Bittensor ecosystem project VoidAI has officially launched Subnet 106 (SN106), a liquidity protocol designed to connect Bittensor’s native token TAO and subnet alpha tokens to broader DeFi markets, starting with Solana.

In a detailed thread on X (formerly Twitter) posted Monday, the VoidAI team described SN106 as a “protocol-native liquidity layer” that enables cross-chain bridging and concentrated liquidity provisioning, tying emissions directly to useful market activity.

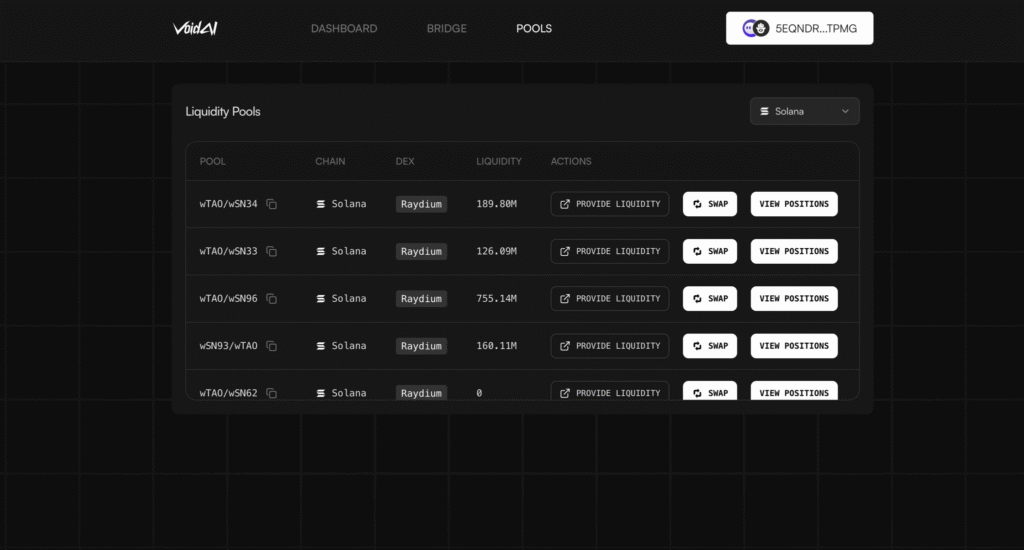

The announcement highlights integration with Solana’s Raydium for concentrated liquidity market making (CLMM) and plans for expansion to Ethereum via Chainlink’s CCIP.

VoidAI, which positions itself as a multi-chain liquidity protocol for Bittensor, aims to unlock value in undervalued subnet tokens by making them accessible beyond Bittensor’s network.

Why SN106 Matters

Bittensor’s subnet tokens—often called “alpha” tokens—have historically been siloed, limiting their liquidity and scalability.

SN106 addresses this by introducing a bridge that allows TAO and alpha tokens to move to Solana as wrapped assets (wTAO and wAlpha), where they can be traded in concentrated liquidity pools.

This creates economic alignment: SN106 mirrors Bittensor’s TAO emission schedule, allocating rewards proportionally to a subnet’s share of emissions.

For example, if a subnet receives 10% of TAO emissions, its corresponding wAlpha/wTAO pool on Solana gets 10% of SN106 emissions. This mechanism extends Bittensor’s consensus into DeFi, potentially boosting token valuations and ecosystem interoperability.

Analysts note that this could transform Bittensor subnets into global DeFi assets, challenging centralized AI token models while fostering sustainable liquidity.

How It Works

Users start by bridging assets via the VoidAI Bridge, receiving wrapped tokens on Solana.

Liquidity providers then create positions in Raydium CLMM pools for wAlpha/wTAO pairs, minting them as NFTs that can be staked into the SN106 Solana program.

Validators score these positions based on factors like concentration (tighter price ranges score higher), price alignment (proximity to current market price), and depth (larger liquidity amounts).

Emissions are distributed accordingly, with trading fees flowing to the SN106 treasury.

Economic Model

SN106’s model emphasizes sustainability: By default, 95% of emissions are burned, while 5% are rewarded to liquidity providers.

This keeps supply tight and aligns incentives with Bittensor’s weighting system.

Trading fees from staked positions bolster the treasury, funding development and growth. The result is a self-reinforcing loop where better liquidity strengthens subnet tokens and attracts more participation.

Roadmap: Multi-Chain Expansion

Solana marks the initial phase, with Ethereum next on the horizon via Chainlink CCIP integration. Governance will determine additional alpha token onboarding and chain expansions, potentially including Base. This phased approach aims to direct liquidity to high-demand ecosystems, ensuring SN106 evolves with market needs.

How to Participate in VoidAI

SN106 offers roles for liquidity providers (miners) and validators. Participation requires access to Bittensor and Solana wallets.

For Liquidity Providers (Miners):

- Bridge Tokens: Use the VoidAI Bridge to transfer TAO or alpha tokens from Bittensor to Solana, receiving wTAO or wAlpha.

- Provide Liquidity: On Raydium, navigate to CLMM, select a wAlpha/wTAO pair, set your price range, and provide liquidity to mint an NFT position.

- Stake Position: Stake the NFT in the SN106 Solana program to start earning emissions based on position quality and subnet emissions share.

- Monitor and Earn: Track rewards, which include emissions and trading fees (redirected to treasury while staked).

For Validators:

System requirements include at least 4 CPU cores, 8GB RAM, 50GB SSD, and a stable internet connection. Recommended: 8 cores, 16GB RAM. Join the VoidAI Discord for support and updates.

Community Response

The announcement garnered positive feedback, with users noting the potential for a “paradigm shift” in Bittensor’s DeFi integration. One commenter predicted benefits for all subnets, while others expressed excitement about the bridge’s go-live.

Be the first to comment