Every ecosystem has a moment when optimism is no longer enough.

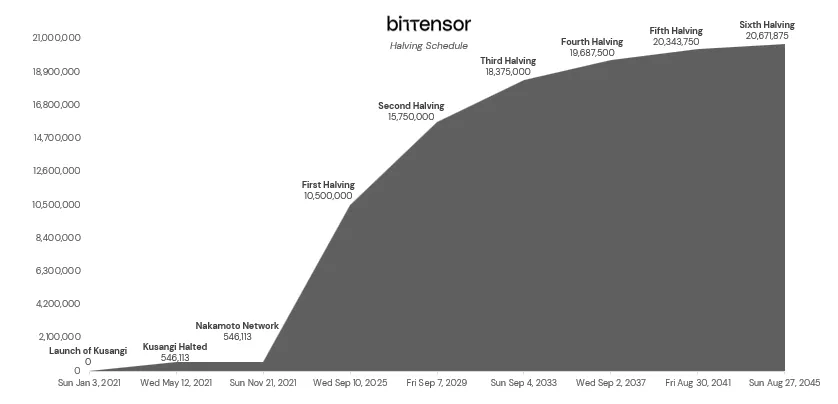

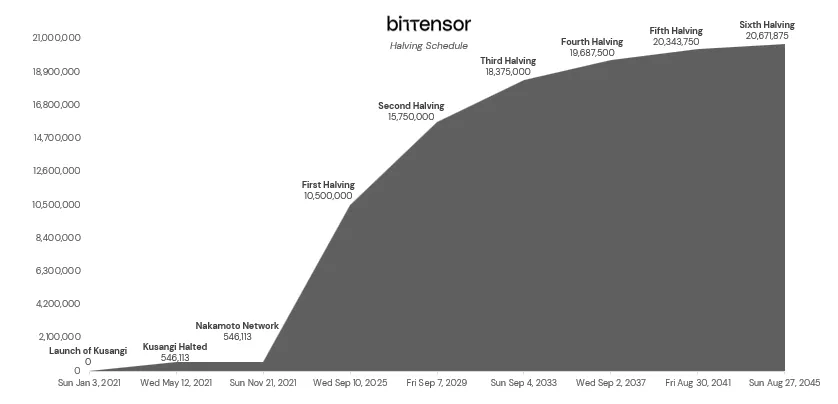

For Bittensor, that moment arrived quietly. No countdown, no drama, just a halving, a shift in emissions, and a sudden realization that incentives now matter more than intentions.

The first episode of The Carrot and The Stick (see below), a new podcast powered by tao.com, captured that moment in real time.

Garrett ‘the Carrot’ Oetken, brought the long view centering on growth, infrastructure, and the belief that Bittensor is still early. Keith ‘the Stick’ Singery brought pressure from the standpoint of incentives, consequences, and the uncomfortable question of who survives when the system tightens.

What followed was not a debate, it was a deliberate and mutual calibration.

Setting the Room: Who the Carrot and the Stick Are

Garrett opened the conversation by grounding it on purpose. As the Head of Protocol at tao.com and a former leader at the Opentensor Foundation, his focus is making sure Bittensor can scale without breaking.

Keith came in from the opposite angle. An early participant in the ecosystem, the creator of Bittensor Guru (one of the foremost podcasts on Bittensor), Keith has lived through every phase of the network’s evolution.

From the start, their roles were clear. Garrett asked where Bittensor is going and for Keith, it’s about the cost of getting there!

From Easy Growth to Earned Survival

Garrett framed $TAO’s halving as a transition, not a shock. Early Bittensor needed excess emissions, exploration required room to fail and subnets needed time to form.

Keith didn’t disagree, but he drew a hard line. He firmly noted that the phase is over. He inferred that when liquidity grows quickly, inefficiency hides, but, when it slows, reality surfaces. Subnets that relied on passive support now have to justify their existence.

This was the first theme both hosts returned to again and again. But they agreed that the network did not become hostile, it just became honest.

What the Halving Really Changed

One of the clearest misconceptions Garrett addressed was miner’s compensation.

Miners are not earning less subnet ‘$ALPHA’ tokens, validators and subnet owners are not suddenly underpaid, what changed is the rate at which $TAO enters liquidity pools.

Keith emphasized why this matters. He explained that liquidity is no longer a cushion but a constraint. While markets react faster, poor token design gets exposed sooner.

The halving did not reduce rewards, it removed forgiveness.

TAO Flow and the End of Quiet Subnets

When the discussion turned to TAO Flow, Keith leaned forward.

Under the old system, stability was enough. A subnet could remain idle and still earn emissions. TAO Flow breaks that pattern by rewarding real buying activity over time.

Garrett explained the implication clearly noting that: Emissions now follow attention, capital follows usage and the network starts favoring momentum over inertia.

Keith added the edge by affirming that this system makes it easier to rise quickly, but harder to stay afloat without substance. Excitement alone no longer carries weight.

Bittensor, they agreed, stopped paying for silence.

Why Difficulty is the Point

At this stage of the chat, the tone shifted. Keith said plainly the worries of many in the ecosystem, which is that ‘some subnets will disappear’. He also said that they disappear not because the system is unfair, but because it finally demands performance. This difficulty, however, forces prioritization and competition clarifies value.

Garrett reinforced the idea noting that if Bittensor is meant to host real AI businesses, it must behave like a real market. That means not every idea would survive.

This was not pessimism, it’s discipline.

Root Swap and Intentional Capital

The most forward-looking part of the conversation centered on root swap.

Keith described how root staking historically created automatic sell pressure. With this, rewards were converted into whether the subnet deserved long-term support or not.

Garrett explained what changes now: ‘Stakeholders can keep subnet tokens and validators will soon influence defaults’. With this, capital becomes a vote, not a reflex.

Keith pointed out what this unlocks. He inferred that new subnets are no longer sentenced to months of structural selling. Trust, relationships, and execution can accelerate credibility.

Support becomes intentional.

Validators as Signal, Not Plumbing

Both hosts circled back to validators.

Garrett emphasized that validators are no longer passive operators. Their decisions shape markets and their defaults guide capital.

Keith welcomed the shift. He expressed that validators now express judgment and stakers choose alignment, not just yield.

The network gains memory.

TAO.COM: The Infrastructure that Matches Maturity

As the episode came to an end, Garrett walked through the tao.com wallet, not as a feature list, but as a reflection of timing.

As incentives tighten, access must be simplified. People need context, clarity, and confidence. Better tools (like TAO.COM) are not cosmetic, they are structural.

Keith agreed that a serious system cannot be opaque. Complexity must serve purpose, not hide it.

Where This Leaves Bittensor

The episode ended without hype: No promises of price, no declarations of victory, just a shared conclusion.

Bittensor has entered a phase where growth must be earned. Liquidity is slower, feedback is sharper and every decision matters.

The carrot is still there (opportunity remains enormous) but the stick now enforces direction.

For anyone building, investing, or paying attention, this episode marked something important. Bittensor did not change what it wanted to be, it simply changed what it is willing to tolerate.

Be the first to comment