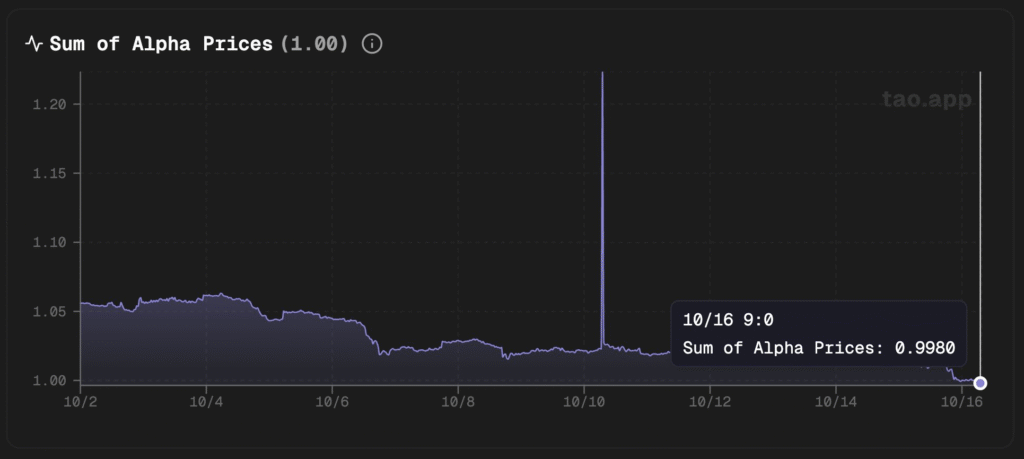

On October 16, 2025, the Sum of Alpha Prices (SoS) in the Bittensor network fell below 1.00 for the first time, reaching 0.9980.

This drop, from highs above 2.0 earlier in the year, has sparked debate among investors, developers, and the Bittensor community about the network’s health, token dynamics, and what lies ahead, especially with the first halving expected around December 11, 2025.

Quick Recap: What Bittensor Is

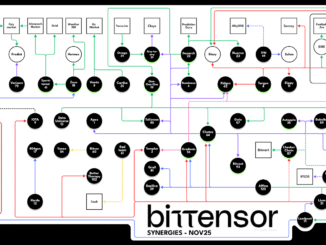

- Bittensor ($TAO) is a decentralized network that rewards the creation and sharing of intelligence through “subnets.”

- Each subnet focuses on a specific function such as prediction, text generation, or data processing.

- The $TAO token is used for staking, governance, and rewarding contributors.

- In early 2025, Dynamic TAO (dTAO) introduced alpha tokens, subnet-specific tokens that trade against $TAO.

- These alpha tokens let users stake on subnets and earn based on performance.

What Is the Sum of Alpha Prices (SoS)?

- SoS = the combined value of all subnet alpha tokens priced in $TAO.

- It’s an indicator of subnet health and demand across the entire network.

- SoS > 1.00: alpha tokens are collectively overvalued → strong market confidence.

- SoS < 1.00: alpha tokens are undervalued → weak demand or subnet inefficiency.

Earlier in 2025, SoS peaked above 2.0 during subnet hype cycles but gradually declined due to dilution, speculation, and broader market pressures.

What Happens When SoS Falls Below 1.00

When SoS drops below 1.00, Bittensor’s emission system automatically enters support mode to stabilize prices.

Here’s how it works:

- Each subnet usually emits:

- 1 ALPHA to liquidity pools (ALPHA in)

- 1 ALPHA to participants (ALPHA out)

- When SoS < 1.00:

- ALPHA in is capped at 1

- ALPHA out remains 1

- This limits alpha inflation and redirects more $TAO emissions to stronger subnets.

- It creates a self-correcting effect, where undervalued alphas become more attractive for staking and liquidity stabilizes.

Explaining SoS to a five-year-old:

Think of Bittensor like a big tree. The Root (SN0) is the trunk. It’s strong and stable but doesn’t grow very fast, which is why its “safe yield” is (currently) only around 1.5%. Then there are subnets, which are like the branches. They grow faster and reach out in different directions, so they can give higher yields, but they also move more unpredictably.

Now, the SoS (or Sum of Alpha Prices) is just a way to measure balance between the trunk and branches. When the total market value of all subnets equals the value of $TAO itself, SoS = 1. If the subnets become twice as valuable as $TAO, SoS = 2. As SoS approaches 1, the system adjusts: root yields shrink, subnet yields rise, nudging people to put more capital into subnets to keep the ecosystem healthy and balanced.

Impact Across the Ecosystem

For Investors and Stakers

- Opportunity: Alphas may be undervalued, offering potential upside.

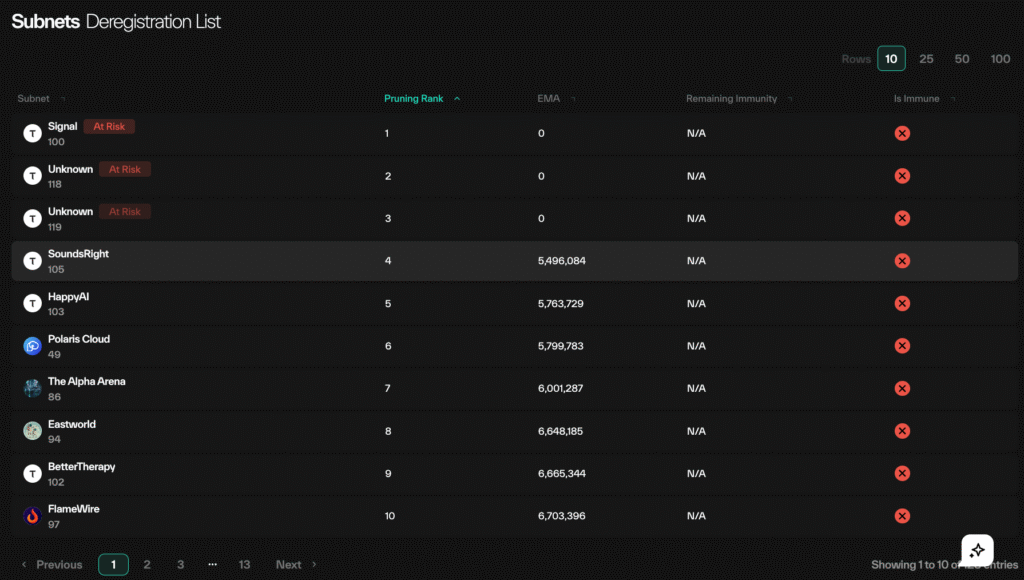

- Risk: Some subnets may lose liquidity or be deregistered entirely.

- Strategy: Focus on high-quality subnets with real performance and emissions strength.

For Subnet Developers

- Competition increases. Subnets must show genuine value to sustain staking.

- Weaker projects risk dilution or dereg, while stronger ones gain more TAO flow.

- This could lead to long-term ecosystem consolidation and innovation.

Interaction with the Upcoming Halving

- The halving will reduce block rewards from 1 TAO to 0.5 TAO, cutting daily issuance by half (~7,200 → ~3,600 TAO).

- This will tighten supply and could:

- Make SoS more volatile, possibly dipping further short-term.

- Increase $TAO scarcity, which might later lift alpha values as subnet demand rises.

Community Sentiment

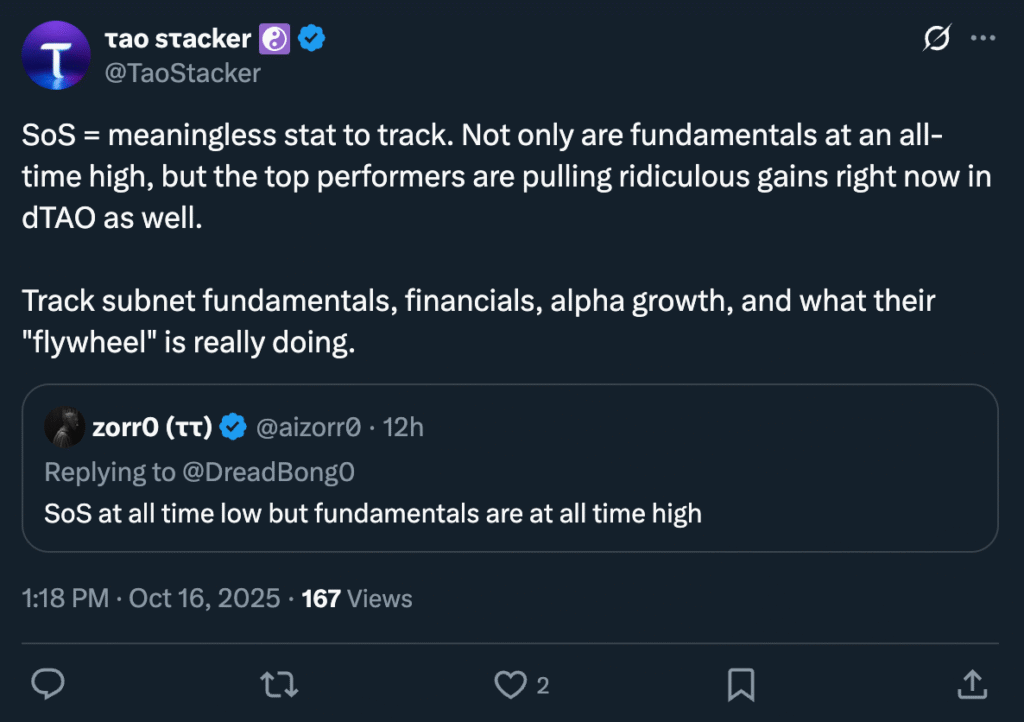

- Optimists: See SoS < 1.00 as a bottom signal before rebound.

- Skeptics: Worry about dilution and speculative subnet behavior.

- Some analysts expect a “Great Repricing” in 2026 that could drive SoS back above 3.00 if strong subnets continue to outperform.

- Neutralists argue that SoS is a meaningless metric to track, focusing instead on fundamentals, financials, alpha growth, etc.

Key Takeaways

- SoS below 1.00 marks a turning point in Bittensor’s market structure.

- The network’s support mechanism shows it’s built to adapt and self-correct.

- The upcoming halving will intensify competitive pressure and potentially refine value distribution across subnets.

- Anyone can track SoS and subnet performance metrics on tao.app and taostats.io.

Be the first to comment