If you’ve been watching $TAO lately, you’ve probably noticed the price is trending downward. After the historic first halving on December 15, 2025, the price hasn’t rocketed like some people expected. Instead, TAO has pulled back, volatility is high, and sentiment feels split.

For people watching their portfolios shrink, this feels painful. TAO is still about 69% below its March 2024 all-time high of $757. Some people are frustrated. Others are loading up quietly. So what’s actually going on?

The Bear Case Everyone’s Talking About

Let’s be honest about what’s causing the downward pressure. After the halving cut daily TAO emissions from 7,200 to 3,600; miners, delegators, and validators who were accumulating rewards started selling. That’s creating immediate sell pressure, and the charts show it clearly with lower lows and no quick reversal signal yet.

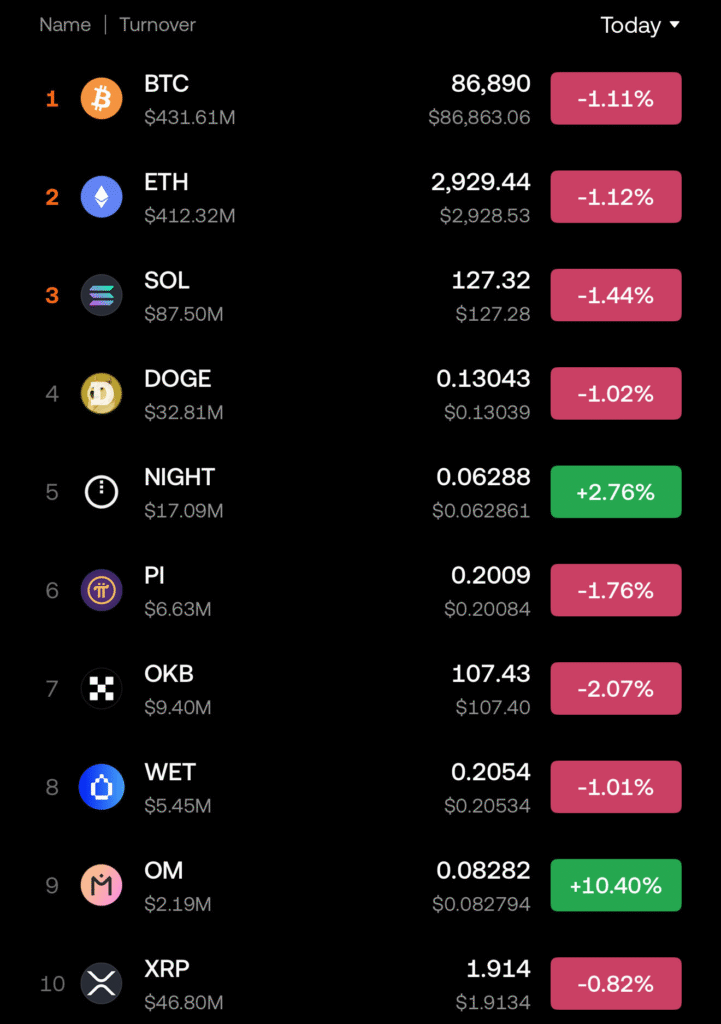

Some traders are also pointing to broader market volatility. The crypto market is dumping sharply, with total market capitalization sliding to around $2.91–$2.93 trillion and Bitcoin hovering near $86,000–$87,000. The sell-off is being driven by a mix of macro tightening, institutional outflows, and technical pressure. Markets are de-risking ahead of a possible Bank of Japan rate hike, which could drain global liquidity. At the same time, over $1B has exited spot BTC and ETH ETFs, raising fears of institutional selling. Miner and long-term holder distribution, especially on Asian exchanges, has added spot pressure, while $500M+ in leveraged liquidations accelerated the drop. With sentiment at extreme fear and weak technicals, Bitcoin and the whole of crypto ($TAO inclusive) risk a deeper move.

Why This Might Actually Be Good

But there’s a completely different way to read what’s happening, and it’s the perspective that has long-term holders staying calm or even excited.

The halving wasn’t supposed to make everyone rich overnight. What it’s actually doing is forcing Bittensor to mature. Think of it as a filter that separates real value from hype. Before the halving, high emissions meant the system was paying for everything—good subnets, mediocre subnets, and outright bad ones. Now that the free money tap is turned down by half, only projects delivering real value can justify their existence.

This is what one popular saying calls “noise getting expensive while signal wins.” Weak projects fold or improve. Strong subnets with real users and real utility get rewarded more. The network is essentially being forced to get sharper and more efficient.

From a pure economics standpoint, cutting supply in half while demand for decentralized AI infrastructure continues growing creates obvious upward pressure over time. The inflation rate just dropped from 26% annually to 13%. That’s a fundamental change in TAO’s scarcity, and scarcity matters in markets. Anyone who’s watched Bitcoin’s halvings knows the pattern is rarely instant, but historically, it’s been powerful.

The Long Game That Has People Bullish

What separates the bulls from the bears right now comes down to the time horizon. If you’re trading TAO trying to catch short-term moves, this environment feels terrible. But if you believe decentralized AI is inevitable and Bittensor is building the infrastructure for it, then buying at $235 looks wildly different.

Many holders frame it this way: TAO represents ownership in 128+ specialized AI “companies” (the subnets), each focused on different aspects of machine intelligence. Some handle data collection, others run AI inference, some provide computing power, and more launch constantly. It’s exposure to an entire ecosystem of decentralized AI innovation, not just one token or one project.

The fundamentals that matter to these people aren’t about today’s price. They’re watching subnets ship new features, verifiable AI going live, trading infrastructure improving, and serious builders committing to the ecosystem despite market conditions. Activity on the network continues to grow. Tools keep getting better. The technology is advancing, whether the token price reflects it yet or not.

There’s also a belief that the centralized AI companies everyone points to as competition are actually creating the demand that decentralized alternatives will eventually capture. OpenAI and Google are proving how valuable AI is, but they’re also showing the problems with a few companies controlling everything—pricing, access, censorship, data privacy. Bittensor positions itself as the open alternative, and many holders see that positioning becoming more valuable as AI becomes more critical to society.

So Is This Hopium or Reality?

TAO’s price is down, and that’s frustrating if you bought higher. The post-halving selloff is real and bears have valid points about market conditions and exposed inefficiencies.

At the same time, sentiment among people who closely follow Bittensor remains strongly bullish. They see the halving as a maturation moment, not a failure. In their view, price is temporarily disconnected from fundamentals that are improving beneath the surface. Whether they’re right or wrong will play out over time.

But one thing is clear: the most convicted TAO holders aren’t selling into this dip. They’re buying it. Sometimes price falls not because the system is failing, but because it’s becoming honest. And in markets, honesty tends to pay later.

Be the first to comment