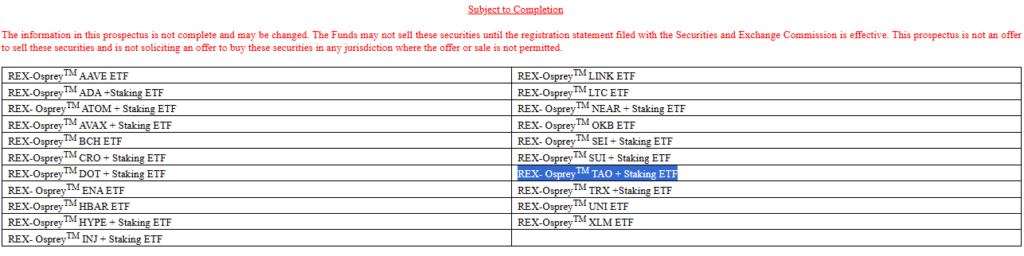

REX Shares and Osprey Funds have filed for 21 new spot cryptocurrency (including TAO) exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC). Operating under Rex-Osprey™, the initiative seeks to bring a wide range of digital assets into the regulated ETF market — from Bittensor’s $TAO, $SUI to $HBAR.

Expanding Beyond Bitcoin

While most crypto ETFs have focused on Bitcoin and Ethereum, this filing signals a shift towards altcoin adoption in regulated markets. Each ETF is structured as a traditional ’40 Act fund, offering spot price exposure in a framework familiar to institutional investors.

Staking Adds a New Layer of Yield

Unlike traditional spot ETFs, several of the new filings include staking mechanisms. Assets like $TAO, ADA, $AVAX, $DOT, $NEAR, and $SUI will not only track price but also generate staking rewards, giving investors additional income streams beyond simple price appreciation.

What This Means for the TAO Ecosystem

For Bittensor, the proposed $TAO Staking ETF could have significant ripple effects:

a. Institutional Access: Traditional investors can gain exposure to TAO without navigating crypto wallets or exchanges.

b. Staking Rewards in ETFs: By passing staking yields back to investors, demand for $TAO staking could rise, reinforcing network security.

c. Ecosystem Visibility: ETF inclusion elevates $TAO’s profile among regulators, institutional funds, and mainstream media.

d. Price & Liquidity Impact: Greater accessibility may increase liquidity and trading volume, potentially reducing volatility over time.

In short, this move could bring $TAO from the niche world of decentralized AI directly into the portfolios of traditional investors — expanding both its reach and relevance.

Timing and the SEC Bottleneck

The SEC recently approved generic listing standards for commodity-based ETFs, a move expected to speed up crypto ETF approvals. However, the current U.S. government shutdown has slowed regulatory activity, leaving timelines uncertain.

October is a critical month, with 16 ETF deadlines approaching, including several covering altcoins beyond Bitcoin and Ethereum. The Rex-Osprey™ filings — especially those with staking features — will be closely watched as a signal of how far the SEC is willing to go in widening crypto ETF coverage.

If approved, the Rex-Osprey™ $TAO Staking ETF could be a milestone moment for Bittensor — bridging decentralized AI with traditional finance and cementing $TAO’s role as one of the few crypto assets recognized at the ETF level.

Useful Resources

Rex Shares: https://www.rexshares.com

X (Formerly Twitter): https://x.com/REXShares

LinkedIn: https://www.linkedin.com/company/rexshares/

Osprey Funds: https://ospreyfunds.io

X (Formerly Twitter): https://x.com/ospreyfunds

Be the first to comment