Stillcore Capital has emerged as one of the first dedicated funds built exclusively for the Bittensor ecosystem. It operates with a singular thesis, differentiating it from traditional crypto hedge funds: Bittensor represents the third great crypto wave after Bitcoin and Ethereum. The fund is built on the conviction that early, deep understanding of its inner workings will yield outsized returns..

In Subnet Magazine’s debut interview, a partner and the co-CIO (Chief Investment Officer) of Stillcore Capital, Mark Jeffrey analyzed the Bittensor ecosystem, discussed the need for a dedicated hedge fund and explained what Stillcore means to the ecosystem.

A Hedge Fund Born from Cycles of Innovation

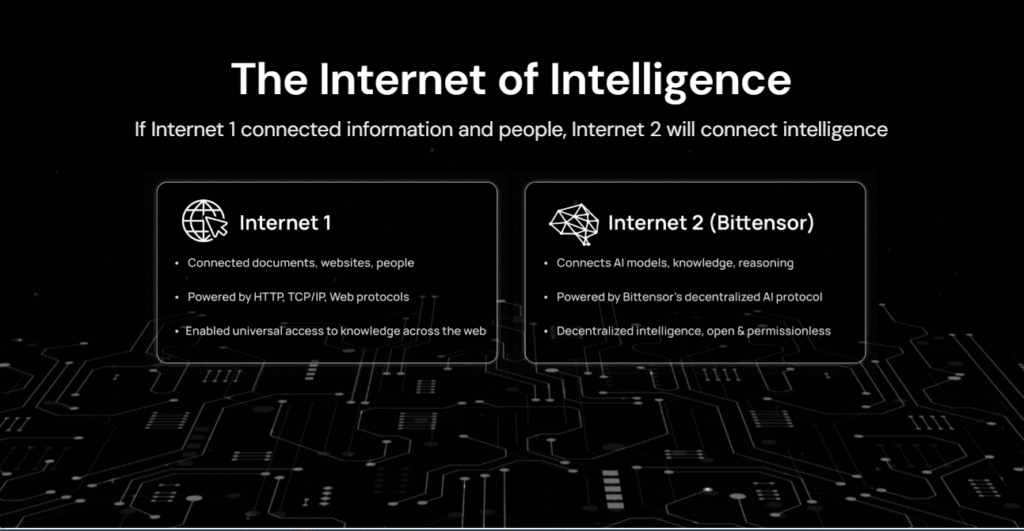

The logic behind Stillcore is rooted in a familiar pattern of technology cycles. Just as the early internet spawned browsers, social platforms, and search engines, and just as Ethereum unlocked DeFi, Bittensor is now creating a marketplace where intelligence, compute, and digital services can be mined, traded, and scaled. For Stillcore, this was not just a narrative — it was a call to design a fund purpose-built for an ecosystem unlike any other.

The Three-Pillar Strategy

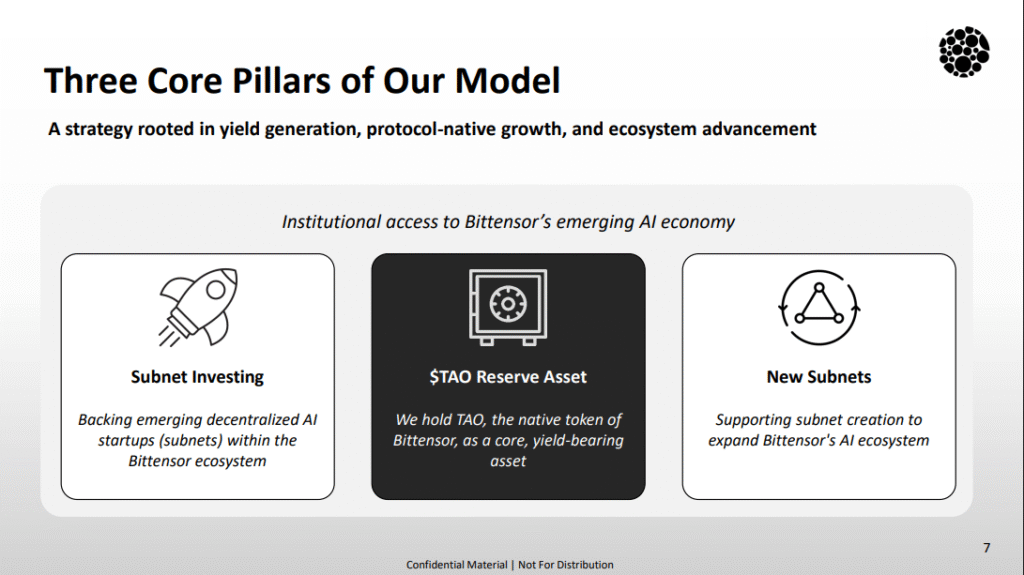

Stillcore runs a three-pillar model:

a. TAO Reserve – Building a strategic reserve of Bittensor’s native token, managed with institutional-grade custody, staking, and validator operations. This provides stability while securing network participation.

b. Subnet Investing – Allocating capital into carefully selected subnet projects.

c. Subnet Creation – Keeping open the option to incubate or co-found new subnets where strategic value aligns, leveraging Stillcore’s capital and network.

This structure ensures that the fund is not only holding $TAO but actively shaping subnet economies.

The Duty of Care Ethos

The crypto industry has often been scarred by predatory venture deals, collapsed hedge funds, and rehypothecation scandals. Stillcore positions itself in deliberate opposition to these patterns. Its guiding principle is duty of care — ensuring that subnet builders and investors are not exploited, and that custody and yield-generation strategies remain transparent and under direct control. The failures of firms like Genesis and FTX are reminders of what happens when this principle is ignored.

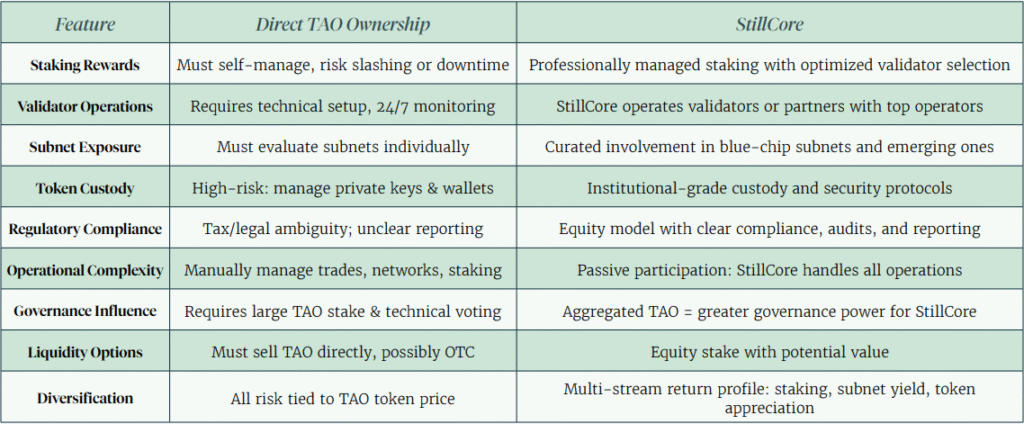

Why Stillcore Instead of Holding $TAO?

For accredited investors, the question naturally arises: why not just hold $TAO? The answer lies in leverage on subnets. If $TAO appreciates 10x in the coming cycle, a carefully managed subnet portfolio has the potential to deliver 15x or more. The complexity of subnet tokenomics — liquidity pools, emissions, staking dynamics, and alpha pricing — requires full-time attention. Stillcore Capital exists to navigate that complexity on behalf of investors who want exposure to Bittensor without managing the intricacies of wallets, validators, and subnet selection.

Mapping the Subnet Economy

A core part of Stillcore’s edge comes from immersion in the subnet ecosystem. Investing in subnets is not just about reading token stats but about knowing founders, gauging community sentiment, and tracking whether miners and validators are satisfied. Discord chats, Twitter (X) sentiment, and community debates all provide signals. Stillcore treats this mapping as essential intelligence work, ensuring that it understands each subnet’s strengths and weaknesses before allocating capital.

Rains Incentives, Not Just AI Jargon

Although Bittensor is best known for decentralized machine learning, Stillcore views its deeper innovation as an alignment engine. A mechanism that can incentivize and reward distributed work across any digital vertical. Storage (Hippius), advertising (BitCast), and financial infrastructure (Yanez MIID) are already emerging on the network. This broadens Stillcore’s horizon: the fund is not just betting on AI, but on an entirely new incentive layer for the internet.

Facilitating Accessibility and Abstraction

Stillcore also acknowledges that the ecosystem remains highly technical. Wallets, staking mechanics, and subnet token visibility are often confusing even for crypto veterans. For institutions and traditional investors, this friction is a barrier. The fund’s role is to abstract away that complexity, providing a fiat in/fiat out bridge into the Bittensor economy — much like how MicroStrategy gave mainstream investors exposure to Bitcoin without forcing them to hold private keys.

The Halving as a Defining Moment

One of the biggest upcoming events for Stillcore’s strategy is the first Bittensor halving. Much like Bitcoin, this will cut $TAO emissions in half. However, because subnet alpha tokens are tied to liquidity pools and emissions schedules, the dynamics are more complex than Bitcoin’s. Stillcore’s research suggests that while the halving should be bullish for $TAO, its effects on subnet tokens remain uncertain. This is precisely the kind of risk-reward calculus that a specialized fund is designed to handle.

Aligning with Bittensor’s Future Outlook

If Bittensor succeeds, Stillcore believes it will reshape the fabric of the digital economy. Subnets could become the default providers of intelligence, storage, compute, and advertising — challenging centralized giants like Google, AWS, and Meta.

In this future, Bittensor is not just another blockchain but the backbone of a global incentive economy, and $TAO becomes a core store of value. For investors, this represents an opportunity comparable to Bitcoin at $300 or Ethereum at $0.30 — but tied to an ecosystem with far broader use cases.

Useful Resources

Official Website: https://stillcorecapital.com

X (Formerly Twitter): https://x.com/stillcorecap

LinkedIn: https://linkedin.com/company/stillcore

Be the first to comment