Cover Image Credit: SmartDev

For twenty years, software has been built around one assumption: That users are humans.

That assumption is breaking, not gradually, structurally.

The next wave of builders won’t win by improving interfaces or refining onboarding flows. They will win by designing systems that autonomous agents can evaluate, transact with, and optimize through.

This isn’t an AI product cycle; it’s a market redesign.

This article, curated from a masterpiece which was articulated by Max Sebti, Co-Founder and CEO of Score (Subnet 44), a simplified core insight that the unit of competition is shifting from interface to output, and from persuasion to optimisation.

And once you see it, you can’t unsee it.

From Persuasion to Optimisation

Traditional SaaS (Software-as-a-Service) was built on persuasion economics. Meaning that they are:

a. Designed with a compelling interface,

b. Tell a strong narrative,

c. Acquire users,

d. Reduce churn (the rate at which customers stop doing business with an entity or stop subscribing to a service over a specific period), and

e. Increase switching costs (intangible expenses, efforts, or risks a consumer or business incurs when changing from one product, service, or supplier to another).

Humans were slow decision-makers, emotional, biased, brand-sensitive, and sales-driven.

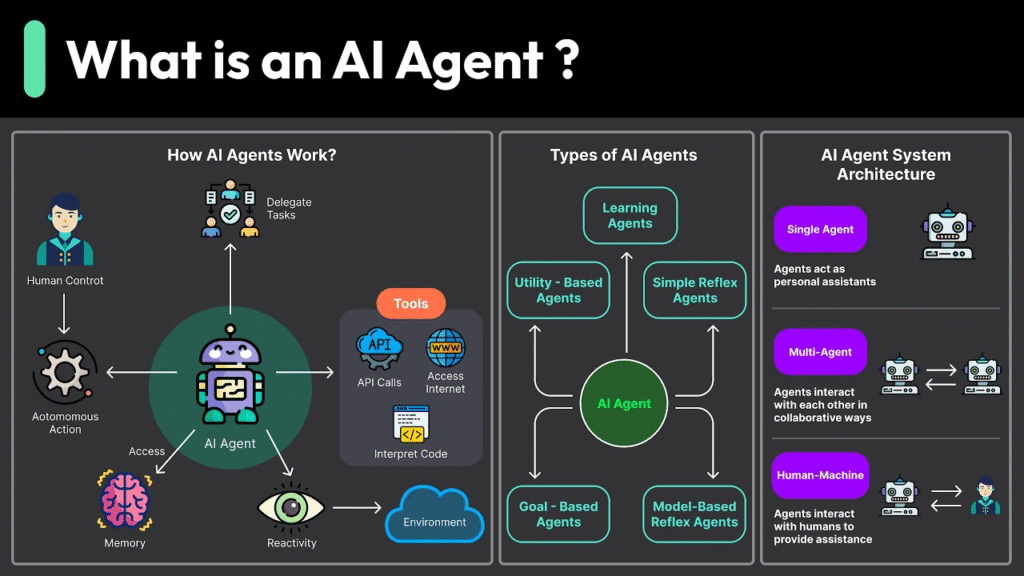

AI “agents” are none of those things.

As outlined in Ten Principles of AI Agent Economics, a recent academic work on agent systems, agents are optimisation engines. They:

a. Execute objective functions,

b. Operate under defined constraints,

c. Adjust autonomy levels based on risk tolerance, and

d. Continuously benchmark alternatives.

They do not care about your landing page, they care about measurable performance, and the product is no longer software someone “uses.”

It is a callable, testable, verifiable output.

The Market Becomes a Loop

In human markets, positioning creates niches, but in agent markets, optimisation creates them.

Instead of quarterly evaluations and procurement cycles, agents will:

a. Probe multiple “suppliers” simultaneously,

b. Benchmark in real-time,

c. Reallocate workloads dynamically, and

d. Arbitrage inefficiencies instantly.

Supplier selection becomes a live loop, and market discovery becomes continuous. This fundamentally alters competition.

Static moat is no longer built on narrative or brand, but on performance, reliability, and cost efficiency only.

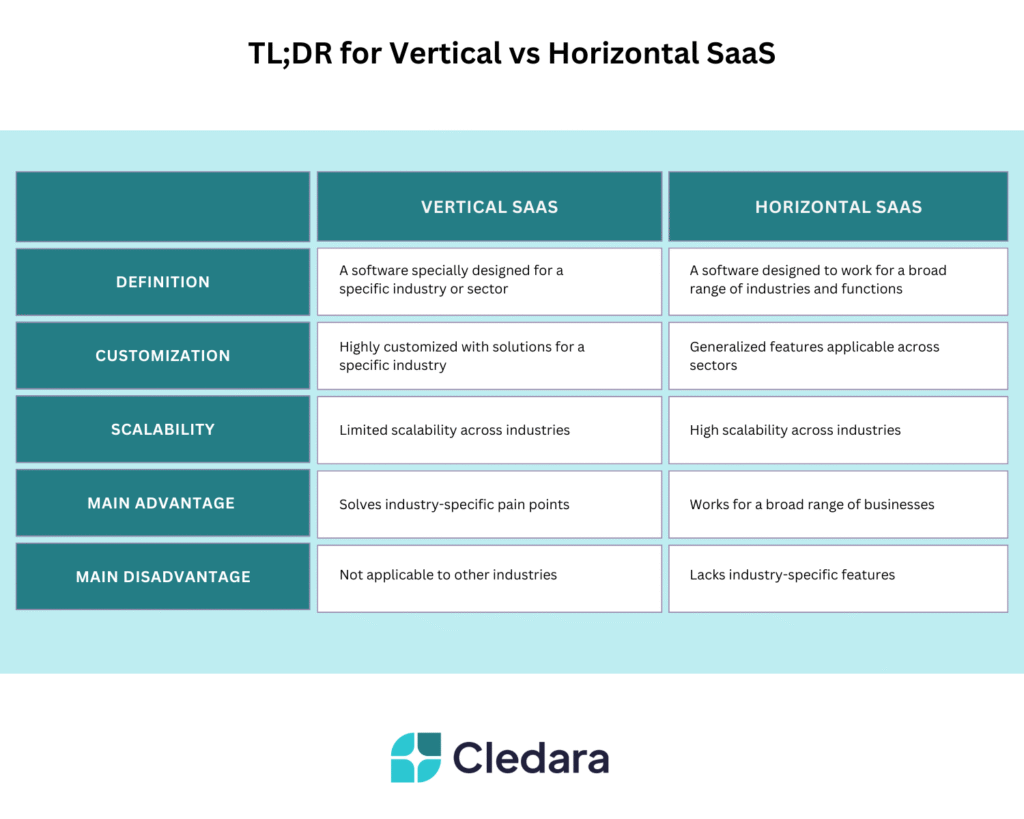

Why the Horizontals Suddenly Works

Historically, horizontal software struggled because humans introduced friction:

a. Onboarding complexity,

b. Departmental silos,

c. Training costs, and

d. Slow feedback loops.

Vertical specialization reduces the cognitive overhead and agents collapse that friction.

They:

a. Integrate via API (Application Programming Interface),

b. Evaluate via metrics,

c. Switch instantly, and

d. Scale in parallel.

When coordination cost drops to near zero, horizontal systems are no longer diluted. They become composable supply layers.

Industries stop behaving like categories and start behaving like optimisation surfaces.

Building for Legibility, Not Aesthetics

The “agent-first” shift is often misinterpreted as removing UI (User Interface), that’s not the real transformation.

The real shift is building for legibility to optimisation systems.

Agent-compatible systems require:

a. Clear invocation methods,

b. Transparent pricing,

c. Deterministic outputs,

d. Verifiable execution,

e. Defined failure boundaries, and

f. Explicit constraint modeling.

In other words, systems must be machine-readable not just machine-accessible.

As autonomy increases, the trade-off between efficiency and safety becomes more pronounced. Builders who succeed will not merely automate workflows: they will engineer constraints, audits, and verification into their economic layer.

The interface becomes secondary, and the mechanism becomes primary.

Distribution Without Marketing

The most underestimated shift isn’t product design, it is distribution.

Agents represent the most efficient distribution channel ever created because they allocate work which are purely based on objective optimization.

They:

a. Select the highest performer,

b. Switch when outperformed,

c. Continuously benchmark alternatives, and

d. Route capital automatically.

In that environment, marketing is not a growth engine, performance is.

This compresses margins for weak suppliers and accelerates growth for structurally efficient ones.

The Structural Advantage of Output Markets

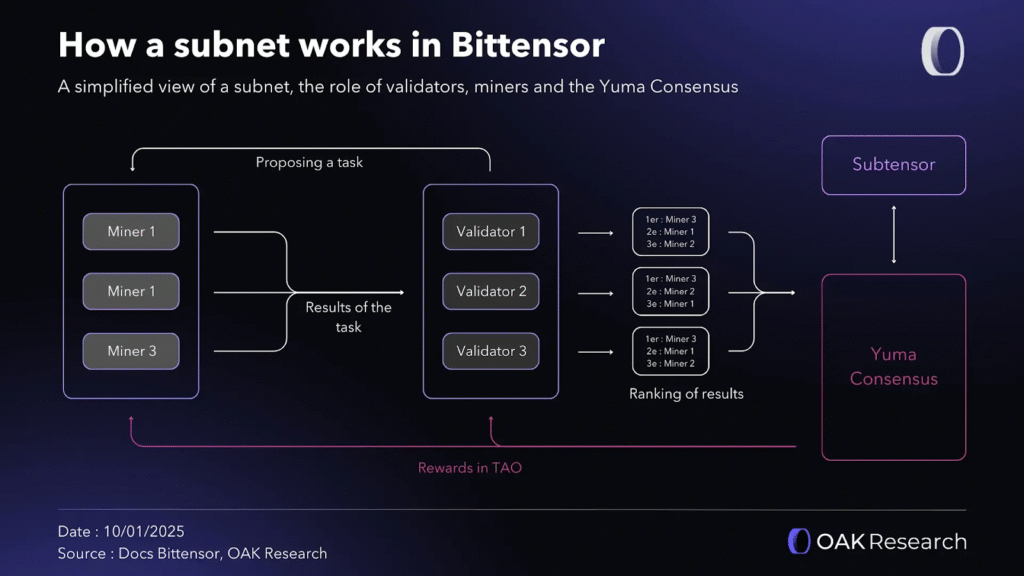

This is why decentralized output markets are uniquely positioned.

In systems like Bittensor, subnets already operate as continuous, tokenized competitions for machine-generated output.

They:

a. Incentivize suppliers (miners),

b. Measure performance (validators),

c. Adjust rewards dynamically, and

d. Operate 24/7.

From an agent’s perspective, this is ideal infrastructure:

a. Always-on,

b. Measurable,

c. Competitive, and

d. Programmatically accessible.

Subnets look less like SaaS platforms and more like liquid supply markets. Exactly what optimisation systems prefer.

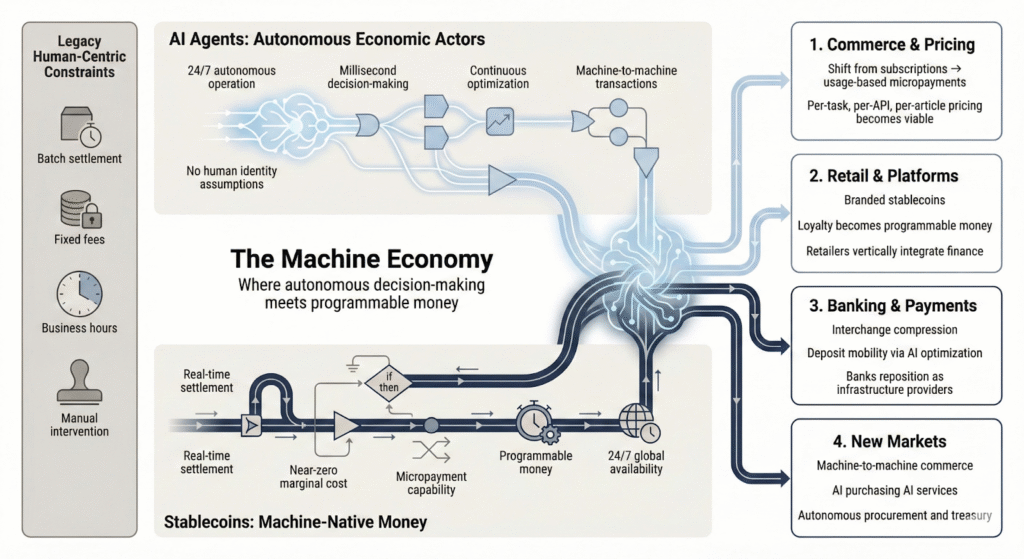

Why Crypto is the Native Rail

Autonomous agents require autonomous settlement. Traditional financial systems assume:

a. Human authorization,

b. Banking hours,

c. Rigorous legal paperwork, and

d. Institutional gating.

Agents require:

a. Programmable transactions,

b. Permissionless participation,

c. Machine-native payment rails, and

d. Instant settlement.

Crypto satisfies those conditions. Tokens, in this context, are not speculative artifacts. They are coordination primitives that allow software to compensate software without intermediaries.

If agents are going to hire other agents 24/7, they need a native economic layer.

When Agents Become Participants

The most underexplored implication is participation. Agents will not simply consume supply markets, they will shape them.

Consider a world where enterprise agents are tasked with optimizing latency, throughput, or cost efficiency, improving the supply network directly improves their objective function.

In permissionless systems, that can mean:

a. Spinning up miners,

b. Contributing improvements,

c. Adjusting validation parameters,

d. Coordinating capital allocation, and

e. Evolving mechanism design.

In SaaS, improvement requires roadmap meetings, and in decentralised market systems, the mechanism is open.

This transforms the relationship between user and platform.

The agent is no longer a customer but a participant in the economic loop.

SaaS Was Feature-Driven, Agent Economies Are Mechanism-Driven.

The SaaS playbook was simple:

a. Build features,

b. Acquire humans, and

c. Increase retention.

The agent economy operates differently:

a. Improve output quality,

b. Reduce cost per task,

c. Increase measurable performance, and

d. Attract routing flow.

The growth engine is not a funnel, it is optimisation pressure.

The Founder Question Has Changed

If the future is co-authored by human and machine intelligence, then the foundational supply layers will not win because they are beautiful. They will win because they are structurally efficient.

So the real question for founders entering 2026 is not:

a. What should our UI look like?

b. What niche should we target? Or even

c. How do we optimize conversion?

It is “What output market are we creating, and what incentive mechanism ensures that output improves every single day without our direct intervention?”

If that can be answered, the result is not just “merely building software(s)”, it is “designing an economy”.

An economy agents will:

a. Continuously route through,

b. Continuously fund, and

c. Continuously refine.

And once agents become the dominant economic participants, that is where infinite scale begins.

The shift becomes structural, not cosmetic, and the builders who understand that early will not just ship apps.

They will “own supply”.

Be the first to comment