By: Zora

For as long as most Bittensor stakers can remember, staking TAO on root has been a simple, stable way to earn passive emissions. No risk, no exposure to subnets—just pure TAO compounding over time.

But that stability came with a tradeoff: no exposure to the upside of subnet tokens (the “alphas”).

If you wanted to earn alpha, you had to stake directly into subnet pools—and that meant risking your TAO principal.

Now, a new feature called Root Claim is changing the dynamic completely.

The Background: Root vs Alpha Staking

Until recently, there were two main ways to stake $TAO:

- Root staking – You stake directly into the Bittensor root network. This is the “risk-free” option: you earn TAO emissions but have no exposure to individual subnets.

- Alpha staking – You stake TAO into a specific subnet’s pool to earn its native alpha token. The upside is higher potential yield—but if the subnet underperforms or dies, you can lose TAO.

Many stakers followed a balanced strategy:

“Keep 50% staked in root (risk-free) and 50% in alpha pools (for exposure).”

Over time, some adventurous stakers shifted fully into alpha positions. But for most, the fear of losing principal TAO kept them anchored in root staking.

That’s what makes this new Root Claim update such a big deal.

Introducing Root Claim: Stake TAO, Earn Alpha

With Root Claim, root stakers can now earn exposure to subnet alpha tokens without taking on direct risk.

Here’s how it works:

- When you stake your TAO on root and choose a validator, that validator naturally interacts with various subnets and accumulates alpha rewards.

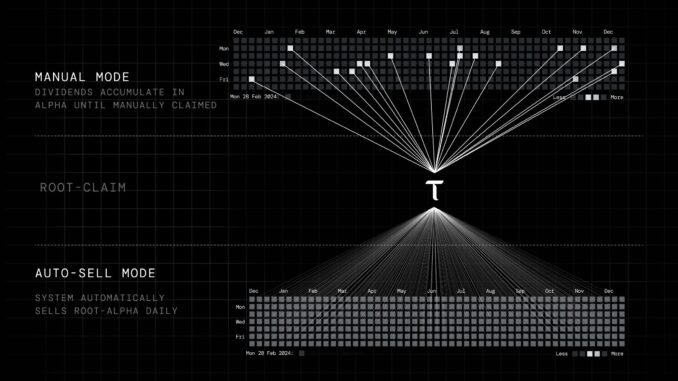

- Instead of automatically selling those alpha tokens back into TAO (as the old system did), the new Root Claim gives you the choice:

→ Keep your alpha tokens, or

→ Auto-sell them back to TAO.

In short:

Stake TAO → Earn Alpha. No subnet pool exposure. No principal risk. No manual trading required.

How It Works (Simple Version)

- Default behavior:

If you do nothing, your alpha rewards will automatically be swapped to TAO and re-added to your root stake. This means the experience remains the same for passive stakers — you still just earn TAO. - Claim frequency:

Auto-claims occur roughly once every two days per account, so the process is smooth and regular. - Want to keep your alpha?

Use theset_root_claim_type(Keep)extrinsic. This tells the network that you want to retain your alpha tokens instead of selling them. - Manual control:

You can also useclaim_root()and pass a subnet list to manually claim alpha from specific subnets that your validator is connected to.

Why It Matters

This update bridges the gap between risk-free TAO staking and subnet participation.

Before, stakers had to choose:

- Play it safe (root)

- Or chase upside (subnets)

Now, you can have a bit of both.

Root Claim allows the entire staking base of Bittensor to participate in subnet growth, aligning incentives across the ecosystem without pushing users into risky positions.

It’s a subtle but powerful shift:

- More exposure to alpha → greater subnet visibility

- More TAO staying in root → healthier network security

- More optionality for users → better capital efficiency

TL;DR

- Root Claim lets root stakers earn subnet alpha tokens passively.

- You can choose to keep or auto-sell your alpha rewards.

- No TAO risk — you still stake to root as usual.

- Currently live on testnet, full mainnet rollout expected soon.

So yes — root stakers can now earn alpha without putting their TAO at risk.

That’s not just an upgrade. It’s a new era for staking flexibility and ecosystem alignment on Bittensor.

Be the first to comment