When Bittensor launched dTAO in February 2025, it introduced one of the most significant tokenomic changes in the network’s history. Alongside Bittensor’s native token, $TAO, each subnet now has its own $ALPHA (subnet token) — effectively creating a dual-emission economy within the Bittensor ecosystem.

This system was designed to reward subnet participants while maintaining liquidity. But over time, the model has revealed several challenges that could affect long-term sustainability.

Douglass Sillars, PhD, of Taostats, has outlined these issues and proposed a nuanced solution aimed at balancing $ALPHA’s emission rate, preserving subnet liquidity, and ensuring fairness across the network.

The Basics of ALPHA Emission

Every Bittensor subnet now receives $ALPHA emissions in two forms:

1. α_in ($ALPHA injection): tokens emitted directly into the subnet’s liquidity pool.

2. α_out ($ALPHA outbound emissions): tokens distributed to subnet participants such as miners, validators, and owners.

Each subnet’s $ALPHA token follows similar rules to $TAO: a maximum supply of 21 million tokens and a halving schedule that reduces emissions over time. However, because $ALPHA can emit at twice the rate of $TAO — one $ALPHA per block into both liquidity and rewards — it reaches its halving stages far more quickly.

As a result, $ALPHA’s halving schedule accelerates dramatically, meaning all $ALPHA tokens could be fully emitted long before $TAO finishes its own emission cycle. This imbalance creates several downstream issues in both older and newer subnets.

The Emission Imbalance Problem

To understand the issue, it’s important to look at how TAO and ALPHA interact.

1. τ_in ($TAO injection) is emitted into each subnet’s liquidity pool in proportion to the subnet’s price.

2. α_in ($ALPHA injection) emission is designed to stabilize that price — ensuring the value of the subnet remains constant relative to $TAO.

When $TAO undergoes a halving, both $TAO and $ALPHA’s injection are reduced by half to maintain price equilibrium. However, $ALPHA also experiences its own independent halving cycle, which happens more frequently because of its higher emission rate.

Over time, this creates an acceleration effect: First, $ALPHA tokens halve more often than $TAO. More $ALPHA continues to be injected into subnet liquidity pools than is distributed to stakeholders. Eventually, $ALPHA emissions begin to outpace the system’s capacity to sustain them.

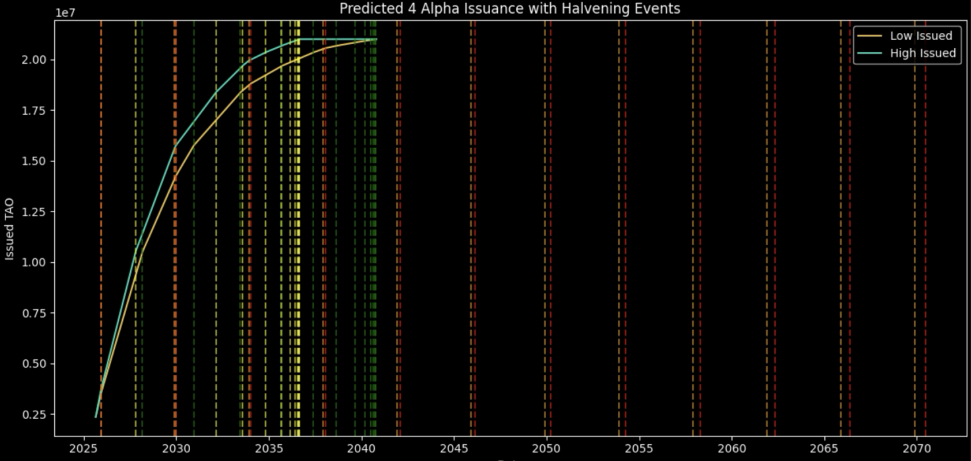

Key:

Red/Orange Lines→Predicted $TAO Halving Range.

Green/Yellow Lines→ Predicted $ALPHA Halving Range.

By 2034–2037, projections show that the earliest (or OG) subnets could reach their final $ALPHA halving — effectively exhausting all $ALPHA emissions decades before the final $TAO is released. Meanwhile, subnets created later in the network’s life cycle face a different problem: low liquidity.

Because newer subnets begin after multiple $TAO halvings, they receive much smaller $TAO and $ALPHA emissions into their pools, making it difficult to build liquidity or reward participants adequately.

Why This Matters

The consequences are twofold:

1. Older subnets emit $ALPHA too quickly and risk becoming unsustainable as their rewards dry up.

2. Newer subnets struggle to attract participants due to thin liquidity and lower emission rates.

This dual problem threatens to create an uneven playing field across the Bittensor ecosystem — where older subnets burn out early and newer ones never reach critical mass.

The Proposed Fix: Rethinking $ALPHA Injection

Sillars’ proposed solution focuses on adjusting how α_in ($ALPHA emitted into liquidity pools) behaves, depending on a subnet’s age and halving schedule.

The key insight is this:

If $ALPHA halving happens faster than $TAO halving, reduce both $ALPHA and $TAO emissions for those older subnets. This slows the acceleration effect and prevents $ALPHA from running out prematurely.

Here’s how it works in principle:

1. For older subnets (those that have survived multiple $TAO halving)

Their $ALPHA and $TAO emissions are reduced proportionally. These subnets already have large liquidity pools, so reducing emissions doesn’t harm stability but does slow $ALPHA exhaustion.

2. For newer subnets (those created after multiple $TAO halving)

The “excess” $TAO saved from reducing older subnet emissions can be redistributed to these newer subnets. This boosts liquidity and supports growth without inflating the overall $TAO supply.

If redistribution is not possible on-chain, the excess $TAO could instead be used as a subsidy to buy and burn $ALPHA, helping maintain subnet price balance.

Potential Benefits

This dynamic adjustment approach provides several key benefits:

1. Slows down $ALPHA halving cycles — Older subnets extend their $ALPHA emission lifespan by decades (from ~2034 to ~2058 in simulations).

2. Improves liquidity for new subnets — Redistribution ensures late-joining subnets have enough liquidity to function effectively.

3. Balances incentives — Validators and miners maintain profitability, avoiding sudden drops in reward emissions.

4. Prevents runaway emissions — By reducing $ALPHA injection in older subnets, the total $ALPHA emitted across the network decreases naturally without harming $TAO’s emission schedule.

Alternative Scenarios and Safeguards

Sillars also suggests refining the redistribution model to make it more equitable:

1. Scenario 1: Equal distribution of excess $TAO across all eligible subnets.

2. Scenario 2: Weighted distribution based on how far a subnet’s $TAO and $ALPHA halving schedules differ.

3. Scenario 3: Apply a “price cap” — preventing already-successful subnets from receiving unnecessary subsidies.

Each approach ensures liquidity flows to where it’s most needed while minimizing potential gaming or over-rewarding mature subnets.

The Road Ahead

This proposal doesn’t require immediate implementation. While syncing $ALPHA and $TAO halving directly could offer a simpler short-term fix, it might also shock the network’s reward dynamics by reducing α_out too soon — risking validator drop-offs and reduced competitiveness.

Instead, the gradual emission adjustment model gives the ecosystem time to adapt. According to Sillars’ projections, the first redistribution of excess $TAO wouldn’t need to occur until around July 2029, allowing years for testing, modeling, and community consensus.

Conclusion

Bittensor’s dTAO system was a bold step toward subnet-level autonomy and token independence, but it introduced new tokenomics complexities. The accelerated $ALPHA halving issue is a natural byproduct of innovation — and Sillars’ research offers a thoughtful, data-driven path forward.

By reducing emission rates for older subnets, redistributing liquidity to newer ones, and managing $ALPHA’s halving pace, Bittensor can achieve a more sustainable, balanced ecosystem. This ensures both early and future subnets continue to thrive — maintaining fairness, decentralization, and long-term stability across the network.

Be the first to comment