Note: Really great piece from Taostats’ team, we’re reposting here for visibility. Full credit to the original author (Taostats).

Over the last week – many folks have noticed that the root APY has tanked (1 day APY under 2%!), and only today (Friday Oct 17) has APY begun recovering, with 1H APY back around 4%. The reason is pretty easy to understand, but we have to go deep into how Bittensor emissions work. (There will be math, sorry. I’ll warn you, and give you a summary in plain English 😅)

Root Stake Rewards

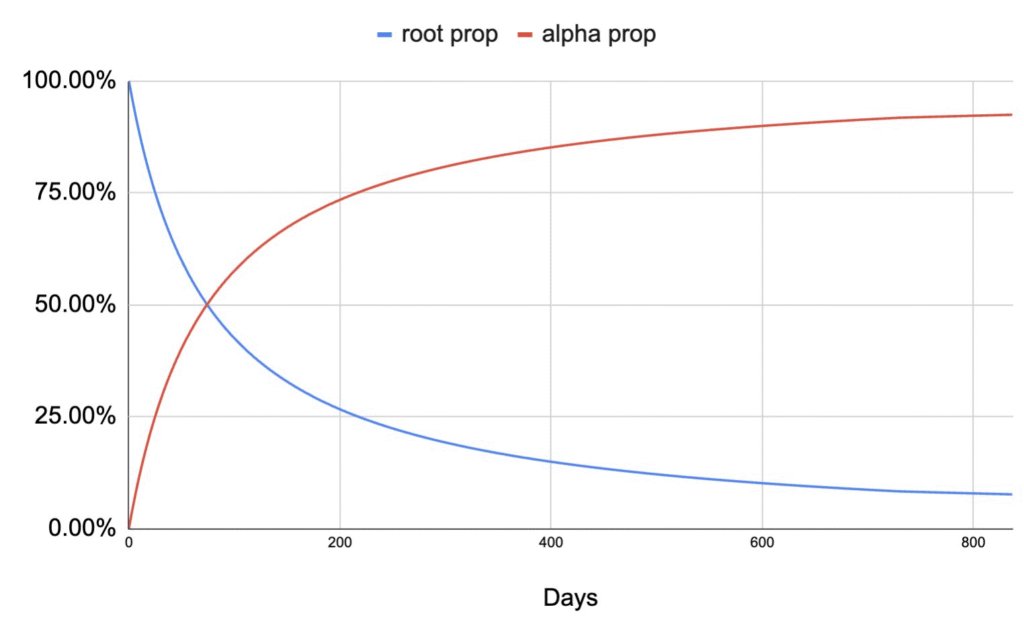

Root APY comes from the validator’s staking rewards. Some of the rewards go to alpha hodlers, and some to those who stake on root. You probably recall this chart from when dTao launched:

The OG subnets – those that were around at dTao launch are sending ~25% of the validator rewards to root. That, of course, does not explain this week’s dip. We have to go deeper into how emissions work.

Root Subsidy

(🧮 if you don’t like math, skip to the next section)

There’s a concept in Bittensor emissions where if the price drops to a certain level, the chain will be unable to emit all the tao for the subnet into the pool.

EMA price is the moving average price. When the ratio on the right (the moving price divided by all the moving prices added up) is bigger than price – we hit subsidy. We can’t emit all the tao? What the heck!!?? Alpha_in (alpha emitted into the pool) has a max of 1, if the EMA ratio gets too large – we’d have to emit more than 1 alpha_in… So the chain does some shuffling of tao emitted, and root emissions to make sure that everything adds up properly.

- Some of the tao emission for the subnet is sold as alpha and recycled. This causes the price to go up.

- Root emission stops on the subnet. Since root emission involves selling alpha for tao (lowering the price), it is suspended. The root emission is kept as alpha, and given to alpha holders – raising the APY for staking in alpha.

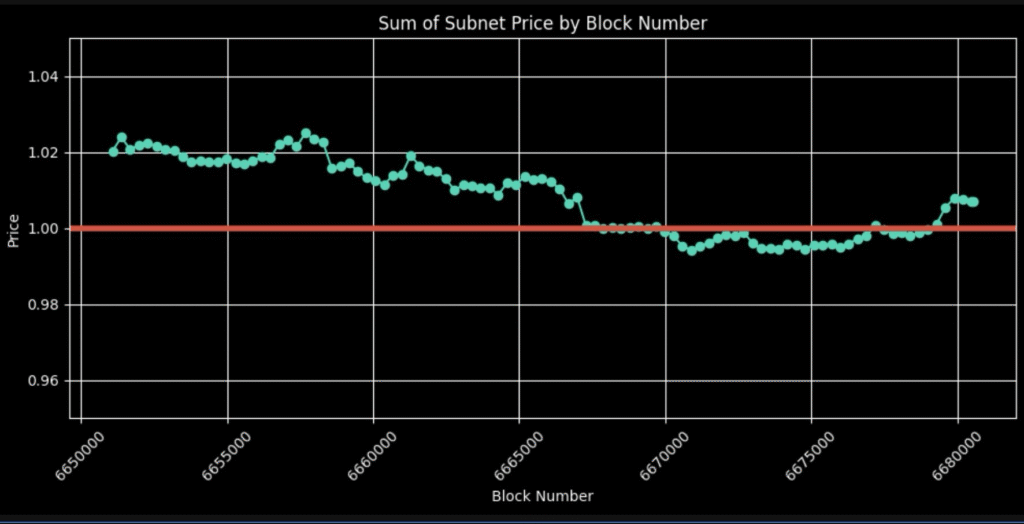

This week, a number of subnets went into subsidy. The reason comes back to Sum of Subnet Prices.

Sum of Subnet Prices

(The math heads have rejoined the non-math heads.)

This week, the SoS price dropped below 1 for the first time.

(Damn – a little more math- you can skip this paragraph – what you need to know is if SoS is less than one -> many subnets go into subsidy)

Remember that SOS price is the denominator of the formula we have above? Yeah, when the denominator is smaller than 1, the overall value of the right side of that equation gets bigger. And, for a bunch of subnets, the value got bigger than the price, dropping the subnets into subsidy.

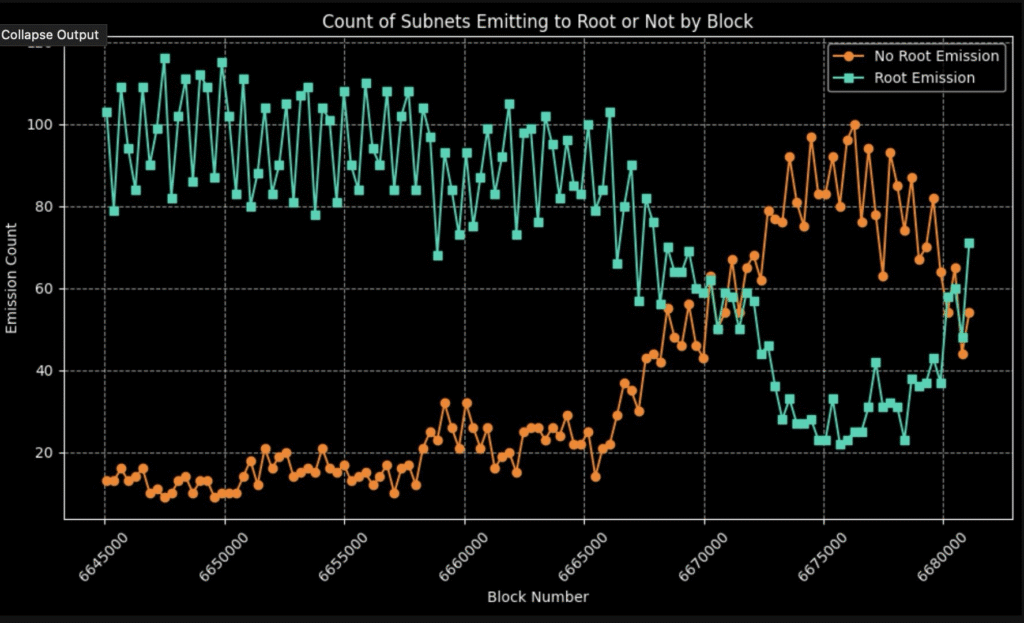

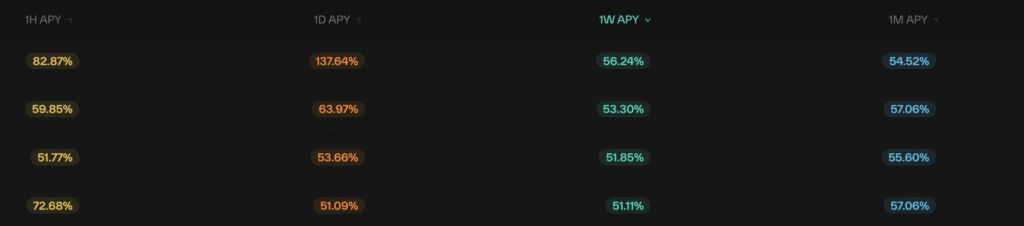

How many subnets dropped into subsidy? 80-100 subnets went into subsidy for a few days last week!! The chart below shows we are recovering.

Now, of course, every subnet has different emission, and price, but we can determine how much of the emission to root was emitted vs. how much was not.

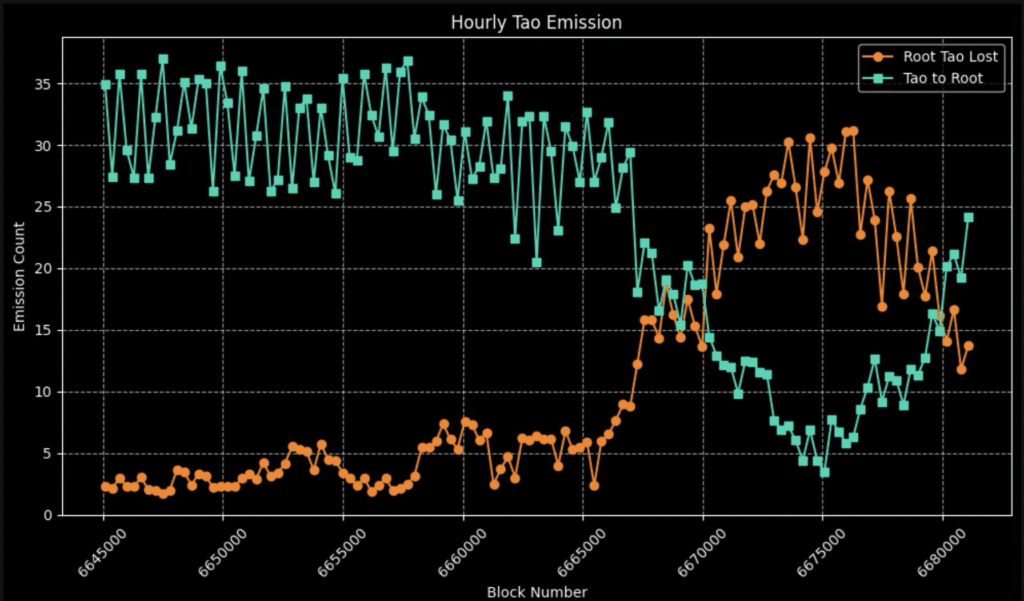

If ~35 tao is emitted to root every hour, there were moments in the last week with <5 tao going to root in an hour.

High subsidy summary

When emission is not awarded to root (like earlier this week) – the alpha is not converted to tao, and goes directly to alpha share holders.

* This increases the APY in subnets that have no root emission.

* This increases the number of investors that stake in the subnet.

* This raises the price, perhaps stopping the subsidy.

This subnet was in subsidy yesterday, and the APY went up. It is slightly down today, but still up. The 1D is much higher than 1W, and the 1H is up from the 1W.

Short bursts of subnets going into subsidy may push stakeholders out of root and into alpha – prices are more stabilized, and emissions higher. This will follow with periods of non-subsidy – a bit of a pendulum effect.

So what’s next?

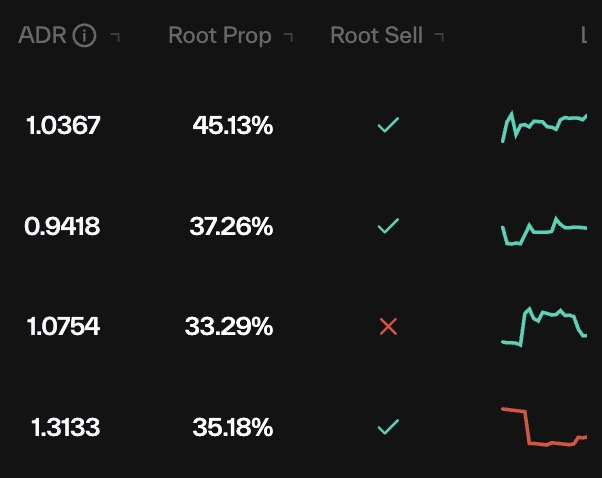

The numbers are changing hourly. You can track subnets that are emitting to root or not at https://taostats.io/subnets, and looking at the Root Sell column:

Will this make for a huge change in staking behaviour in Bittensor? Only time will tell…

Be the first to comment