In a year marked by turbulence across the cryptocurrency market, Bittensor’s TAO has emerged as a symbol of resilience. While many AI-linked tokens have stumbled, TAO has shown steady strength. Over the 30 days leading up to October 23, 2025, it recorded a 35% rebound, outperforming its peers in the sector and gaining attention for its consistent upward momentum. TAO is not just surviving; it is thriving.

Recent Performance: Outshining the AI Pack

As of October 23, 2025, TAO trades around $388.40, with a market capitalization of $3.94 billion and a 24-hour trading volume of $300 million. This marks a strong recovery from early October levels near $300, a gain of more than 35% within the month, to local highs of around $480.

Trading activity has also grown rapidly, with total monthly volume nearly tripling from $2.3 billion to $7.03 billion in October. Despite a broader downturn that has pulled many AI-related cryptocurrencies into negative territory, TAO continues to climb.

Here’s how TAO compares to other leading tokens in the space (as of mid-October 2025):

| Token | Project Focus | 30-Day Price Change | Market Cap (USD) | Key Notes |

|---|---|---|---|---|

| TAO (Bittensor) | Decentralized AI marketplace | +35% | $3.94B | Strong rebound; institutional inflows; halving anticipation |

| FET (Fetch.ai) | AI agent economy | -15% to -20% | ~$2.5B | Impacted by market downturn, project controversy |

| RENDER (Render Network) | GPU rendering | -10% to -15% | ~$1.8B | Lower demand; centralized competition |

| ICP (Internet Computer) | AI on blockchain | +5% to +10% | ~$4.2B | Moderate recovery |

| NEAR (NEAR Protocol) | AI-integrated blockchain | -5% to -10% | ~$5.1B | DeFi slowdown impact |

TAO’s performance stands apart. Even during a market-wide decline, it posted a 12% surge after the resolution of a $28 million hack investigation, where an insider was identified, restoring investor confidence. Technical indicators also support its strength, with a rising Chaikin Money Flow, bullish MACD crossovers, and positive sentiment suggesting potential movement toward the $540 resistance level.

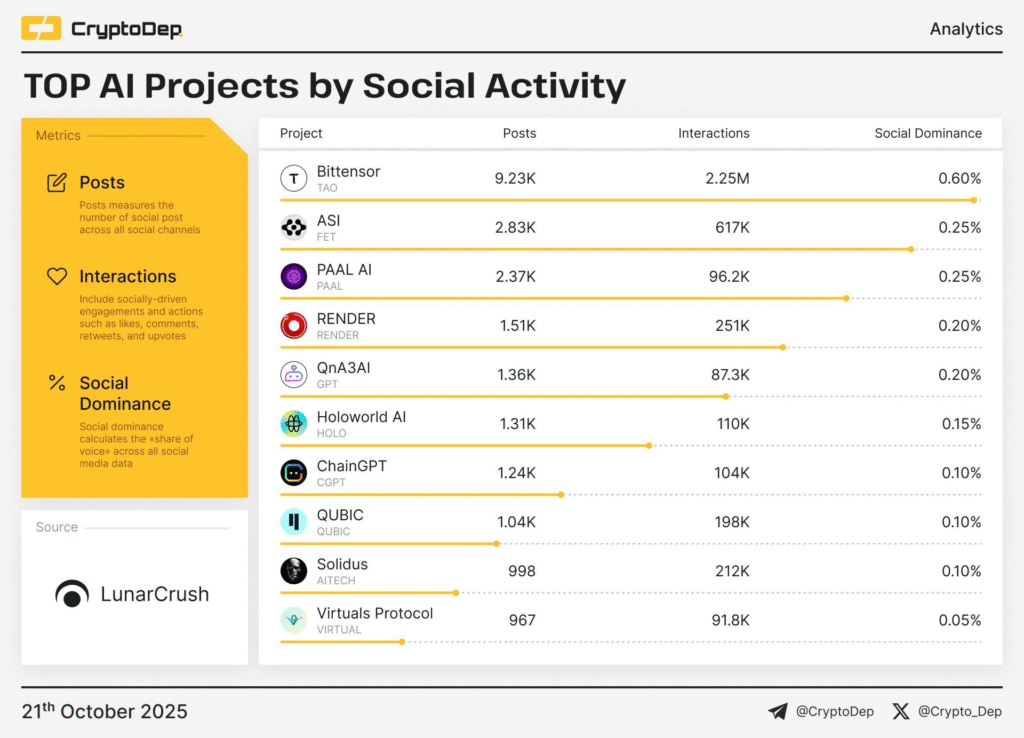

Bittensor ($TAO) continues to dominate both social and market momentum among AI tokens.

According to CryptoDep / LunarCrush, Bittensor leads all AI projects in social activity. Across trader discussions, TAO is consistently identified as one of the few AI tokens still in profit, commanding nearly 33% of the DePIN sector’s mindshare. This visibility is reinforced by recent 80% gains in just two weeks, largely attributed to institutional accumulation and rising subnet activity.

Token Fundamentals: Bitcoin-Like Scarcity Meets AI Utility

Bittensor operates as a decentralized protocol for machine learning, rewarding contributors who provide valuable intelligence outputs. The model creates an open market for intelligence, where network participants earn TAO based on real contributions rather than speculation.

Key fundamentals include:

- Supply Dynamics: TAO has a maximum supply of 21 million, with 10.14 million currently in circulation. Emissions halve every four years, with the next halving expected in December 2025, tightening supply and potentially driving price appreciation.

- Staking and Utility: About 12.7% of the total supply is locked in active subnets, reducing liquid supply. Validators stake TAO to score outputs, miners compete for rewards, and users pay for intelligence—all creating organic demand.

- Economic Model: TAO has no pre-mine or team unlocks. Emissions flow to participants who actively contribute to the network.

While TAO remains 49% below its all-time high of $767.68 (April 2024), it has surged over 1,100% from its low of $30.40 (May 2023), underlining strong long-term growth. Analysts forecast further upside potential, particularly with institutional adoption accelerating.

Why TAO is Outperforming: Market Drivers and Catalysts

TAO’s resilience is supported by a combination of real-world demand, sound economics, and market catalysts:

- Institutional Validation: Grayscale’s AI fund lists TAO as its largest position. Nasdaq-listed firms like Oblong and TAO Synergies have added TAO to their corporate treasuries. Foundry has shifted a portion of its staff to build dedicated Bittensor infrastructure, signaling long-term confidence.

- Halving Anticipation: The December halving will cut token issuance by 50%, creating immediate supply pressure similar to Bitcoin’s post-halving trends.

- Decentralized Intelligence Infrastructure: TAO enables a permissionless economy for AI applications such as inference, training, and agents—bringing decentralization to one of the fastest-growing global industries.

- Resilience During Market Stress: Even during broader market selloffs, TAO has shown a consistent ability to recover faster than other tokens, supported by staking demand and steady protocol upgrades.

Conclusion

TAO’s 35% rise over the past month is the result of solid fundamentals, not hype. Its structure mirrors Bitcoin’s scarcity while introducing real utility through decentralized computation. With halving, institutional accumulation, and continued ecosystem growth ahead, TAO remains one of the strongest performers in the crypto-AI sector.

While short-term corrections are always possible, the underlying momentum points toward sustained strength and continued leadership in decentralized intelligence and DeAI.

Be the first to comment