This is an article version of Andy’s tweet.

A 45% drawdown in a month is enough to shake even the strongest hands. Social sentiment turns fearful, charts turn red, and timelines fill up with panic. But instead of reacting emotionally, let’s zoom out and look at the on-chain data, derivatives structure, liquidity conditions, and staking behavior.

Because once you lay everything out, the picture looks very different from what the chart suggests.

Derivatives Say: Clean Setup, Not Collapse

The derivatives market often tells the truth long before the spot chart does. And right now, it’s flashing one message: this is a healthy reset.

- Open Interest: $191.8M (–16.65%)

- Funding Rate: 0.005% (Neutral)

- 24H Volume: $556M (+62.15%)

- Liquidations (24h): $2.07M — 99% longs

A few things stand out:

1. Deleveraging is in full effect.

Open interest dropping while price falls = excessive leverage flushing out.

2. Funding is neutral.

No crazy long apes paying insane premiums. 0.005% means a $10,000 long pays 50 cents every 8 hours. Healthy. Controlled. Boring. Exactly what you want before a bigger move.

3. Smart money is still long.

Long/short ratios:

- Binance (accounts): 1.19

- OKX (accounts): 1.61

- Top Trader Accounts: 1.29

- Top Trader Positions: 2.54

Retail got wiped. Smart money stayed. This is textbook pre-move structure.

The Supply Story: Almost Nothing Is Liquid

This is where the data gets wild:

- 70% of all $TAO is staked.

- 7,315,453 $TAO staked.

- Only ~2.6M $TAO is actually tradeable.

- But here’s the kicker: only 477,098 $TAO sits on exchanges.

That’s just 4.6% of total supply, and even this tiny pile is shrinking:

- –17,865 $TAO this month

- –24,520 $TAO in the last 30 days

The supply is disappearing daily.

Money Isn’t Leaving — Supply Is Leaving Exchanges

Some traders panic-sell. Smart money removes liquidity.

The numbers speak for themselves:

- $430M removed from exchanges in the last 30 days

- $970M removed in the last 90 days

This is not fear. This is accumulation.

Staking Is Ramping Up Daily

Stakers are not scared. They’re doubling down:

- +861 $TAO staked yesterday

- +5,767 $TAO the day before

This is not behavior you see in a collapsing ecosystem. This is conviction.

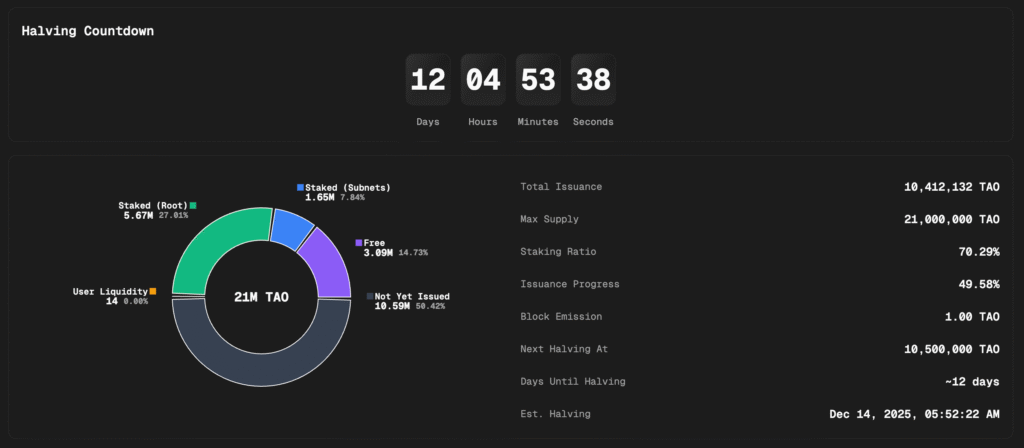

Halving in 12 Days: Emissions About to Be Cut in Half

Hard catalysts matter.

We’re now 12 days from the halving, which means:

- Daily emissions drop by 50%

- Sell pressure cuts instantly

- New supply gets even tighter

- Scarcity accelerates

Supply was already thin before the reduction. After halving? It becomes razor-thin.

Every major asset that has undergone halvings (Bitcoin did it four times) followed the same curve:

Capitulation → Panic → Supply Squeeze → New ATH

Putting It All Together

Look at the full picture:

- Pre-halving shakeout flushed all weak hands

- 70% of supply locked and staked

- Exchange balances shrinking every day

- Nearly $1B left exchanges in 90 days

- Derivatives wiped out retail leverage

- Funding neutral and stable

- Smart money holds long positions

- Halving around the corner

- Classic BTC-style structure forming

So… is it time to chicken out? Or is this exactly the kind of setup long-term investors wait years for?

If the data is anything to go by, the market isn’t exiting $TAO. It’s positioning.

Be the first to comment