Bittensor has emerged as one of the most ambitious crypto projects, rewarding intelligence activities through a system of specialized “subnets.” Its native token, $TAO, powers every part of the ecosystem — from staking and delegation to validator/mining rewards.

Recently, however, data shows a striking movement: $TAO is flowing out of Bittensor’s Root Network and landing in private wallets instead of subnets. The shift raises important questions about confidence, liquidity, and the network’s long-term balance.

Understanding Root and Subnets

To grasp the implications, it helps to understand Bittensor’s structure. The Root Network (also called Subnet 0) serves as the foundation.

Staking on Root has traditionally been a safe choice. Holders can earn steady yields, often between 5% and 15% APY, with little operational risk. Root staking supports network governance and stability, allowing rewards to compound automatically without lock-ups.

Subnets, by contrast, are independent projects focused on specific services such as data processing, model training, or inference. They carry higher risk and higher potential return. Delegators must convert their $TAO into subnet tokens, stake them, and earn APY yield. If a subnet performs well, returns can be substantial; if not, losses can occur.

This system creates a dynamic equilibrium: Root allocates emissions based on subnet performance, while subnets depend on new delegations to remain liquid and competitive.

The Data: $TAO’s Quiet Migration

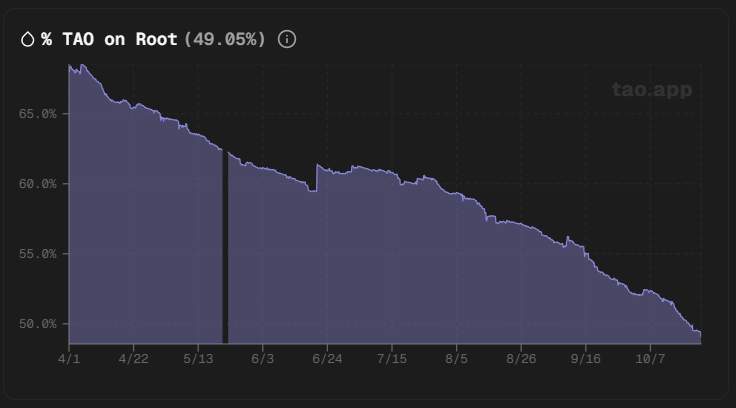

On-chain metrics show that as of today (October 23, 2025), the percentage of $TAO staked on the Root Network dropped to about 49.05%, marking the first time it has fallen below the 50% threshold. Earlier in the year, Root staking hovered around 65%.

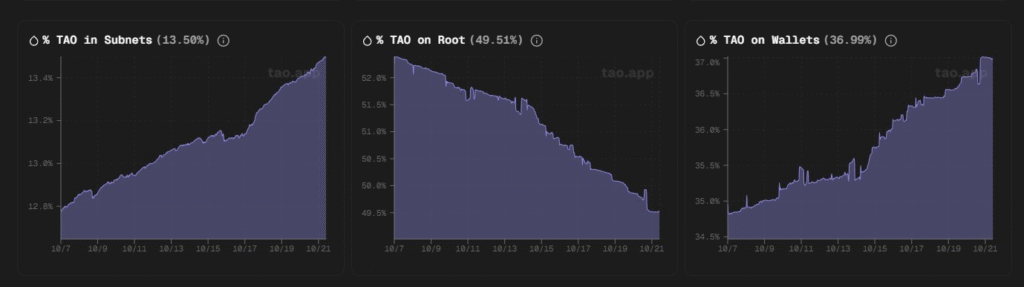

Meanwhile, private wallet holdings have grown to roughly 37%, suggesting that tokens are being withdrawn from active participation rather than reallocated to subnets. The modest rise in subnet-held $TAO appears to come mostly from emissions, not new staking inflows.

Charts display a clear negative correlation between Root staking and wallet balances, signaling that capital is leaving the network’s productive layers.

Observers on social media have voiced mixed reactions. One post summarized the mood: “Subnets are scary. Investors prefer to keep their $TAO idle rather than risk delegation.” Another asked pointedly: “Is it moving to subnets or just to wallets? One is good news, the other means people are checking out.”

Why the Shift? Risk, Liquidity, and Incentives

Several factors help explain this pattern:

1. Risk aversion.

Subnets can underperform, leading to reduced rewards or losses during staking. Many large holders, wary of volatility and tax implications, prefer the stability of Root. A common portfolio mix among delegators is an 80/20 split favoring Root.

2. Liquidity pressure.

Without steady inflows of fresh $TAO, subnets rely mostly on emissions to fund operations. This can depress subnet token prices and discourage new delegations, creating a feedback loop of low liquidity and weaker incentives.

3. Yield versus speculation.

For some investors, Root’s predictable yield appears less appealing than the potential appreciation of $TAO itself. If they expect the token price to rise, they may choose to keep it idle in wallets rather than stake it anywhere. However, this logic is somewhat faulty. Holding $TAO on Root still provides exposure to the same price appreciation while generating additional yield. Opting for no yield (in private wallets) effectively sacrifices passive income without reducing exposure to market volatility. This suggests that the hesitation may be more psychological than rational.

Implications for the Network

The declining share of $TAO in Root staking reflects a larger tension inside Bittensor. Subnets are where innovation happens, but without delegated capital they risk stagnation. When subnets underperform, emissions keep flowing yet create more selling pressure instead of reinforcing value.

Still, some see opportunity in this phase. As Root yields tighten and subnet valuations fall, strong subnets may look undervalued, attracting investors willing to take calculated risks. Others propose reforms such as profit buybacks or revised emission models to strengthen subnet liquidity.

Crisis or Catalyst?

The migration of $TAO from Root to private wallets reflects both caution and recalibration. It shows that Bittensor’s economy is maturing, forcing participants to weigh safety against innovation.

For investors, this moment could mark an inflection point. Those who can identify promising subnets with real utility and active development may find rare opportunities. For the network, the challenge is clear: subnets need more than emissions; they need fresh capital.

What do you think, do you see this as a crisis or a catalyst?

Be the first to comment