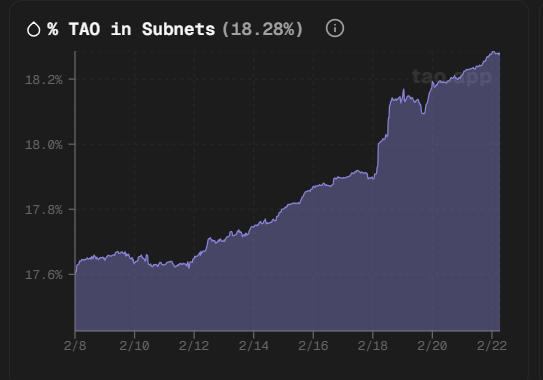

Numbers can mislead when they are stripped of context. Today, roughly 18% of $TAO is staked into subnets. At first glance, that figure feels underwhelming.

In a network where subnets are supposed to be the economic engines, 18% sounds small. Skeptics see hesitation. Critics see weakness. Casual observers see a system that has not fully activated.

But serious capital does not move on optics. It moves on structure.

And structurally, this moment says something very different.

Where is the Rest of the Capital?

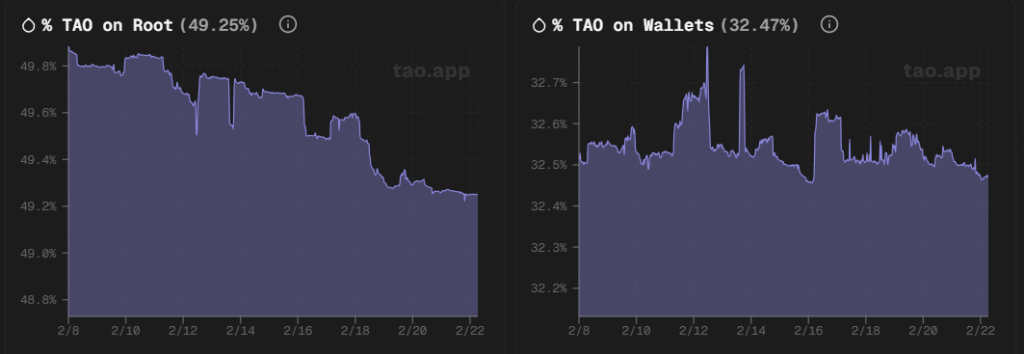

If ~18% is in subnets, then where is the remaining ~82%? The breakdown tells a clearer story:

TAO.APP: % $TAO in Root and Wallets

a. Nearly half of $TAO remains in Root,

b. A significant portion sits in wallets, and

c. Only a growing minority is deployed into subnets.

This is not a network drained of conviction, it is a network in transition.

Root is not an economic engine, it secures and anchors the protocol, but it does not host miners, generate intelligence, or produce subnet “$ALPHA” tokens.

Wallet balances represent liquidity reserves, undeployed capital waiting for opportunity.

Subnets, by contrast, are the productive layer. They host miners, run models, generate output, and distribute emissions based on activity.

So when people fixate on 18%, what they are really observing is undeployed capital still sitting on the sidelines.

And sidelined capital is not weakness, it is optionality.

Dynamic $TAO Changed the Incentive Structure

To understand why this matters, we have to understand what changed. Before Dynamic $TAO (dTAO), emissions were influenced heavily by validator weight and governance dynamics. Then, allocation was political, and influence mattered more than capital flow.

dTAO rewired the system: Now emissions follow capital.

When capital flows into a subnet:

a. Emissions redirect toward that subnet,

b. Miner participation increases,

c. Liquidity deepens, and

d. Economic gravity strengthens.

It is a capital allocation market (no longer a governance game), and markets take time to rotate.

The Trend is More Important Than the Snapshot

The most important detail in the current distribution is not the 18% itself, it is the direction of travel.

Subnet allocation is rising, root allocation is slowly compressing, and wallet balances fluctuate but remain large pools of potential deployment.

This is a healthy migration pattern.

Capital rarely floods into new economic structures instantly. It moves in stages:

a. Stage One: Architecture is deployed,

b. Stage Two: Capital observes,

c. Stage Three: Early rotation begins, and

d. Stage Four: Compounding accelerates.

Bittensor is currently between stages two and three, a setting that shows normal early-cycle behavior.

Why Capital is Starting to Rotate

Capital rotates when risk declines and clarity improves. The gradual increase in subnet staking is not random, it reflects progress across the ecosystem.

Several factors are driving this shift:

1. Subnets Are Shipping Real Products

Bittensor subnets are deploying real products such as APIs, data layers, compute services, and marketplaces that are used in the real world.

Subnets are moving beyond whitepapers and into execution, and that tangibility builds confidence.

2. Reward Visibility Has Improved

Participants can now assess important information about the ecosystem transparently, and this has helped in drastically reducing “perceived volatility.”

3. Competitive Pressure Is Working

Under Taoflow, underperforming subnets lose capital (in form of emissions), and strong subnets gain it. This competitive filter improves capital quality over time.

4. External Revenue Narratives Are Emerging

While emission is one of the important components in a subnet’s revenue, the strongest subnets are not relying purely on emissions, they are positioning toward real users and real fee generation.

Capital follows competence, it always has.

What Needs to Happen Next

If subnet allocation is to expand meaningfully beyond 18%, the ecosystem must continue maturing. That requires more than incentives, it requires economic substance.

Subnets that want to attract sustained capital must demonstrate:

a. Durable external demand,

b. Transparent and predictable reward structures,

c. Capital efficiency rather than inflation dependence, and

d. Clear differentiation from competing subnets.

This is where the Taoflow upgrade becomes significant. Increased capital fluidity means allocations adjust faster, underperforming subnets can be deregistered, and strong performers compound more quickly.

Discipline attracts serious allocators, and serious allocators drive long-term stability.

Be the first to comment