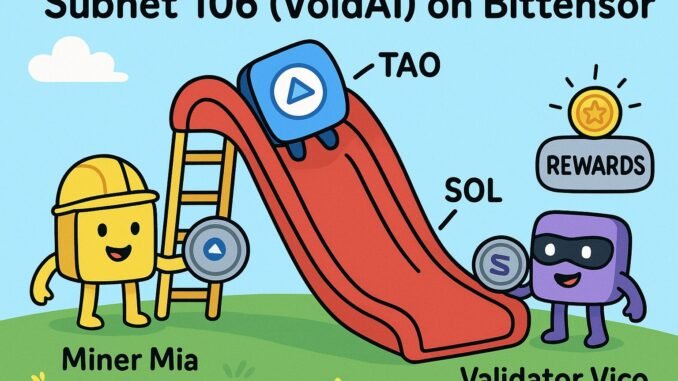

Bittensor can be thought of as a giant digital playground, where each subnet is a unique entity powered by miners and validators. Among these subnets, Subnet 106 (VoidAI) stands out for its mission: building liquidity bridges that connect the Bittensor ecosystem with other thriving blockchain networks like Solana.

At its core, VoidAI is a multi-chain liquidity protocol designed to make tokens more useful, more mobile, and more liquid across DeFi ecosystems. By leveraging Bittensor technology and Chainlink infrastructure, VoidAI is creating smooth pathways for TAO and other assets to move across chains without friction.

How VoidAI Works

1. Liquidity Provision

Think of miners in VoidAI as helpers who bring balls (liquidity) to the game. They supply token pairs—such as wTAO/wALPHA—to decentralized exchange pools like Raydium. In return, they receive LP tokens (proof they’ve contributed liquidity).

These LP tokens are then staked in smart contracts, where miners participate in network validation and earn rewards. The key difference in SN106 is that miners are rewarded not for computing tasks but for providing real, lasting liquidity that strengthens the entire ecosystem.

2. Validators

Just as monitors keep the playground fair, validators in SN106 ensure that liquidity is truly locked and maintained. Their role is to check whether miners have properly deposited tokens and kept them staked. If the checks pass, miners get rewarded with TAO and SN106 tokens—VoidAI’s version of gold stars for good behavior.

3. Cross-Chain Interoperability

VoidAI’s most important feature is interoperability. It acts like a bridge that lets tokens like TAO cross from Bittensor to Solana, where DeFi activity is bustling. This makes TAO more accessible and usable in broader markets, while bringing liquidity and visibility back into the Bittensor network.

The Reward Flywheel

VoidAI doesn’t just stop at rewarding participants—it reinvests back into its ecosystem through a flywheel mechanism:

- 50% of protocol fees are returned to liquidity pools, reducing slippage and improving the experience for traders.

- The other 50% is used to buy more SN106 tokens, strengthening the token’s demand and liquidity.

This creates a cycle of growth where increased usage directly fuels deeper liquidity and stronger tokenomics for SN106.

Why It Matters

VoidAI is more than just another subnet—it’s Bittensor’s liquidity engine. By combining cross-chain infrastructure, real liquidity provision, and an incentive system aligned with TAO, SN106 is helping Bittensor extend its reach beyond its own network into the wider DeFi universe.

With a market cap still under $5 million, Subnet 106 represents one of the most experimental yet high-potential ventures in Bittensor’s growing ecosystem.

⚠️ Editor’s Note: This article’s image was originally published by Gab on X.

Be the first to comment