Note: Full article was written by Benson Sun.

Three days ago, the crypto market suffered the largest liquidation wave in its history. Many analysts — myself included — first noticed that the USDe stablecoin had sharply depegged, but only on Binance.

At the time, we assumed this was the result of cascading liquidations from looping loans tied to Binance’s 12% APY USDe promotion.

In hindsight, that theory was backwards. The depeg wasn’t the cause — it was the consequence. The market had already collapsed before USDe moved.

The Two-Minute Fault Line

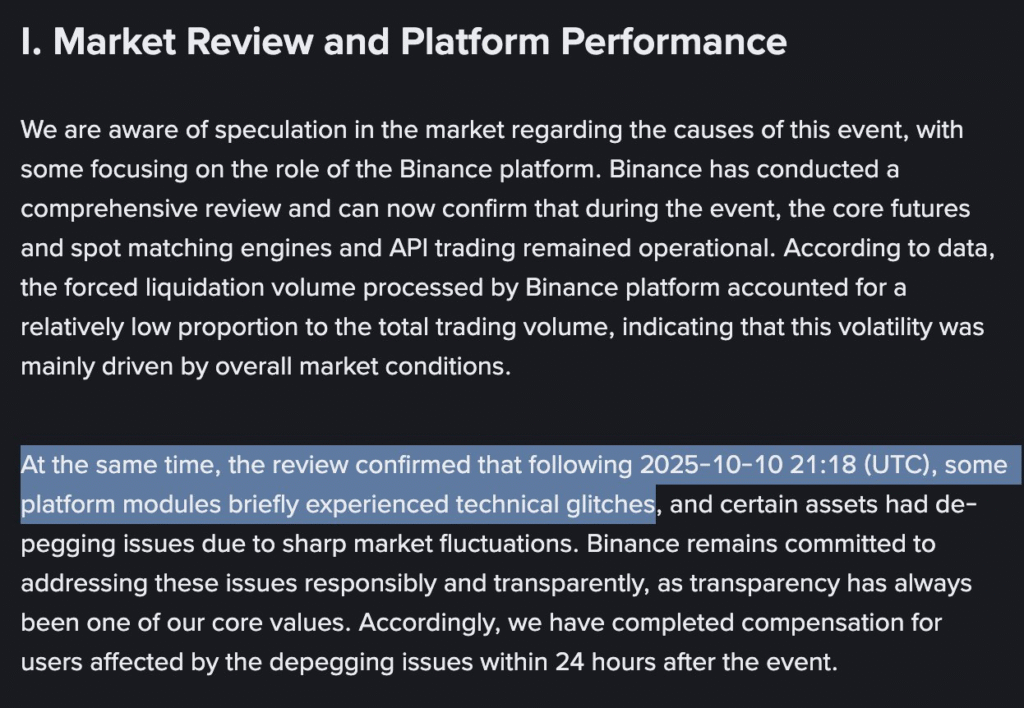

Between 21:18 and 21:20 UTC, Binance experienced an abnormal, synchronized withdrawal of liquidity. Order books were nearly drained, leaving the market in a brief but total vacuum.

When risk events hit, it’s normal for market makers to widen spreads and pull back temporarily. But this wasn’t normal caution — it was a disappearance.

Between Trump’s tariff announcement at 20:00 UTC and the market’s breakdown an hour later, a mild contraction in liquidity was expected. Yet the scale of what happened in those two minutes went far beyond anything that “risk management” could explain.

But the sheer scale of the collapse between 21:18 and 21:20 UTC went far beyond anything that “market-maker caution” could explain.

The Collapse in Context

Was Trump’s last-minute tariff announcement bad for crypto?

Absolutely.

Yet, when measured against history — the March 2020 COVID crash, the LUNA implosion, or the FTX meltdown — those crises were far more severe, and still none triggered such an extreme liquidity withdrawal in such a short window.

The top two assets, BTC and ETH, which benefit from deep off-exchange liquidity, remained relatively stable. Altcoins, however — dependent almost entirely on on-exchange market makers — became the biggest casualties of this liquidity vacuum.

Binance, long regarded for its deep spot liquidity, experienced unprecedented price dislocations across multiple tokens. As the world’s largest offshore exchange, its outsized influence caused USDT-based venues to mirror the collapse, while USD-pair platforms remained comparatively stable.

Take $XRP as an example:

- Binance’s lowest price: $1.2543

- Coinbase’s lowest price: $1.7710

- The gap between the two was approximately 41.2%—a discrepancy nearly unthinkable in normal market conditions

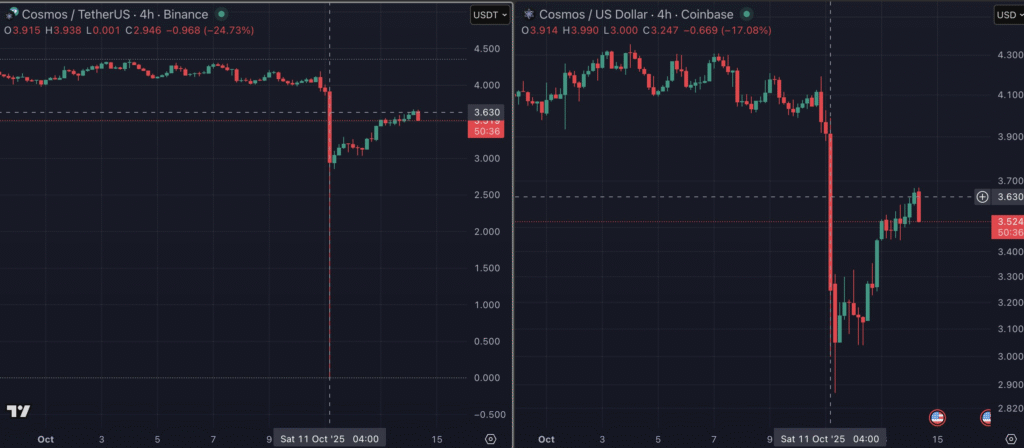

$ATOM is another example, even more extreme:

- Binance’s lowest price: $0.001

- Coinbase’s lowest price: $2.872

- A 2,871-fold price discrepancy — for a token ranked 54th by market cap.

The Question No One Is Asking

Three days after the crash, CT remains obsessed with surface-level narratives:

- debates over whether USDe’s depeg was the fault of the project team

- arguments about whether Binance’s $280 million compensation deserves praise or outrage;

- wild speculation that the mysterious whale who shorted early on Hyperliquid has ties to the Trump family.

Yet almost no one is asking the only question that truly matters——What exactly happened inside Binance’s trading systems between 21:18 and 21:20 UTC?

This was not a typical liquidation cascade driven by panic.

The synchronization of Binance’s liquidity collapse during those two minutes exceeded anything seen in previous market crises.

If this were merely a case of market makers collectively pulling liquidity as a hedge, other exchanges should have shown similar signs.

But they didn’t — no other venue experienced a spot-market vacuum anywhere near this scale.

Binance’s role in crypto is analogous to that of the CME in global commodities — it functions both as a hub for price discovery and as the clearing backbone of the entire ecosystem.

Now imagine this: if one day, crude oil or gold prices on the CME were to suddenly plunge far below those quoted elsewhere, triggering mass liquidations and market-wide margin calls, regulators and institutions around the world would demand a full, transparent investigation.

Yet in crypto, an event of comparable magnitude has been met with silence.

The world’s largest exchange experienced a systemic collapse in spot prices within a mere two minutes, and to this day, no concrete postmortem or technical explanation has ever been released.

Binance’s response — a vague reference to “a temporary glitch in some trading modules” — hardly explains what happened.

This was no ordinary flash crash.

It was the largest liquidation wave in crypto’s history — an event that shook the market’s structural foundation:

- Mass Liquidations — Hundreds of thousands of traders were wiped out within minutes, with tens of billions of dollars evaporating from the system.

- Market Maker Losses — Several major liquidity providers reportedly suffered multi-billion-dollar losses, as order books thinned and spreads exploded.

- Delta-Neutral Fund Breakdown — Countless delta-neutral funds saw their short legs forcibly ADL’d, leaving their long positions fully exposed, triggering cascading losses across the market.

If an incident of this magnitude can be brushed off so casually, how can market participants continue to trust the industry?

I personally didn’t lose much in this event.

Binance has long been my primary exchange. Before the incident, roughly 15% of my portfolio was held there — but I’ve since moved those assets elsewhere.

It’s not about the loss itself; it’s about the lack of accountability.

Several of CoinKarma’s core metrics rely on data sourced directly from Binance’s market API endpoints.

For researchers, developers, and quantitative teams like us, Binance’s trading data is not merely market information — it is the foundational infrastructure that underpins our entire research framework and strategy validation process.

Yet when a systemic anomaly of unprecedented scale occurred, the community was left without even the most basic technical explanations.

No postmortem, no data transparency, no insight into how — or why — the world’s largest exchange experienced a market-wide vacuum in just two minutes.

I am not a conspiracy theorist, nor do I believe Binance has any motive to manipulate markets, profit at the expense of its own users, or deliberately target market makers.

If that were true, Binance could never have achieved its current stature — let alone become the world’s largest exchange.

Binance’s rise to this scale has been built on a long record of making sound and decisive choices at critical moments.

It is precisely for this reason that I sincerely hope Binance will take the initiative to provide a comprehensive post-incident explanation:

- The state of its internal trading systems between 21:18–21:20 UTC,

- How its matching and risk-control modules behaved, and

- Why its prices deviated so dramatically from peers.

This is not merely about trading risk; it is about transparency and systemic trust.

If the world’s largest exchange can suffer the steepest price collapse in crypto history — and choose to downplay the fact that its prices fell far below its peers — it exposes every participant in the crypto industry to an unavoidable systemic risk.

Be the first to comment