The Bittensor ecosystem has been abuzz with speculation following a series of intriguing wallet movements tracked by analyst Michael D. White. A prominent wallet, widely believed to be linked to Yuma—a subsidiary of Digital Currency Group (DCG) focused on advancing decentralized AI—has been actively investing approximately $1 million in TAO tokens across various subnets.

This strategic activity offers a glimpse into what could be a calculated play in subnet investing. But what exactly is Yuma up to, and what does this mean for TAO?

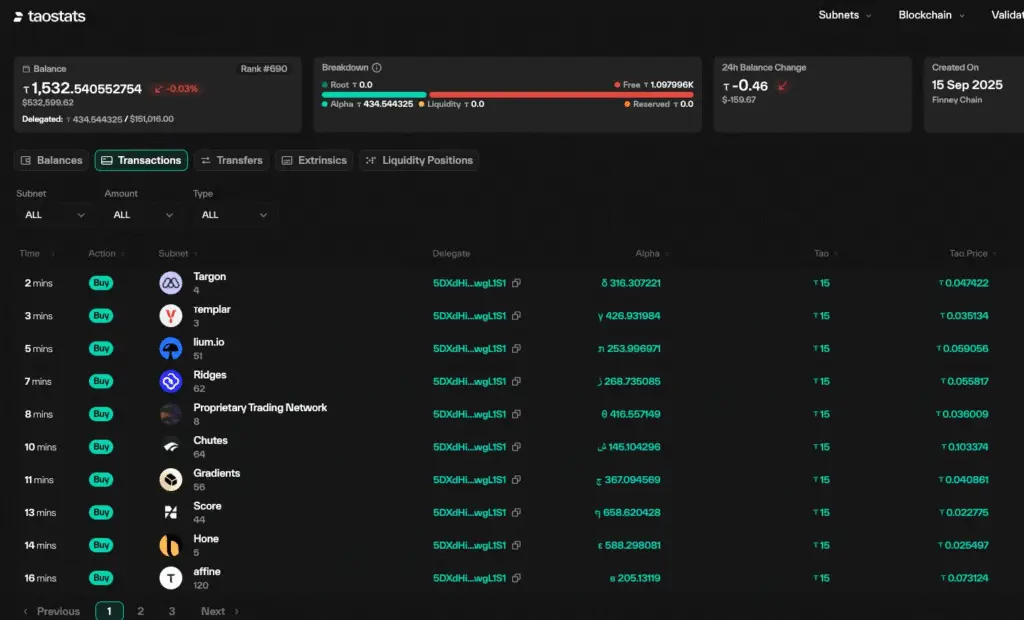

The Wallet Activity: A Strategic Investment Pattern

Michael D. White’s analysis reveals that Yuma’s presumed wallet executed two distinct investment strategies over the course of a single day. The first wallet allocated funds equally across the top 10 subnets by emissions percentage, while the second wallet adopted a market cap-weighted approach (e.g., an 11.5% allocation to the Chutes subnet, reflecting its $98.2 million share of a total subnet market cap of $861 million).

This dual strategy suggests a broad-based positioning, aiming to capitalize on a potential rally across Bittensor’s subnet ecosystem rather than betting on individual outperformers.

The scale of the investment—approximately 3,000 TAO tokens valued at around $1 million—underscores the seriousness of this move. Given TAO’s current market cap of approximately $3.15 billion, this represents a modest but significant allocation from a player with deep pockets and a clear strategic intent.

The timing, just a few months before the anticipated halving event that will reduce token emissions by half, adds further intrigue, hinting at a preemptive strike to secure value before potential market shifts.

Yuma’s Role in the Bittensor Ecosystem

Yuma positions itself as an accelerator within the Bittensor network, investing in and scaling subnets to foster decentralized AI innovation. Backed by DCG, Yuma’s mission is to counter the dominance of centralized AI giants like Google by supporting early-stage research teams and ensuring broad access to advanced computing resources.

This aligns with Bittensor’s core philosophy, which leverages a decentralized network of miners and validators to reward intelligence contributions through its native token, TAO, using a consensus mechanism known as Yuma Consensus.

Context and Implications

Yuma’s recent wallet activity suggests confidence in Bittensor’s growth trajectory, particularly as the network approaches its halving event. Historically, Bitcoin halving events have led to price increases due to reduced supply (e.g., Bitcoin’s 2020 halving preceded a price surge to $69,000 by late 2021), and while Bittensor’s dynamics differ, the principle of reduced emissions could similarly impact TAO price.

However, crypto economic analyses (e.g., Ledger Journal, 2024) caution that subnet prices might face downward pressure post-halving, as miners receive half the reward (0.5 TAO per block), potentially reducing their ability to sustain current price levels. This concern was echoed in a Reddit discussion where users speculated on the halving’s impact given recent price drops.

Yuma’s broad investment strategy—spanning top subnets like Tplr.ai, TargonCompute, and Chutes.ai—could be a hedge against this uncertainty, positioning the firm to benefit from a rising tide across the ecosystem. The equal allocation to top emitters and market cap-weighted distribution indicate a diversified approach, potentially aiming to maximize ROI.

Be the first to comment