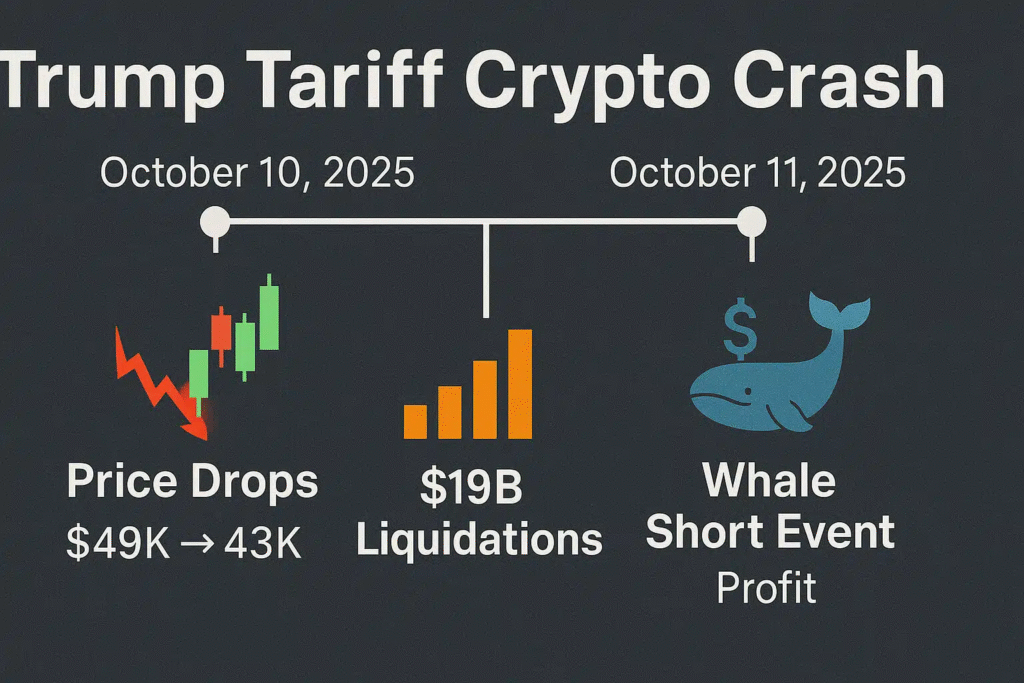

Markets today move faster than ever. Prices shift in milliseconds, liquidity disappears without warning, and automated trading systems can unintentionally amplify volatility instead of containing it. October 2025 proved this again when a sudden chain of liquidations sent several crypto assets crashing within minutes.

So the question is simple: How do we design exchanges that stay stable when markets get chaotic?

“Dynamic Incentives on Exchanges: Proposal for Intelligent Maker Takers”, a research paper curated by TAOS (Subnet 79 on Bittensor), proposes a fresh answer. It presents a new kind of incentive structure built for modern, AI-driven markets.

This is a clear summary of that proposal, written for readers who don’t want dense math or academic language, just the core ideas.

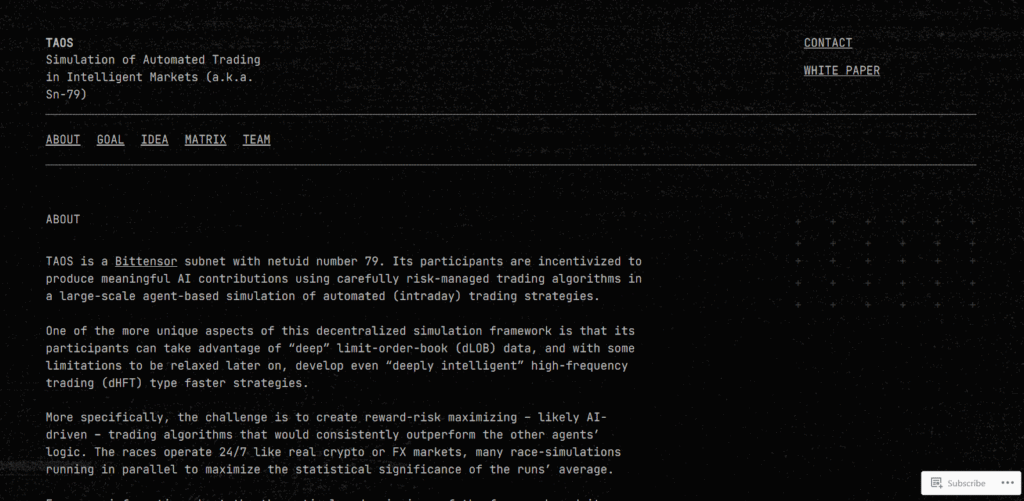

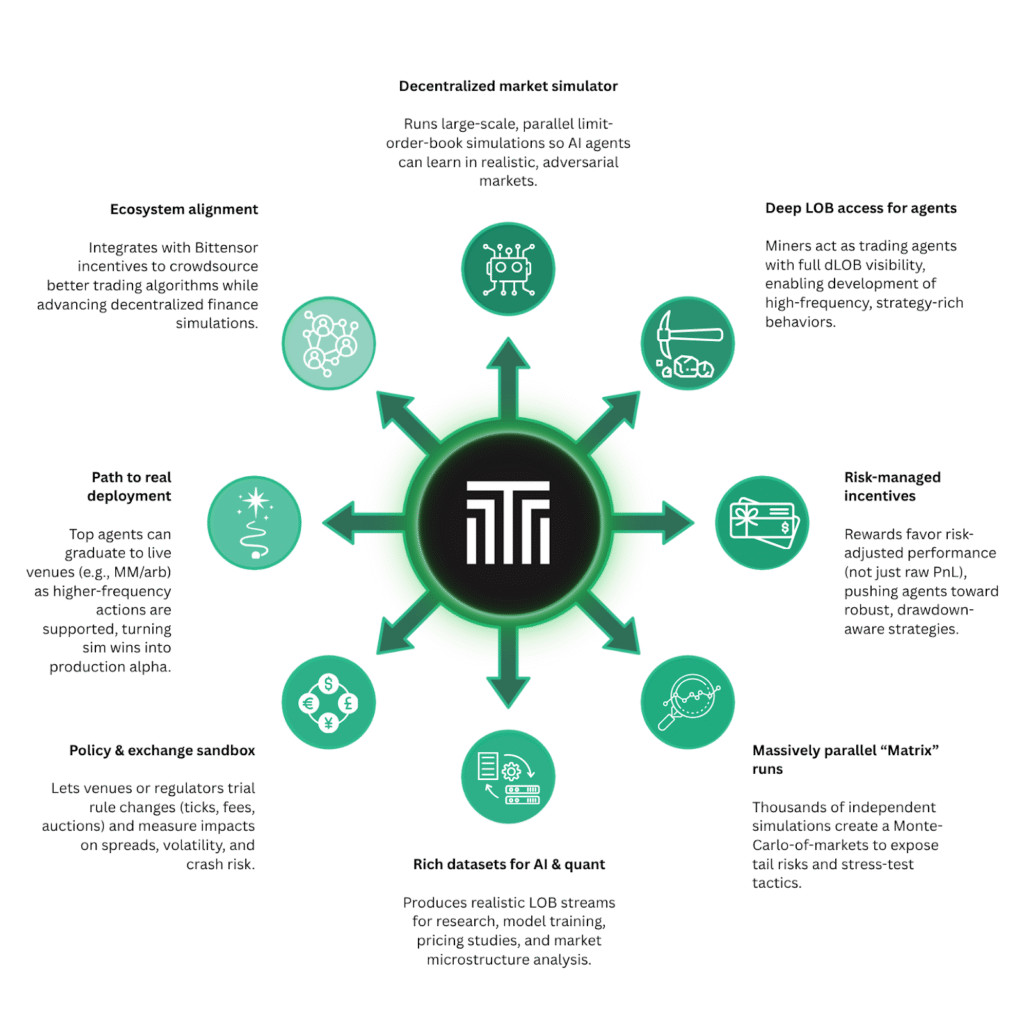

What TAOS Stands For?

TAOS is a Bittensor subnet built to test and train AI-trading strategies in a safe, simulated environment. Instead of risking real money, TAOS creates thousands of virtual markets where AI agents can trade, learn, and improve.

This subnet achieves this with the following strategies:

a. It runs large simulated markets that look and behave like real crypto exchanges.

b. AI “miners” act as trading bots, placing buy and sell orders just like real traders.

c. A system that rewards the bots that make the smartest, safest, and most consistent decisions.

d. It produces realistic market data that anyone building AI trading tools can use.

e. It helps teams test new trading ideas, exchange designs, or risk models without real world losses.

In simple terms, TAOS is a decentralized trading simulator that trains better trading algorithms and exposes how markets behave under different conditions.

It brings financial research, risk modeling, and AI-trading tools into the Bittensor ecosystem.

Why Today’s Exchanges Need Better Incentives

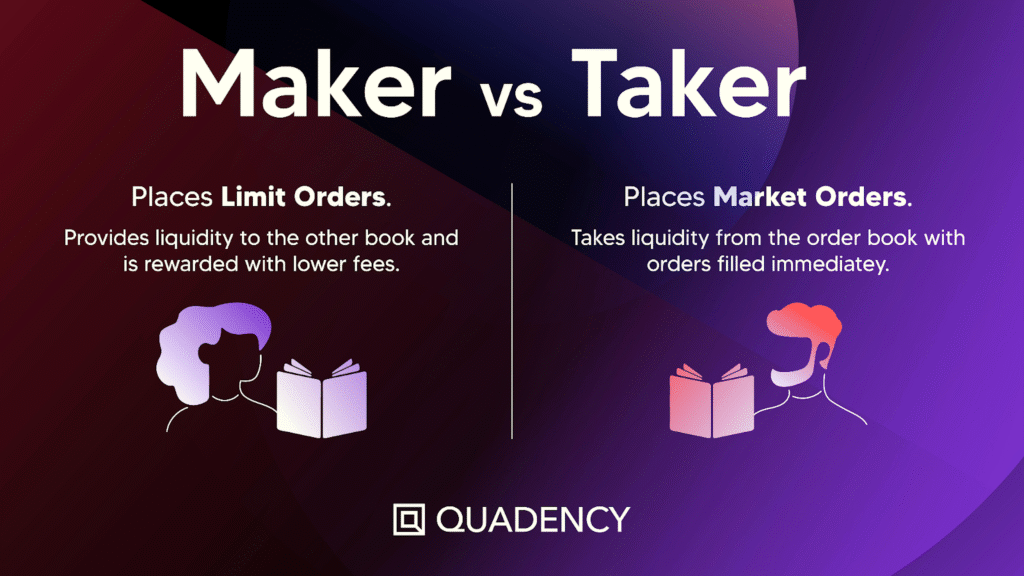

Most exchanges use a simple fee system:

a. Makers (who add liquidity) get lower fees

b. Takers (who remove liquidity) pay higher fees

This static approach worked when human traders dominated markets. But it breaks down in today’s environment because:

a. Traders artificially increase volume just to qualify for lower fees

b. During extreme volatility, makers withdraw instead of staying in the market

c. Takers are discouraged from pushing prices toward fair value

d. Fee structures don’t react to current liquidity or stress conditions

In short, static incentives assume slow markets, but modern markets aren’t slow anymore.

What the Dynamic Incentive Structure (DIS) Proposes

TAOS introduces a new model called the Dynamic Incentive Structure (DIS), a system where transaction rebates and fees change automatically based on what the market needs right now.

The idea is this: Instead of paying fixed maker or taker fees, traders are rewarded or penalized depending on whether their action helps restore balance in the order book.

For example, if the market needs more passive liquidity:

a. Makers get rebates

b. Takers pay small fees

Likewise, if the market needs more aggressive trades to move toward the true price:

a. Takers get rebates

b. Makers pay small fees

This creates a self-correcting system where traders are financially nudged toward whatever improves market health in real-time.

Key benefits of this system is that it:

a. Encourages makers to stay during volatility

b. Encourages takers to push price toward fair value when needed

c. Reduces extreme crashes by balancing order flow

d. Rewards traders who help stabilize the market

Think of it like the funding rate in perpetual futures, but applied directly to spot trading behavior.

Why Intelligent Speed Matters

Over the last 20 years, market speed has escalated from milliseconds to nanoseconds. Now, with AI-driven trading, it’s not just about speed but intelligent speed.

TAOS argues that modern markets require incentives that:

a. Reward traders who react to real information quickly

b. Discourage stale orders that distort the book

c. Encourage better order placement, cancellation logic, and risk management

d. Push algorithms toward optimal behavior instead of volume gaming

In other words, DIS pushes traders to be smarter, not just faster.

Improving Market Quality Without Heavy Regulation

When markets crash, regulators typically introduce circuit breakers or delays. But TAOS argues these are blunt tools that don’t fix the underlying issue.

DIS offers a market-native alternative:

a. No need to slow down trading

b. No need for centralized rule changes

c. Incentives adapt automatically to each moment

d. Works 24 hours a day without human intervention

This is especially valuable in crypto and foreign exchange markets, where trading never stops and liquidity can vanish instantly.

The October 2025 crash showed how quickly markets can unravel without real-time stabilization forces. DIS is designed to provide that missing layer of resilience.

TAOS as a Testing Ground

TAOS, running on Bittensor’s Subnet 79, creates a decentralized artificial exchange where new economic mechanisms can be safely tested before deployment in live markets.

With this infrastructure:

a. Designs can be calibrated using real trader behavior

b. Incentive models can evolve based on empirical data

c. Future versions of DIS can adapt to more complex market structures

This is not just theory, TAOS is actively running experiments in real-time.

Conclusion

The TAOS research paper makes a compelling case for a new generation of exchange incentives. Traditional fee systems were built for slower markets and simply cannot handle today’s AI-driven, ultra-fast trading landscape.

Dynamic Incentive Structure (DIS), however, introduces flexibility and intelligence into market design. They reward traders who contribute to stability, penalize those who introduce imbalance, and continuously adapt to market conditions.

This approach could fundamentally improve:

a. Liquidity

b. Volatility

c. Crash resistance

d. Price accuracy

And TAOS is already putting it into practice on Bittensor. This isn’t just another fee model, it is a blueprint for healthier markets in an era where trading speed and intelligence have outgrown the systems designed to contain them.

Be the first to comment