already priced in.

Be the first to comment