Credit: Thanks to Taostacker for his context about how to explain this concept to non-technical readers.

Over the past few days, you may have heard talk about new emission rules rolling out across the Bittensor network. Many subnet teams and $TAO holders are trying to make sense of what this means, especially the idea of “net TAO flow.”

If you’re not deep into the technical side of Bittensor, don’t worry, this article will break it down in plain language.

First, what are emissions?

Think of emissions as the daily TAO rewards distributed across all the subnets in the Bittensor ecosystem, currently around 7,200 TAO per day (and soon to be 3,600 TAO after the halving in December 2025).

These rewards are like fuel that keeps the network’s AI subnets running, encouraging builders, miners, and validators to keep contributing value.

What changed?

Before now, subnets earned emissions mostly based on their price (essentially a value score).

That approach had one big flaw: it didn’t always reflect which subnets were actually attracting real users or capital.

To fix that, the Bittensor protocol introduced a new rule based on net TAO flow. In other words, how much TAO is actually staked into a subnet.

What is “net TAO flow”?

It’s basically a measure of how much confidence the community has in a subnet.

When users stake their TAO into a subnet, it signals belief in that subnet’s long-term potential.

The new system rewards this behavior directly. The more TAO a subnet attracts (i.e., TAO flowing in), the more emissions it earns.

If TAO flows out (unstaking), the subnet’s emissions go down accordingly.

How does this work in practice?

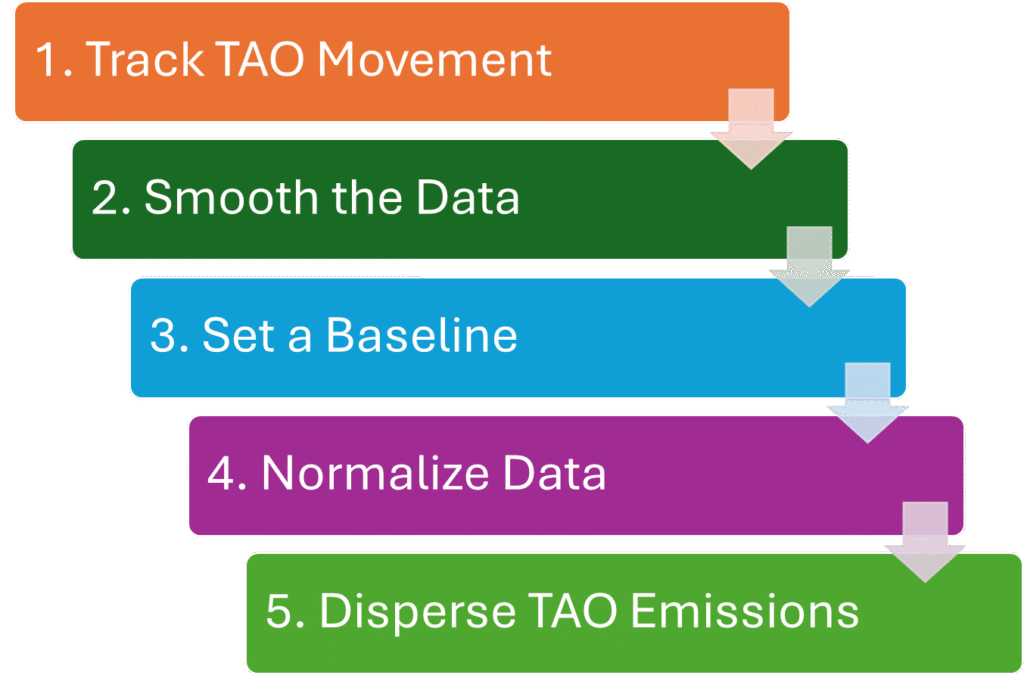

Here’s a simplified version of the process:

- Real-time tracking: Every few seconds, the system checks how much TAO is moving in or out of each subnet.

- Smoothing out the data: The numbers are averaged so that emissions don’t swing wildly every block.

- Comparison: Subnets are compared to the lowest performer to determine who’s attracting more TAO.

- Fair adjustment: Results are cleaned up and balanced so everyone’s rewards are proportional.

- Reward distribution: Each subnet gets a slice of the emission pie based on how well it’s doing in attracting TAO.

Why does this matter?

This new model shifts the focus from past performance to current activity.

Subnets that are growing and bringing in new TAO get rewarded faster, while those losing traction see reduced rewards.

It’s a more dynamic, responsive, and community-driven way to allocate emissions, and it better aligns incentives between builders, investors, and the overall health of the network.

Winners and Losers under the TAO Flow model

Winners:

• Subnets with consistent net inflow, not just short-term pumps.

• Teams with real utility and revenue generation that keep TAO locked in.

• Projects showing genuine product-market fit, not just hype cycles.

Losers:

• High-price subnets experiencing net outflow, relying only on old momentum.

• Pump-and-dump patterns: the system’s EMA (Exponential Moving Average) “forgets” hype quickly, so short bursts of activity won’t sustain emissions.

In other words, the new rules reward steady growth and real contribution over temporary hype.

A quick note on “revenue”

This isn’t about customer revenue in the traditional sense; it’s purely about how much TAO gets staked.

However, some subnets use their revenue to buy back and stake TAO, which naturally helps them under this new system since they’re increasing their inflow.

The takeaway

Bittensor’s shift to net TAO flow-based emissions is a major evolution in how value gets distributed in the ecosystem.

It rewards real traction, community trust, and capital inflow, not just old metrics or speculative price moves.

As the change continues to roll out, the subnets that actively attract and retain staked TAO will rise to the top.

Which subnets do you think would benefit mostly from the net TAO flow mechanism?

Be the first to comment