The State of TAO: January 2026 report, published by Stillcore Capital, a U.S.-based fund focused exclusively on Bittensor, serves as an accessible introduction to the Bittensor ($TAO) ecosystem for newcomers.

The report explains how the network works in simple terms, evaluates the state of the ecosystem as of January 2026, and outlines potential growth trajectories. At its core, the report positions Bittensor as a transformative force in decentralized AI by combining open competition, decentralized incentives, and real economic output.

Download the report here.

Stillcore frames Bittensor as a network that mirrors Bitcoin’s original breakthrough, but with a critical difference. While Bitcoin miners compete to secure the network through hash-based Proof of Work, Bittensor miners compete to perform useful work.

This work can include building AI models, training neural networks, generating data, or solving other programmable tasks that create tangible value. In this sense, Bittensor is described as a decentralized, global network secured by a blockchain.

Understanding Bittensor’s Core Concept

Bittensor functions as a decentralized marketplace where miners compete to complete tasks and are rewarded in $TAO, the network’s native token. The system is often compared to Bitcoin, but instead of expending energy on arbitrary computations, Bittensor’s Proof of Useful Work channels competition toward productive outcomes.

Over time, this model has effectively aggregated a massive, globally distributed “supercomputer” for AI, built without centralized corporations, employment contracts, or traditional management hierarchies.

The report draws a powerful analogy to Bitcoin’s rise. Bitcoin incentivized miners to construct the largest compute network in the world, creating trillions of dollars in value along the way. Bittensor applies this same incentive structure to AI and other digital tasks, making mining programmable across many domains and opening participation to anyone with the skills or hardware to compete.

Subnets: The Engine of Innovation

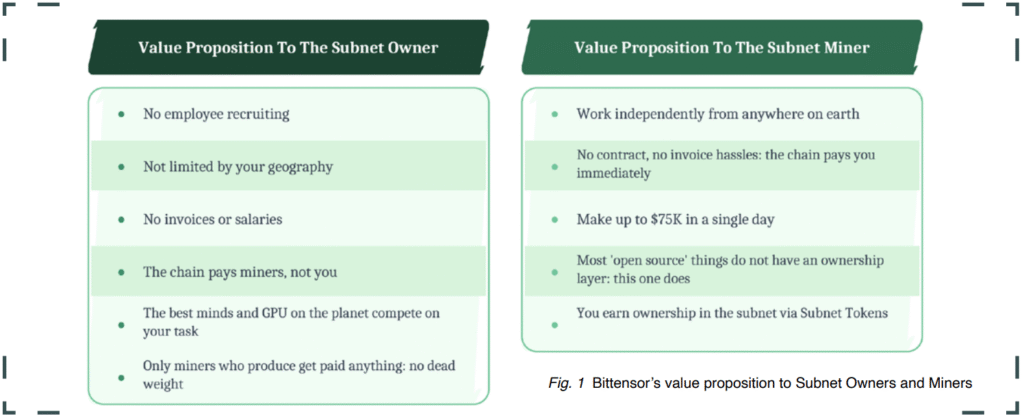

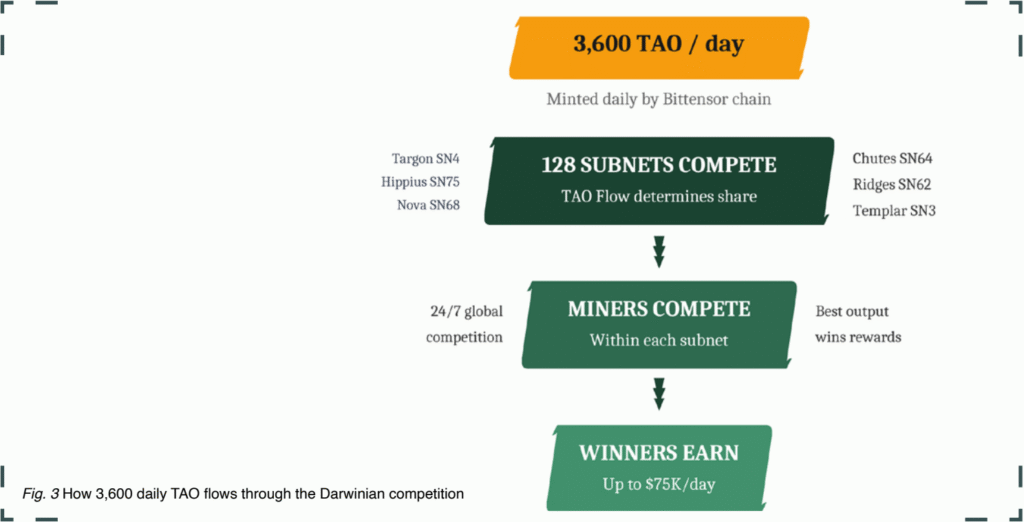

Bittensor’s ecosystem is organized into 128 Subnets, each operating as a specialized competition. Every Subnet is defined by an owner, which can be an individual or a company, and each sets its own rules for evaluating miners. Miners compete within Subnets for rewards, while Subnets themselves compete against one another for emissions from the broader network.

Subnets operate much like open-source startups. Anyone can join as a miner or investor, and performance is evaluated continuously. Poorly performing miners—and even entire Subnets—are automatically culled through daily evaluations, creating what the report describes as a Darwinian system.

Several Subnets are highlighted as examples of what this model can produce. Ridges (Subnet 62) focuses on AI coding assistants and reportedly outperforms tools like Claude or Cursor at a fraction of the cost. 404Gen (Subnet 17) specializes in text-to-3D object generation, while Nova (Subnet 68) targets pharmaceutical molecule discovery. Other Subnets, such as Templar (Subnet 3) and IOTA (Subnet 9), are pushing decentralized AI training at scales comparable to large centralized systems like Elon Musk’s Colossus infrastructure for Grok.

Subnet Highlights

| Subnet | Focus Area | Key Achievement |

|---|---|---|

| Ridges (SN62) | AI coding assistants | Tops SWE Benchmarks; costs 1/70th of competitors (e.g., ~$10/month vs. $500 for Cognition Labs) |

| Hippius (SN75) | Decentralized storage | 1/400th the cost of Filecoin |

| Chutes (SN64) | AI inference | #1 on Openrouter, thousands of daily queries |

| Lium (SN51) | Decentralized LLM training | Uses globally distributed GPUs for efficient model training |

According to Stillcore, this structure enables constant innovation. Subnets can deliver products faster and cheaper than centralized alternatives, with early development subsidized by network rewards rather than venture capital.

$TAO and Bittensor’s Economic Design

$TAO is Bittensor’s native token and has a fixed supply cap of 21 million, with approximately 10.5 million in circulation. As of January 2026, 3,600 $TAO are minted daily and distributed through Subnet and miner competitions.

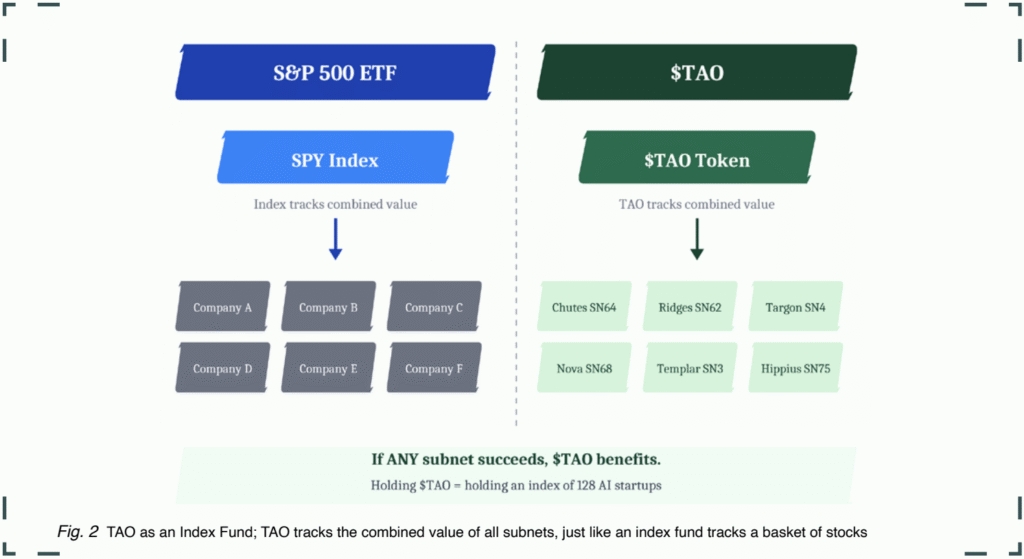

The report frames $TAO as functioning like an index. Similar to an S&P 500 ETF, $TAO captures the aggregate value of all Subnets in the ecosystem. Unlike Ethereum, where value often accrues primarily to individual ERC-20 tokens, Bittensor is designed so that value flows back into $TAO itself. This is reinforced by a reward mechanism that dynamically adjusts emissions based on real-time inflows and outflows in Subnet AMM pools.

The December 15, 2025 halvening reduced daily emissions from 7,200 to 3,600 $TAO, mirroring Bitcoin’s halving cycles. Stillcore notes that Bitcoin’s first halving preceded an 83× price increase and suggests that $TAO could see a 10× to 20× move in 2026, projecting a potential range of $3,000 to $6,000.

Ecosystem State and Recent Improvements

For much of its early life, Bittensor’s adoption was limited by clunky wallets and poor onboarding, effectively capping the user base at around 20,000 insiders. This began to change in December 2025 with the release of new consumer-friendly tools.

Crucible Labs launched a Chrome-based wallet with Ledger support, while Tao.com introduced an iOS app featuring fiat onramps, including credit card and Apple Pay support, as well as in-app Subnet trading. These releases significantly lowered the barrier to entry for new users.

On the exchange side, $TAO is now listed on major centralized exchanges such as Coinbase, Binance, and Kraken. While only a few Subnet tokens are listed on centralized venues, decentralized trading is more developed. The native Bittensor AMM processes tens of millions of dollars in daily volume, and projects like Rubicon and TaoFi are expanding cross-chain access and liquidity, particularly via Base.

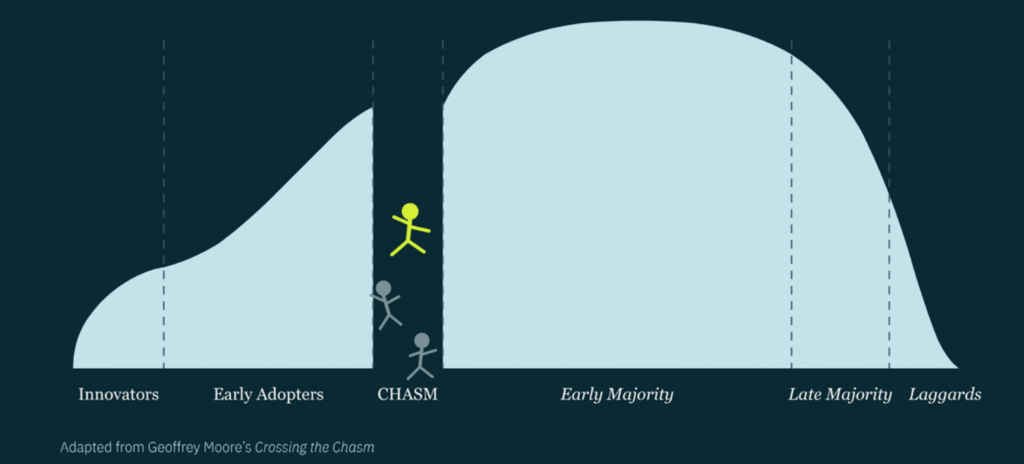

Despite this progress, the report notes that the ecosystem has yet to produce a true breakout consumer Subnet, although 10 to 20 Subnets are considered highly promising.

The “ICO Phase” Thesis for 2026

Drawing parallels to Ethereum’s 2016–2017 ICO boom, the report argues that Bittensor may enter a similar phase in 2026. During Ethereum’s early years, projects like The DAO and Golem raised massive amounts of capital, driving significant demand for $ETH. Stillcore believes Bittensor could experience comparable dynamics.

In this scenario, at least one Subnet could reach a $1 billion market capitalization, attracting broader crypto attention. Demand for $TAO would rise as it remains the primary asset required for Subnet participation, while improved wallets could enable a wave of new users from Ethereum and Solana ecosystems.

Competition, Risks, and Final Thoughts

Stillcore concludes that no current competitor matches Bittensor’s combination of fair launch mechanics, minimal insider allocation, and growing momentum. Rival projects such as ASI Alliance or GenSyn are described as heavily VC-driven, with significant insider ownership. However, the report also acknowledges real risks, including challenges around productization, marketing, and the possibility that the ecosystem fails to cross the chasm into mainstream adoption. As with all digital assets, volatility remains a significant factor.

Ultimately, the report frames Bittensor as a radical reimagining of how companies and networks can be structured. By turning organizations into incentivized contests, Bittensor unlocks global talent and channels it toward AI innovation at unprecedented scale. While the outlook is optimistic, Stillcore emphasizes that the report is informational rather than investment advice and discloses that the firm holds positions in $TAO and related assets.

Be the first to comment