Note: This article is from an interview of Leo Chan, hosted by Sami Kassab.

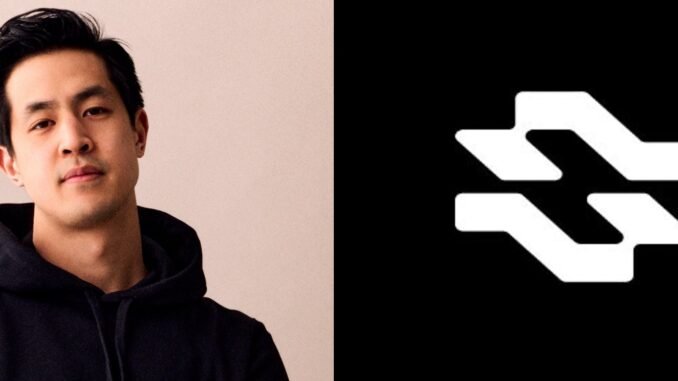

Sportstensor, led by CEO and co-founder Leo Chan, is emerging as one of the most dynamic projects within the Bittensor ecosystem. Built on Bittensor’s Subnet 42, the team is creating a platform that goes beyond traditional prediction markets by integrating incentive-driven intelligence and decentralized coordination. Unlike existing systems that only surface probabilistic signals, Sportstensor’s model aims to actively direct liquidity and expertise toward high-value events, turning predictions into programmable markets of intelligence and capital.

Founded in mid-2024, Sportstensor was born from Leo’s early fascination with the convergence of AI and crypto. Having mined $TAO during the early subnet days, he connected with his co-founders through shared experimentation on different subnets. That technical foundation shaped Sportstensor’s vision: a network that turns competitive prediction into verifiable signal generation.

Over the past year, the team has been refining its incentive architecture, learning through trial and error how to reward accuracy without leaking value to noise. The latest iteration, which Leo describes as “the first completely anti-dilutive incentive mechanism,” ensures that only miners producing profitable, verifiable signals earn rewards. This move closes one of the hardest economic challenges in decentralized prediction systems.

A major part of Sportstensor’s evolution is its partnership with Polymarket, one of the largest decentralized prediction platforms. Through this integration, Sportstensor can create markets on-demand, targeting information that traders and institutions genuinely need. If a sports fund requires precise probabilities for niche leagues, or a hedge fund needs accurate geopolitical or weather data, Sportstensor can open markets and direct incentives toward those specific informational gaps. This flexibility allows it to operate at the intersection of decentralized intelligence and institutional demand, serving both open markets and private entities that value predictive accuracy.

To bring these capabilities to users, the team launched Almanac (Sportstensor’s first product built on its redesigned subnet). Almanac functions as an incentivized front-end to Polymarket’s liquidity and infrastructure.

Traders can submit predictions, feed their models into the system, and earn rewards based on measurable signal quality. The beta launch, scheduled for December 1, 2025, marks the first step toward integrating prediction markets, data infrastructure, and decentralized AI into one fluid ecosystem.

The platform’s economic model is tightly coupled with its subnet ‘$ALPHA’ token. All trading fees generated on Almanac are recycled back into the system through buybacks, ensuring that miner incentives remain sustainable and anti-dilutive.

Leo describes it as a “closed-loop flywheel” where value creation, usage, and reward continuously reinforce one another. Miners generate real signal, users trade on that information, and revenues flow back into $ALPHA through buybacks and emissions. This approach not only ties subnet performance to real economic activity but also makes Subnet 42’s $ALPHA one of the few tokens with intrinsic revenue linkage on Bittensor.

Sportstensor’s expansion into esports adds another layer to its growth. Through a partnership with GRID, the official data provider for major titles such as League of Legends, Valorant, and Counter-Strike, Sportstensor gains access to direct in-game data streams, the equivalent of real-time order flow in financial markets. This data partnership opens the door for high-frequency predictive modeling across a fast-growing sector of sports intelligence, estimated at nearly $3 billion in annual volume. By integrating esports into its prediction infrastructure, Sportstensor is broadening its scope while staying true to its data-driven foundation.

What sets Sportstensor apart from traditional sportsbooks or centralized prediction apps is the alignment of incentives at the subnet level. While sportsbooks rely on losing bettors to maintain profitability, Sportstensor leverages open, decentralized markets where both casual and professional traders contribute to a shared pool of truth. The information itself becomes the product, not the byproduct. This shift aligns perfectly with Bittensor’s ethos, rewarding useful intelligence rather than speculation or noise.

Leo and his team see this as a critical inflection point, both for Sportstensor and for the broader Bittensor ecosystem. As he emphasizes, the goal isn’t just to build within Bittensor but to use Bittensor’s decentralized infrastructure to power systems that can thrive beyond it. The mission is clear: abstract away the technical complexity, attract real users, and prove that decentralized incentive layers can outperform centralized coordination.

Prediction markets are evolving, and Sportstensor stands at the forefront of that transformation. By merging the precision of data science with the incentive logic of Bittensor, it’s building a new kind of financial intelligence layer. One where every trade, prediction, and model refines a continuously learning network of truth.

As the December launch of Almanac approaches, Sportstensor’s next chapter is set to define how decentralized AI and prediction markets converge into a single, self-sustaining economy of information.

Be the first to comment