Originally written by Michael Parker || Fact-check & review by σℓαigє τ

I came across something worth sharing while reviewing the Grayscale Bittensor Trust, and it adds real context to current TAO pricing.

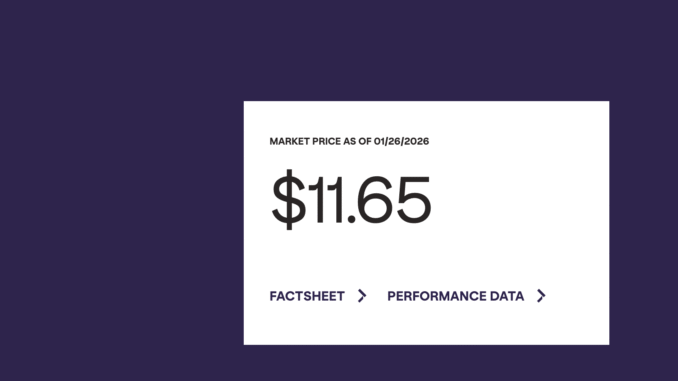

Grayscale publicly lists the trust’s share math. Each share represents ~0.01920202 TAO, and the market price per share is about $11.65. Do the math:

$11.65 ÷ 0.01920202 ≈ $607 per TAO

That is the implied price investors are already paying for TAO exposure through Grayscale.

Meanwhile, spot TAO trades around the low $230s.

This pricing gap is not unusual. We saw the same pattern with GBTC and early Ethereum trusts, where institutional investors paid large premiums because they could not buy or custody the asset directly. Regulated access mattered more than price efficiency.

What this shows is not a price prediction. It is evidence of real demand willing to pay significantly more for TAO exposure through compliant rails. That demand simply does not have access to spot markets today.

Historically, when assets move from trust-only exposure to broader ETF-style access, these premiums do not remain isolated forever. Liquidity improves, access widens, and spot pricing adjusts.

This does not mean TAO immediately goes to $600. It means current spot price is set by a market missing a large class of buyers who are demonstrably willing to pay more.

The data is public. No narratives required.

You can verify everything directly on Grayscale’s site, including TAO per share, NAV, and market price, updated daily: https://grayscale.com/funds/grayscale-bittensor-trust

Just sharing the math for anyone who prefers data over hype.

Be the first to comment