We read the comprehensive article by CryptoRand about Bittensor TAO (“Why Bittensor (TAO) Could Become the ‘NVIDIA of Crypto’ in 2026: A Comprehensive Look”). Here, we will provide key takeaways from the piece.

The article argues that Bittensor (TAO), a decentralized AI network, has the potential to mirror NVIDIA’s dominance in AI hardware but within the crypto ecosystem, driven by AI growth, decentralization, and market incentives.

We organized the summary into key sections with bullet points for clarity.

Introduction to Bittensor (TAO)

- Bittensor is a blockchain-based protocol that creates a decentralized marketplace for artificial intelligence (AI), allowing users to share, train, and monetize AI models and data.

- It operates on a proof-of-intelligence (PoI) consensus mechanism, where miners compete by providing valuable AI computations rather than raw hashing power.

- TAO is the native token used for governance, staking, and incentivizing network participants, with a current market cap of around $2-3 billion.

- Founded in 2019 by the Opentensor Foundation, it aims to democratize AI access, countering centralized giants like OpenAI or Google.

Comparison to NVIDIA

- NVIDIA dominates AI through its GPUs, which power 80-90% of AI training; similarly, Bittensor could become the “infrastructure layer” for decentralized AI in crypto.

- Just as NVIDIA benefited from the AI boom (e.g., ChatGPT hype leading to stock surges), Bittensor is positioned to capitalize on the convergence of AI and blockchain, potentially becoming a foundational protocol.

- The article draws parallels: NVIDIA’s CUDA ecosystem locks in developers; Bittensor’s subnets could create a similar network effect for crypto AI devs.

- By 2026, with AI market projected to hit $1 trillion, TAO could see explosive growth if it captures even a fraction of decentralized AI demand.

Key Features and How Bittensor Works

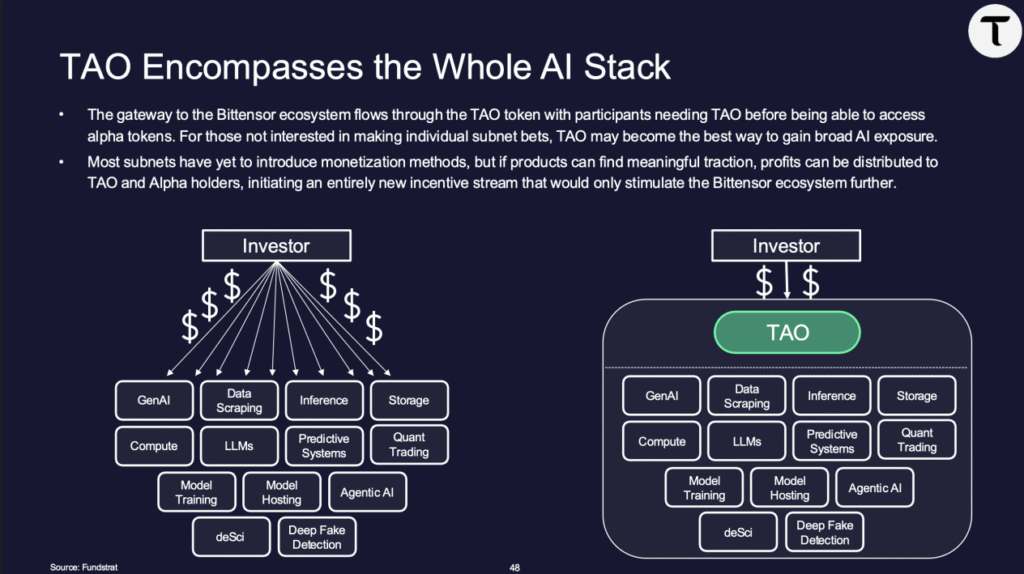

- Subnets: The network is divided into specialized subnets (e.g., for text generation, image recognition), where validators and miners earn TAO rewards based on performance and usefulness.

- Incentive Mechanism: Uses Yuma Consensus to rank and reward high-quality AI contributions, fostering competition and innovation while penalizing low performers.

- Decentralization Benefits: Reduces reliance on centralized data centers (e.g., AWS), lowers costs, enhances privacy, and enables global collaboration without intermediaries.

- Ecosystem Tools: Includes tools like Bittensor API for easy integration, and partnerships with projects like Polkadot for scalability.

Growth Potential and 2026 Outlook

- Market Drivers: Rising AI adoption in crypto (e.g., AI agents, NFTs, DeFi analytics) could drive TAO demand; the article predicts a 10-20x price increase by 2026 if AI hype continues.

- Tokenomics: Fixed supply (21 million TAO, like Bitcoin), with halvings every 4 years to create scarcity; staking yields 15-20% APY, attracting long-term holders.

- Price Projections: Base case: $1,000-2,000 per TAO by 2026 (from ~$400 current); bull case: $5,000+ if it becomes the go-to AI protocol, rivaling Ethereum’s role in smart contracts.

- Catalysts: Regulatory clarity on AI/crypto, mainstream partnerships (e.g., with NVIDIA itself?), and the Bitcoin halving cycle boosting overall crypto sentiment.

Risks and Challenges

- Competition: Faces rivals like Fetch.ai, SingularityNET, or centralized AI firms entering blockchain space.

- Technical Hurdles: Scalability issues with growing subnets; potential for low-quality AI spam if incentives aren’t balanced.

- Market Volatility: Crypto winters or AI bubbles could hurt TAO; regulatory risks (e.g., SEC scrutiny on tokens).

- Adoption Barriers: Needs more developer tools and user-friendly interfaces to attract non-crypto AI experts.

- The article advises diversification and DYOR, noting TAO’s high beta (volatility tied to AI trends).

Conclusion and Investment Thesis

- Bittensor represents a “picks and shovels” play in the AI/crypto gold rush, much like NVIDIA in traditional AI.

- By 2026, if decentralized AI becomes mainstream (e.g., via Web3 apps), TAO could achieve “NVIDIA-like” status with massive returns for early adopters.

- Overall Tone: Bullish but balanced, emphasizing long-term potential over short-term hype; recommends monitoring metrics like active subnets and institutional adoption.

This summary captures the article’s core arguments without spoilers or external opinions. If you need more details, check the original article.

Be the first to comment