$400 trillion in global real estate. $600 billion extracted annually in commissions. $14 trillion changing hands through stone-age systems.

Every property transaction on Earth flows through gatekeepers who profit from opacity. These intermediaries have constructed an elaborate maze where simple questions require expensive answers, where public records hide behind private paywalls, and where a young family’s dream of homeownership gets taxed at 6% not because it must be, but because it always has been. The real estate cartel didn’t just build a business model; they built a belief system that their inefficiency was somehow necessary.

But beliefs built on sand are drowned when the tide of technology rises.

Welcome to ReDeFi: Where Property Meets Protocol

RESI represents something fundamentally new in the evolution of real estate: an intelligence layer that doesn’t just digitize property but transforms it into programmable value.

Built on Bittensor’s Subnet 46, we’re creating the bridge between $400 trillion in physical assets and the infinite composability of decentralized finance.

Consider what this means in practice. Today, using your home as collateral requires weeks of paperwork, appraisals, and intermediaries who each take their cut. Tomorrow, that same home becomes instantly verifiable collateral across any DeFi protocol, with valuation determined not by a single appraiser’s opinion but by mathematical consensus across thousands of data points. The friction doesn’t just decrease; it disappears entirely.

The old world hoards. The new world shares. The old world extracts. The new world distributes. The old world controls. The new world computes.

The Three-Layer Revolution

Layer 1: Data Foundation

Live: November 2025

We’ve forked Subnet 13 to incentivize the creation of America’s first truly open property database. Not scraped from county records. Not licensed from monopolists. Mined, validated, and updated daily through Bittensor’s proof-of-intelligence mechanism.

Miners compete to provide the most accurate, comprehensive property data, validating everything from transaction histories to zoning changes, from permit applications to storm damage reports.

The result is a nationwide property database updated daily, accessible to any builder who wants to create the future rather than rent it from the past. Imagine every startup having the same data advantage as Zillow on day one. Imagine every DeFi protocol knowing the exact value and condition of collateral in real-time. This is the foundation everything else builds upon.

Layer 2: The Oracle

Live: December 2025

When builders access our oracle, they’re not getting yesterday’s comparable sales adjusted by human intuition. They’re getting real-time valuation consensus that factors in everything from local employment trends to weather patterns, from school district rankings to interest rates.

A storm approaching Miami triggers instant recalculation across affected properties. A tech company announcing a new headquarters sends ripples through neighborhood valuations before the press release ends.

This enables entirely new categories of products. Real estate-backed stablecoins can finally exist because collateral values update continuously rather than quarterly. Prediction markets can form around any property, any neighborhood, any trend. Micro-loans against home equity become possible when assessment costs approach zero.

This isn’t speculation. It’s computation. The fractionalized real estate oracle replaces human appraisers with mathematical certainty, enabling not just prediction markets but also:

- Real estate-backed stablecoins validated by property conditions

- Instant collateral assessment for DeFi protocols

- Micro-loans against home equity

- And more applications that external builder to crafts

The oracle doesn’t just serve existing use cases; it creates new ones we haven’t imagined yet.

Layer 3: Autonomous Execution

Live: 2026 and Beyond

The final transformation occurs when RESI evolves from infrastructure to actor, from platform to participant. Smart contracts don’t just record property transfers; they execute them. Lending protocols don’t just process applications; service transaction and loans autonomously with AI Appraisers fed by computer vision inspection, pooled capital, and network intelligence.

Picture a world where selling your home means signing a single transaction that triggers cascading smart contracts: title search, inspection scheduling, financing approval, escrow management, deed transfer, and fund distribution all execute automatically based on predetermined conditions. The six-week process becomes a six-minute transaction. The 6% commission becomes a 0.06% protocol fee.

The anxiety and uncertainty of traditional real estate evaporate into mathematical certainty.

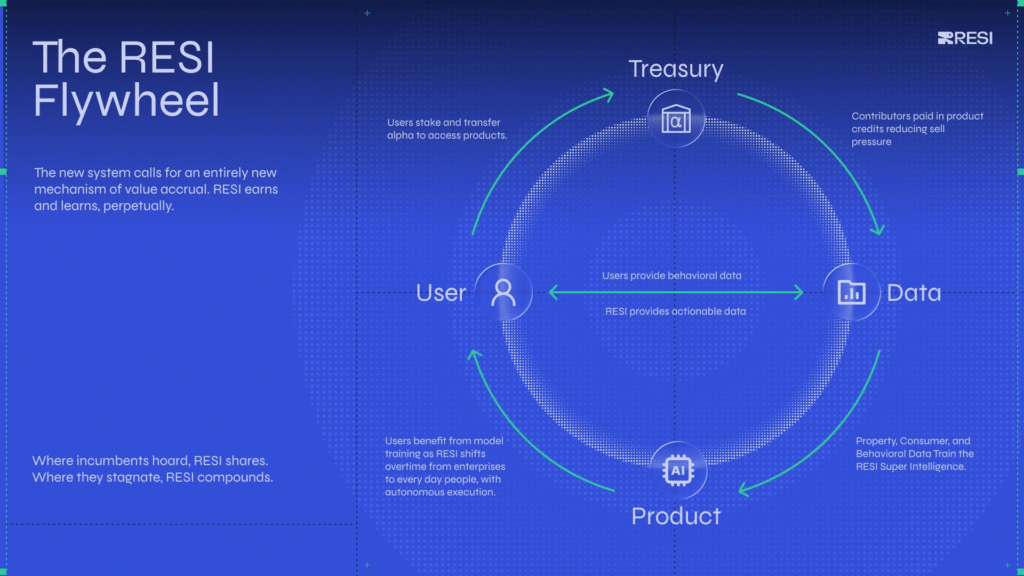

The RESI Flywheel

The economics of RESI create a self-reinforcing cycle that grows stronger with every participant. Users contributing behavioral data don’t just improve the system; they become stakeholders in its success.

When a real estate investor uploads their transaction history to access our predictive tools, that data trains the entire network to better identify motivated sellers.

When a DeFi protocol queries our oracle for collateral values, those queries refine our valuation models.

The new system demands new economics. RESI earns and learns, perpetually, from all parties.

- Users provide behavioral data → Training the intelligence

- RESI provides actionable insights → Enabling profitable decisions

- Revenue flows to treasury → Through staking and vesting mechanisms

- Treasury funds autonomous execution → Reducing human dependency

- Success attracts more users → Compounding network effects

This is stake-holding in its truest form: every participant owns a piece of the intelligence they help create.

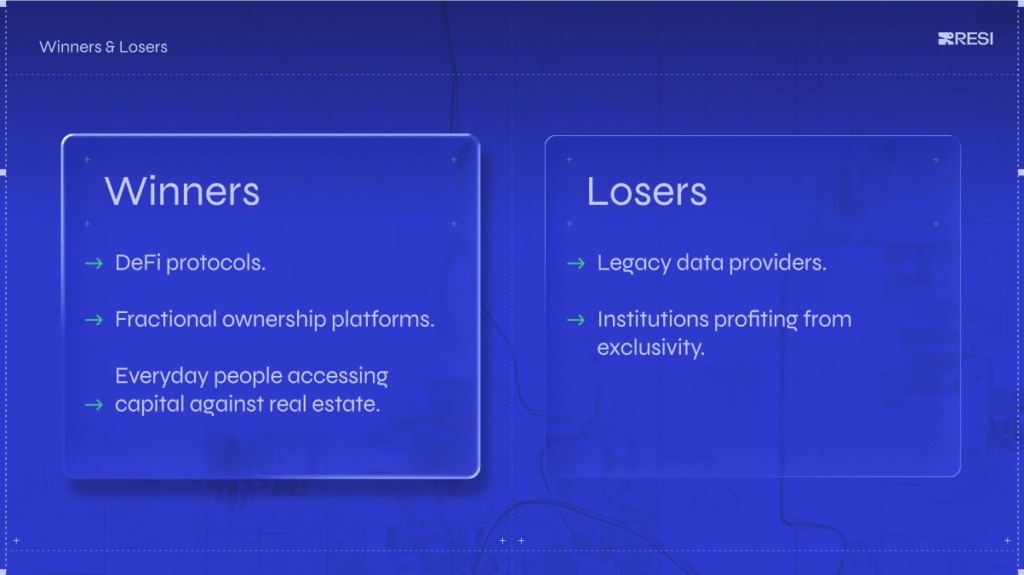

Winners & Losers in the New Order

Winners:

- DeFi protocols gaining access to $400 trillion in collateral

- Fractional ownership platforms democratizing property investment

- Everyday people accessing institutional-grade intelligence

- Builders creating the next generation of PropTech on RESI’s rails

Losers:

- Legacy data providers watching their moats evaporate

- Institutions whose profits depend on information asymmetry

- Gatekeepers charging tolls on transparent markets

- Cartels maintaining artificial scarcity

They’re not evil. They’re just obsolete.

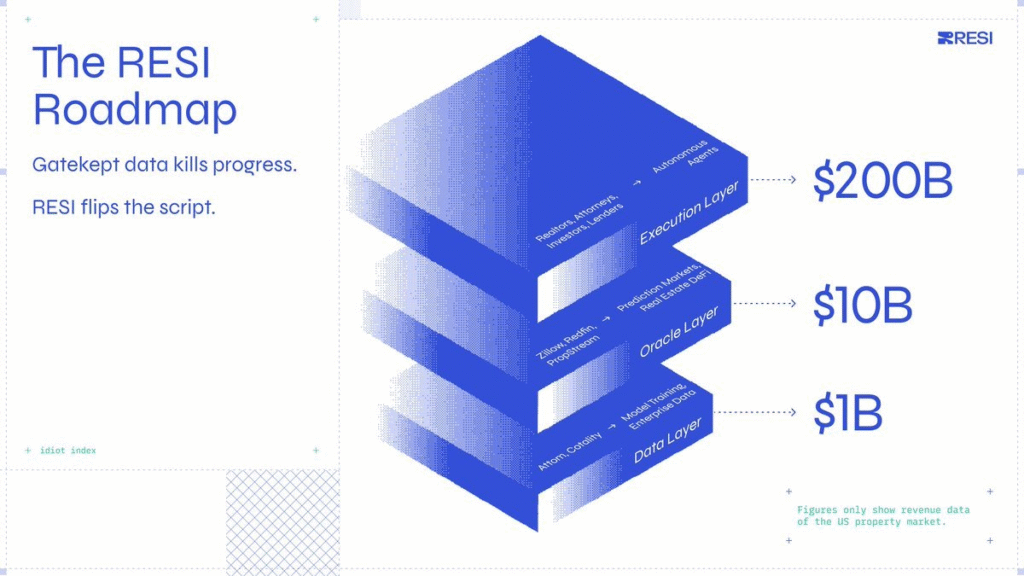

The Roadmap to $200 Billion

Phase 1: Data Layer ($1B Market)

October 2025 Nationwide property database complete. Every address, every transaction, updated daily.

Phase 2: Oracle Layer ($10B Market)

November 2025 Prediction markets launch. Real estate becomes liquid intelligence. The database acquires behavioral data to enable insights never thought possible.

Phase 3: Execution Layer ($200B Market)

2026-2028 Autonomous agents execute transactions. ReDeFi protocols proliferate. Traditional brokers become subject of historians.

The Bittensor Thesis

RESI embodies Bittensor’s vision: incentivized intelligence as infrastructure.

Our subnet doesn’t just mine data; it mines understanding and optimizes cost through subnet interoperability. Every validator contributes to a collective consciousness that grows smarter with each block. The treasury accumulates not just Alpha, but a stake in every protocol building on our intelligence.

Builders will be trained to leverage the piping of Bittensor, enabling the cost savings and superior product building to bring the old world onchain.

We’re not building a tech company. We’re building an alpha treasury, a venture ecosystem, and the permanent infrastructure for humanity’s largest asset class. Sub-subnets will emerge for specialized verticals while Protocol tokens will flow through our treasury.

The Global Vision

America is the proving ground, but the opportunity is planetary. The patterns we’re learning in Los Angeles apply to London. The algorithms trained on New York scale to New Delhi. Real estate may be local, but intelligence is universal.

Once we’ve demonstrated that property can exist simultaneously in the physical and digital realms, that ownership can be both singular and fractional, that transactions can be both legal and programmable, the model replicates globally.

Join the Network

The question isn’t whether real estate moves onchain. It’s whether you’ll own the rails it rides on.

Stake your claim in the intelligence layer.

Data wants to be free. Value wants to flow. Intelligence wants to grow.

Welcome to RESI. Welcome to the future of property.

Get Started

For Investors:

https://taostats.io/subnets/46

Builders & Protocols:

https://github.com/resi-labs-ai/resi

Follow Resi on X:

The greatest market in history is about to be liberated.

Be the first to comment