Contributor: Ali G

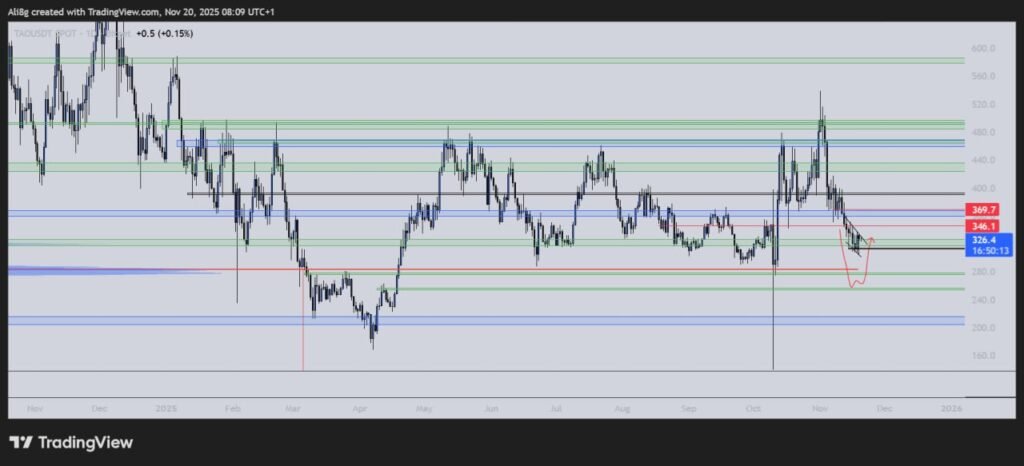

TAO has spent several months trapped in a well-defined price range, and according to a multi-timeframe analysis, the market is now approaching areas that could trigger a significant move.

Below is a structured breakdown of the outlook, supported by the provided charts.

Higher-Timeframe Overview: TAO Still Ranging

On the weekly chart, TAO continues to move inside a broad consolidation zone. This prolonged range has created several high-volume nodes and points of control (POC) where price has historically reacted.

On higher timeframes, price is likely to seek imbalance around key POC areas before showing any convincing reversal. This behavior aligns with classical volume-profile theory: markets often revisit areas of high inefficiency before rebalancing.

TAO is still in its macro range. No higher-timeframe trend confirmation yet.

Zooming into the daily chart, we observe how the price currently hovers near a potential inefficiency zone, marked by the trader on the chart. If TAO breaks downward into this imbalance, we should monitor whether price:

- Closes inefficiency (fills imbalance)

- Prints a bullish reversal structure

- Reclaim the POC

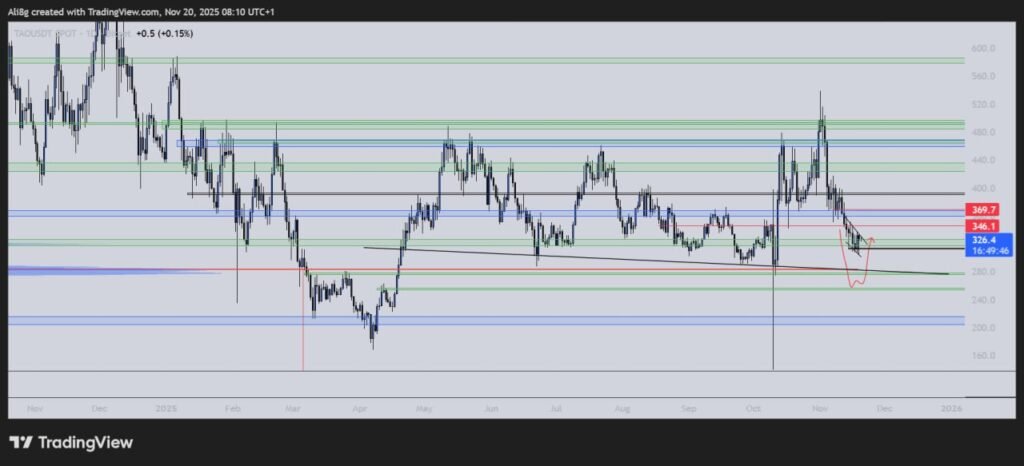

Lower Time frame (1h)

On the 1h TF, the price is forming a channel that could accompany the price in the areas identified on the higher TFs or, once again, create an imbalance by breaking the channel downwards, then regaining it.

In the event of an upward breakout, the first two targets are marked on the chart, where the PA could find another downward reaction, forming new structures on lower TF.

Final Notes

If, on the other hand, it breaks the channel upwards, the first two targets have been marked on the chart.

Be the first to comment