Bittensor continues to find its way into mainstream financial markets. On December 19, Virtune announced the launch of Virtune Bittensor ETP, a regulated ETP (Exchange-Traded Product) now listed on Nasdaq Stockholm.

The listing gives both institutional and retail investors a straightforward way to gain exposure to Bittensor ($TAO) without navigating the technical hurdles of direct crypto ownership.

What the Virtune Bittensor ETP Offers

Virtune Bittensor ETP ($VIRTAO) is built to mirror the performance of $TAO as closely as possible, while operating within a regulated market framework.

The product provides:

a. One-to-one exposure to Bittensor’s $TAO,

b. Full physical backing with $TAO held in custody,

c. Streamlined trading through traditional brokers and banks, and

d. A transparent structure aligned with institutional standards.

This approach allows investors to access Bittensor in the same way they would trade a listed equity or fund.

$VIRTAO Overview

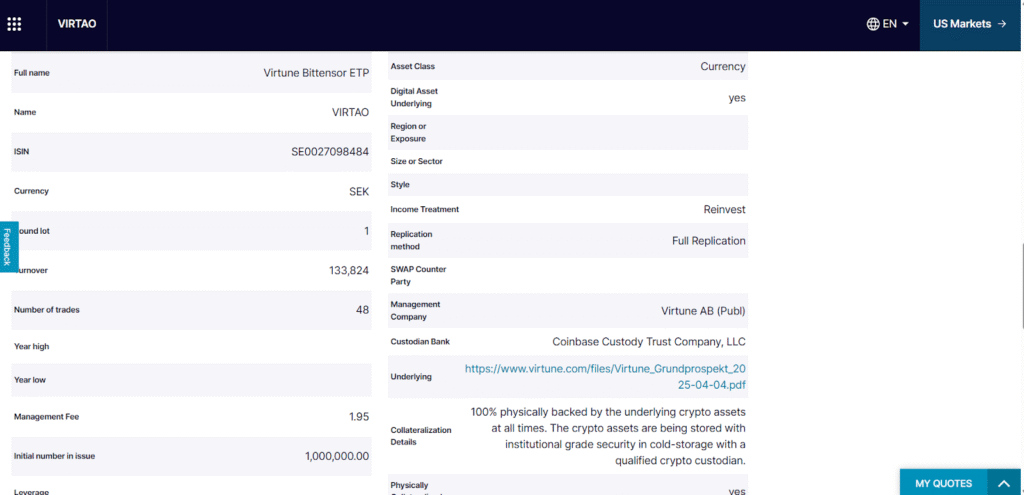

Key details of the Virtune Bittensor ETP include:

a. Ticker: $VIRTAO

b. Exchange: Nasdaq Stockholm

c. Trading Currency: Swedish Krona ($SEK)

d. Management Fee: 1.95% annually

e. ISIN (International Securities Identification Number): SE0027098484

f. Launch Date: December 19, 2025

The asset is available via well-known Nordic platforms such as Avanza, Nordnet, SAVR, Montrose, Strivo, Pareto Securities, Handelsbanken, DNB and Carnegie.

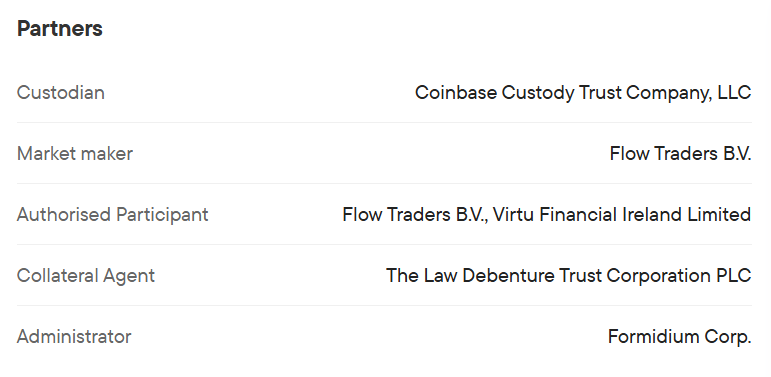

Transparency and Asset Protection

Virtune places strong emphasis on security and verification. Amongst the measures put in place to ensure this are that:

a. All underlying $TAO is held in cold storage offline,

b. Assets are kept separately in Coinbase’s custody,

c. Public wallet addresses are published for proof of holdings, and

d. A collateral agent is appointed to safeguard investor interests.

This structure ensures that the ETP remains fully backed at all times, with clear visibility into the underlying assets.

Why $VIRTAO Matter for Crypto Exposure

For many investors, $VIRTAO strikes a balance between accessibility and security.

It allow investors to:

a. Gain crypto exposure without managing wallets or keys,

b. Keep crypto investments alongside traditional portfolios,

c. Benefit from simpler tax reporting, and

d. Rely on regulated custody and oversight.

As this digital asset matures, it continues to attract capital from investors who value structure and compliance.

What This Means for Bittensor

Bittensor is designed as an open network for artificial intelligence, where contributors are rewarded based on measurable value. The launch of $VIRTAO, a regulated and physically-backed ETP, amongst others recently unveiled, reflects growing confidence in $TAO as a long-term digital asset.

It also signals a broader trend, that decentralized networks are moving closer to traditional financial rails without compromising their core principles.

Final Take

The Virtune Bittensor ETP ($VIRTAO) represents a meaningful step in expanding access to Bittensor. By pairing direct $TAO exposure with a regulated exchange product, Virtune is joining the league of protocols that are making it easier for investors to participate in the Bittensor ecosystem through familiar financial channels.

As interest in decentralized AI continues to grow, products like this are likely to play an important role in bridging crypto innovation with traditional markets.

Be the first to comment