As Bittensor matures from a research-driven network into a production grade economic system, one constraint has become increasingly clear: liquidity. Not just access to liquidity, but liquidity that is verifiable, sustainable, and aligned with Bittensor’s native incentive structure.

VoidAI was built to address that constraint.

Through its liquidity provisioning subnet, VoidAI is laying the infrastructure that allows Bittensor assets to move beyond their native environment without fragmenting markets or weakening protocol incentives. The VoidAI v2.0 roadmap outlines how this vision evolves into a fully interoperable, multi-chain execution layer for $TAO and subnet ‘$ALPA’ tokens.

What VoidAI (Subnet 106) Does

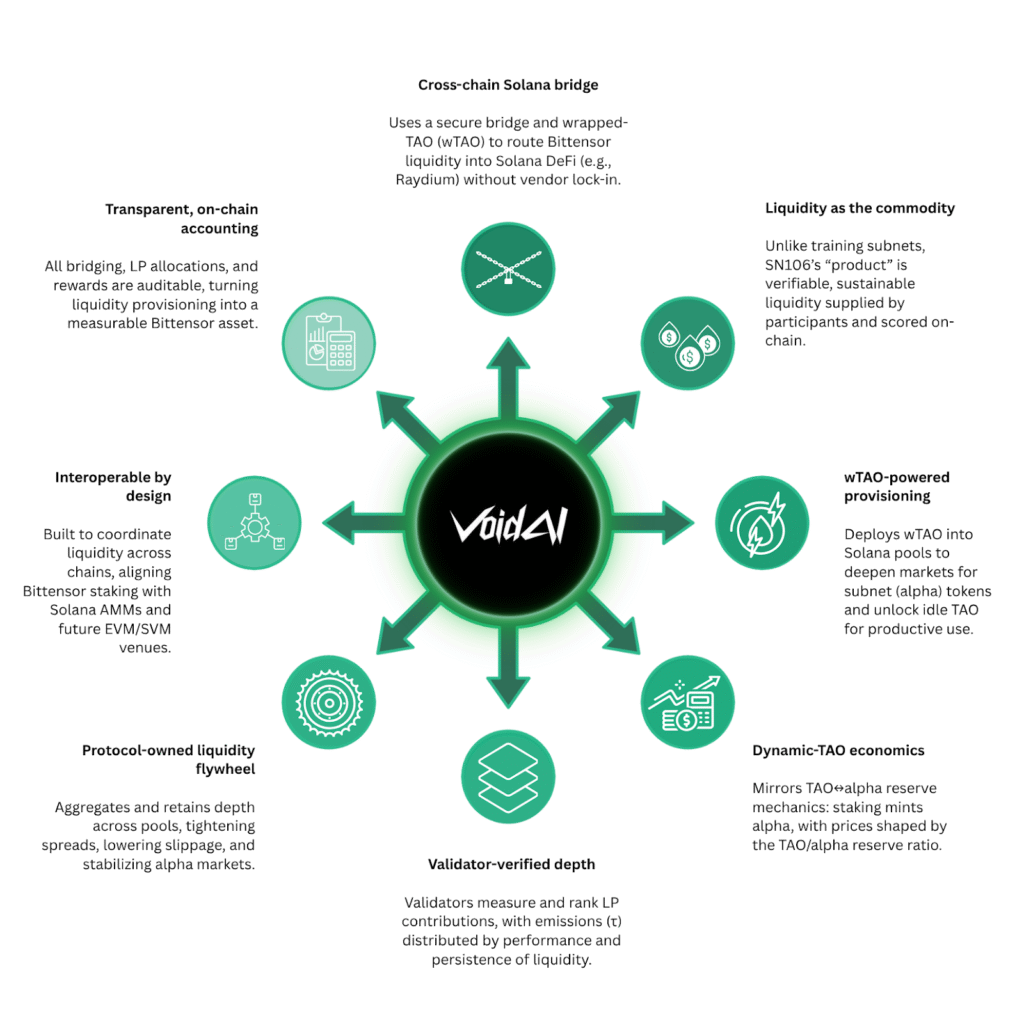

VoidAI, grounded on Subnet 106, is a dedicated Bittensor subnet designed to coordinate on-chain liquidity for Bittensor’s $ALPHA by connecting them to external DeFi ecosystems, starting with Solana.

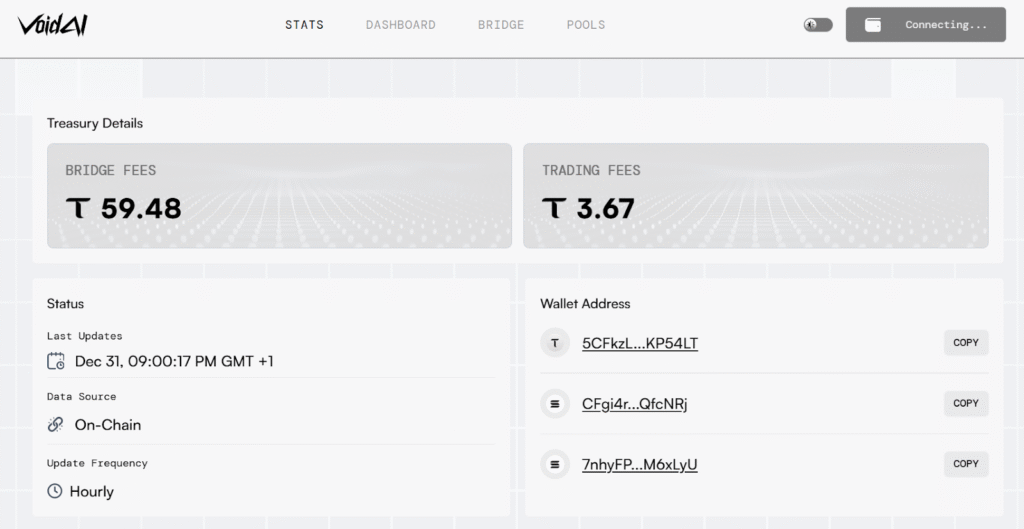

Rather than treating liquidity as an external byproduct, Subnet 106 formalizes it as a measurable commodity within Bittensor’s economic model. Validators assess and score liquidity contributions, and emissions are distributed based on verified performance, following the same Dynamic TAO (dTAO) principles that govern other subnets.

Key characteristics of Subnet 106 include:

a. Cross-chain interoperability between Bittensor and Solana,

b. Use of wrapped $TAO ($wTAO) to enable liquidity provisioning in Solana native DeFi pools,

c. Integration with automated market makers while preserving Bittensor’s $TAO/$ALPHA pricing mechanics, and

d. Emissions tied to liquidity depth and effectiveness, not passive capital.

In effect, Subnet 106 turns liquidity into protocol-owned infrastructure rather than outsourced market depth. VoidAI v2.0 builds on this foundation, extending the model beyond Solana and into a broader multi-chain execution framework.

Design Philosophy Behind VoidAI v2.0

The roadmap is guided by a deliberate architectural choice: that execution and price discovery remain native to Bittensor, while external chains serve as access and distribution layers.

This avoids a common failure mode in cross-chain systems, where liquidity fragments across competing markets and incentives drift away from the base asset.

Instead, VoidAI positions Bittensor as the canonical settlement layer, with Ethereum, Solana, and Base acting as user facing environments.

The roadmap unfolds in five tightly-scoped phases:

PHASE 1: Native Routing With Ethereum UX

The first phase, projected for production by January 19, 2026, would introduce VoidAI’s routing engine.

With this, users would be able to initiate swaps from Ethereum through a familiar interface while trades are routed to Bittensor for native execution, where $TAO and subnet liquidity already exist.

The resulting assets are then delivered back to Ethereum. This structure ensures that:

a. Price discovery remains on Bittensor,

b. Liquidity is not duplicated off-chain, and

c. Users gain access without interacting directly with Bittensor tooling.

Ethereum becomes an entry point, not a competing market.

PHASE 2: CCIP Expansion to Solana and Base

In this phase, VoidAI expands its access layer by adding Solana and Base via ChainLink’s CCIP (Cross-Chain Interoperability Protocol).

Projected for use by January 22, 2026, users would be able to begin and end transactions on any supported chain while swaps continue to settle on Bittensor. This extends distribution to major ecosystems without compromising canonical execution.

At this stage, VoidAI becomes a true multi-chain rail rather than a single bridge.

PHASE 3: Liquid Staking for $TAO and Subnet Assets

On January 28, 2026, the ecosystem is looking forward to liquid staking on Ethereum. Through this phase, users can stake $TAO or supported subnet assets and receive a liquid representation that continues to earn yield while remaining usable across DeFi applications.

This addresses one of the largest structural frictions in Bittensor participation: the choice between earning emissions and maintaining liquidity.

Liquid staking makes yield portable without detaching it from the base asset.

PHASE 4: SDK (Software Development Kit) and Partner Integrations

At this stage, distribution becomes the focus. With this targeted to be in production by February 16, 2026, VoidAI would release an SDK that allows wallets and applications to integrate routing, bridging, and staking flows without bespoke infrastructure.

This abstraction layer enables:

a. Quote requests and execution from third-party apps,

b. Seamless asset movement across supported chains, and

c. Clean integration of liquid staking tokens.

At this point, VoidAI begins to resemble a standard infrastructure primitive rather than a standalone product.

PHASE 5: Unified Multi-Chain Experience

The final phase, set for February 23, 2026, would deliver a single, chain-agnostic experience. Through this, users would be able to:

a. Enter from Ethereum, Solana, or Base,

b. Gain exposure to $TAO and subnet ‘$ALPHA’ tokens,

c. Use liquid staking tokens as first-class assets, and

d. Rely on Bittensor for native settlement in all cases.

Bittensor becomes the economic core, while other chains provide composability and reach.

Why This Roadmap Matters

VoidAI’s approach stands out not because it is aggressive, but because it is restrained in the right places.

Notable design outcomes includes (but not limited to):

a. No fragmentation of liquidity,

b. No off-chain price discovery,

c. No incentive leakage away from $TAO, and

d. No forced tradeoff between yield and usability.

Instead, liquidity compounds quietly inside the system, reinforcing Bittensor’s economic gravity as adoption grows.

Closing Perspective

VoidAI v2.0 is infrastructure work in the truest sense. It does not chase short-term volume or superficial integrations. It focuses on aligning liquidity, incentives, and interoperability in a way that can scale with Bittensor over years, not quarters.

By treating liquidity as a verifiable subnet commodity and positioning Bittensor as the canonical settlement layer, VoidAI extends Bittensor’s reach without diluting its core economics.

That is what makes this roadmap meaningful. It is opinionated where it matters, conservative where it must be, and built for long-term use rather than short-term optics.

Be the first to comment