By: Punisher

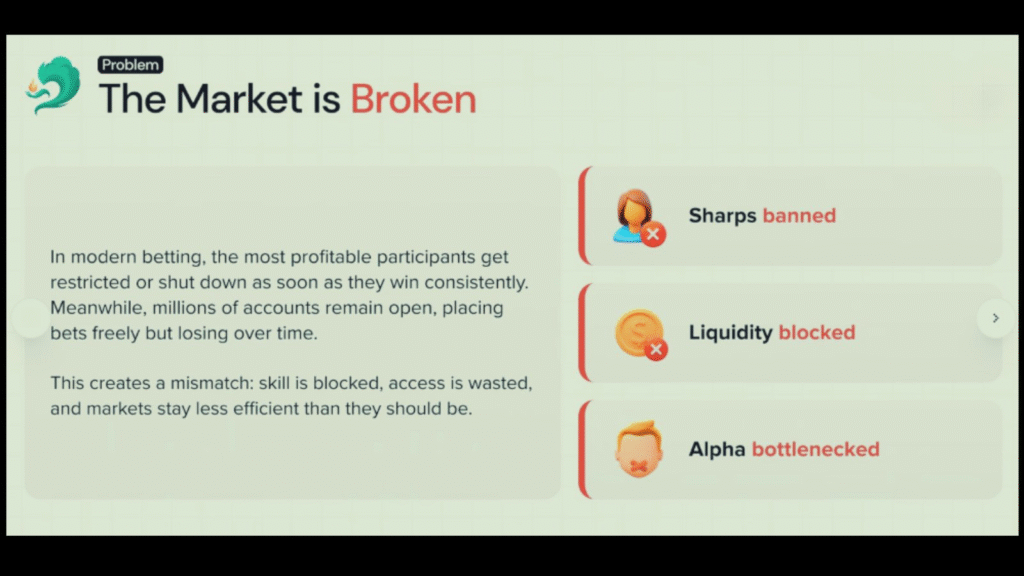

1. The problem – a market that actively rejects intelligence

Modern sports betting markets are not inefficient by accident. They are designed to function this way.

As soon as a participant demonstrates consistent profitability:

- accounts are limited,

- bet sizes are capped,

- or access is shut down entirely.

Meanwhile, millions of losing accounts remain fully active and are encouraged to keep betting.

This creates a structural mismatch:

- skill is blocked

- liquidity is wasted

- alpha is bottlenecked

Markets continue to operate, but far below their natural efficiency.

2. Djinn in one sentence

Djinn is a decentralized, trustless coordination layer that separates insight from execution, allowing intelligence to scale without being censored.

It does not execute bets. It does not custody funds. It does not promise returns.

It coordinates information, incentives, and accountability.

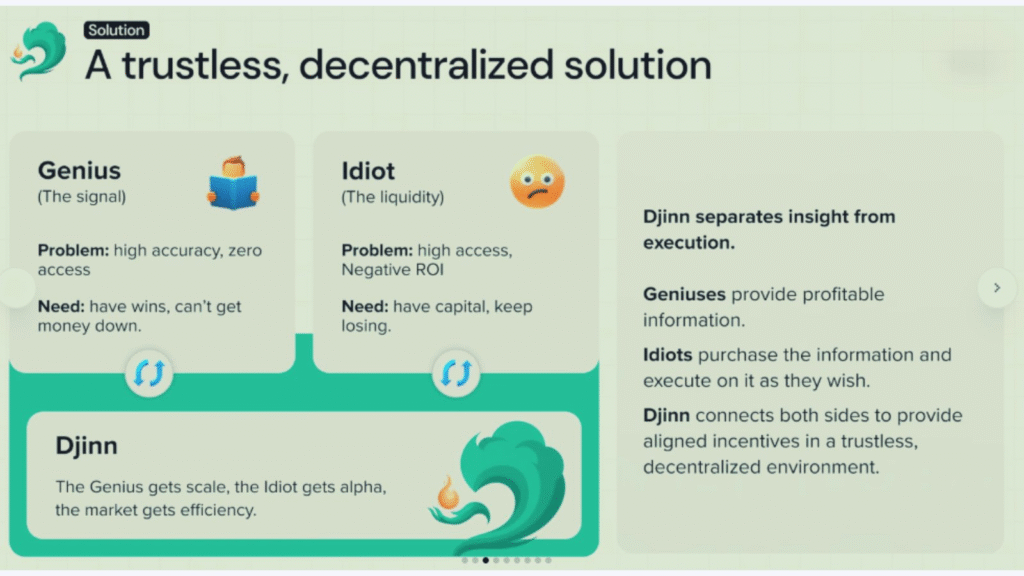

3. Genius × Idiot – a deliberate separation of roles

Djinn formalizes a reality that already exists off-chain.

🧠 Geniuses, signal providers (miners)

- High accuracy

- Proven models

- Zero or limited market access

They:

- submit encrypted signals

- stake TAO as a performance bond

- scale without direct exposure

⚙️ Idiots, executors (buyers)

- Full market access

- Capital

- Negative ROI over time

They:

- purchase signals

- choose freely whether to execute

- are protected by protocol guarantees

🧩 Djinn’s role

Djinn connects both sides so that:

- the Genius gets scale

- the Idiot gets alpha

- the market regains efficiency

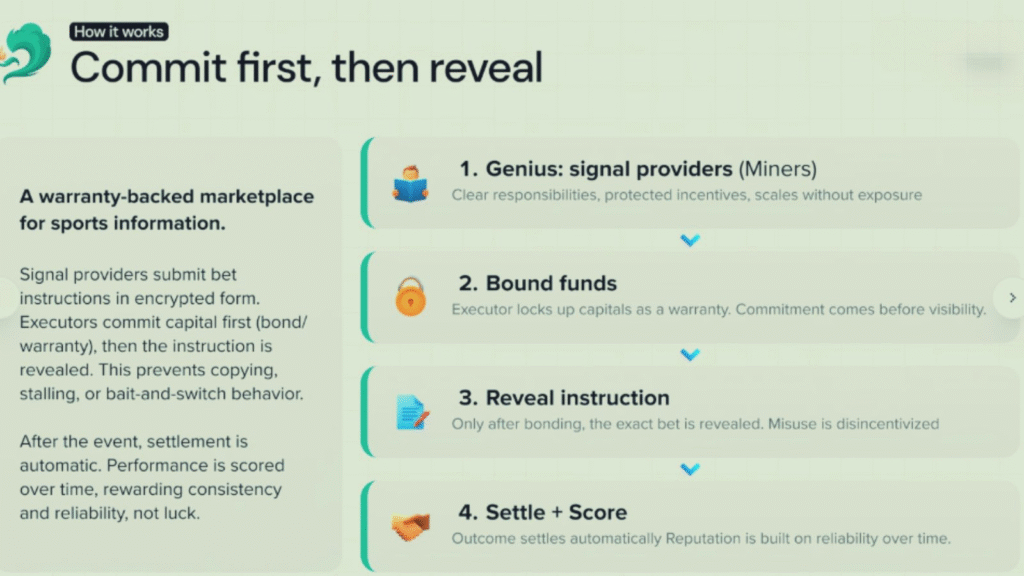

4. How it works – commit first, then reveal

At the core of Djinn is a simple but powerful mechanism:

commit → reveal → settle → score

- Encrypted signal submission The Genius submits a signal without revealing it.

- Capital commitment first The buyer locks funds before seeing the signal.

- Reveal after commitment The instruction is revealed only after bonding.

- Automatic settlement & scoring Validators verify outcomes and update reputation.

This prevents:

- copying

- front-running

- bait-and-switch behavior

Performance is scored over time, consistency beats luck.

5. Economic accountability: the Quality Assurance Threshold

Each Genius commits to a minimum performance threshold X%.

Two outcomes only:

Underperformance (Y < X)

- full fee refund

- compensation paid from Genius stake

- Djinn collects nothing

Outperformance (Y > X)

- Genius earns fees

- buyers receive fidelity rebates

- Djinn collects a fixed fee on fees

👉 No value → no rewards. 👉 No hiding behind narratives.

6. Fidelity rebates, aligning upside, not just protection

When performance exceeds the threshold, buyers receive a retroactive rebate.

Effects:

- buyers participate in upside

- Geniuses are discouraged from overstating edge

- pricing becomes self-correcting

The slides and examples clearly show:

- why caps are needed

- how bad parameter choices are punished

- how equilibrium emerges through market forces

This is not theoretical, failure modes are explicitly modeled.

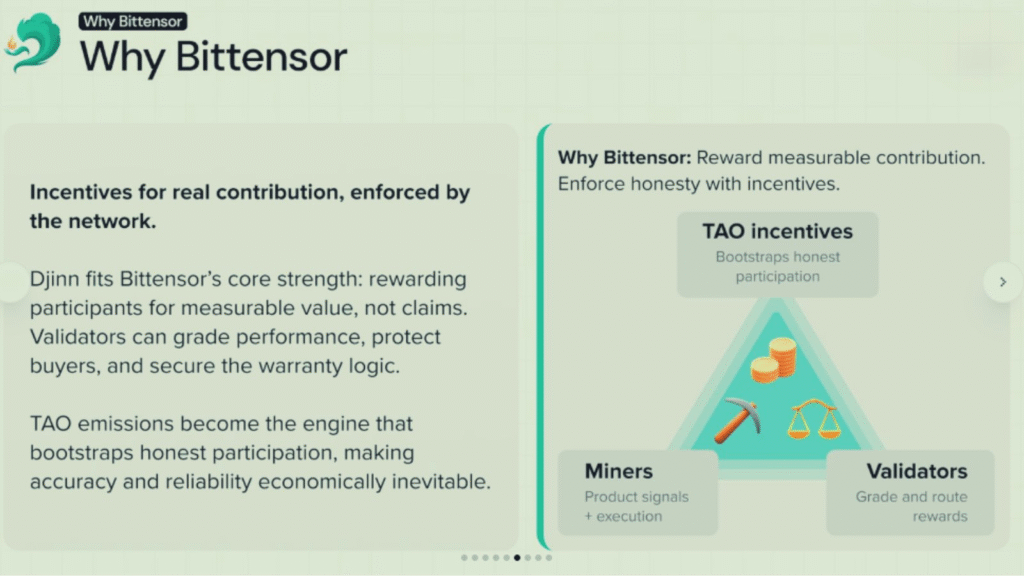

7. Why Bittensor

Djinn fits Bittensor’s core philosophy:

reward measurable contribution, not claims

- TAO staking → real economic guarantees

- Validators → grading, auditing, enforcement

- Slashing → security without trust

- No custody, no yield promises

Djinn doesn’t need Bittensor for branding. It needs it for enforcement.

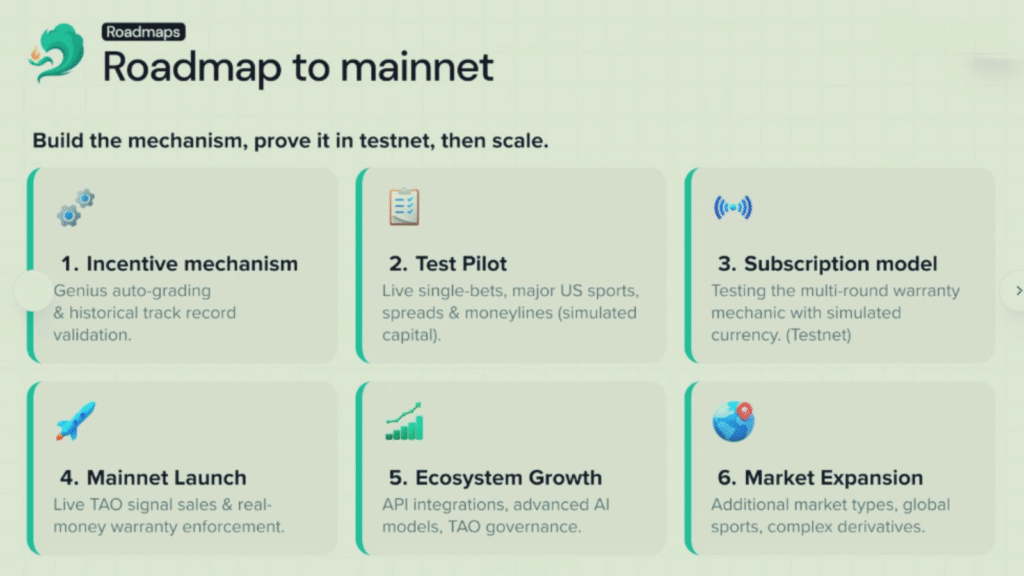

8. Roadmap – build, prove, then scale

The roadmap is deliberately conservative:

- Incentive mechanism & historical validation

- Test pilot (simulated capital)

- Subscription & multi-round warranties (testnet)

- Mainnet launch with real TAO enforcement

- Ecosystem growth (APIs, models, governance)

- Market expansion (sports, regions, derivatives)

This is infrastructure-first, not growth-at-all-costs.

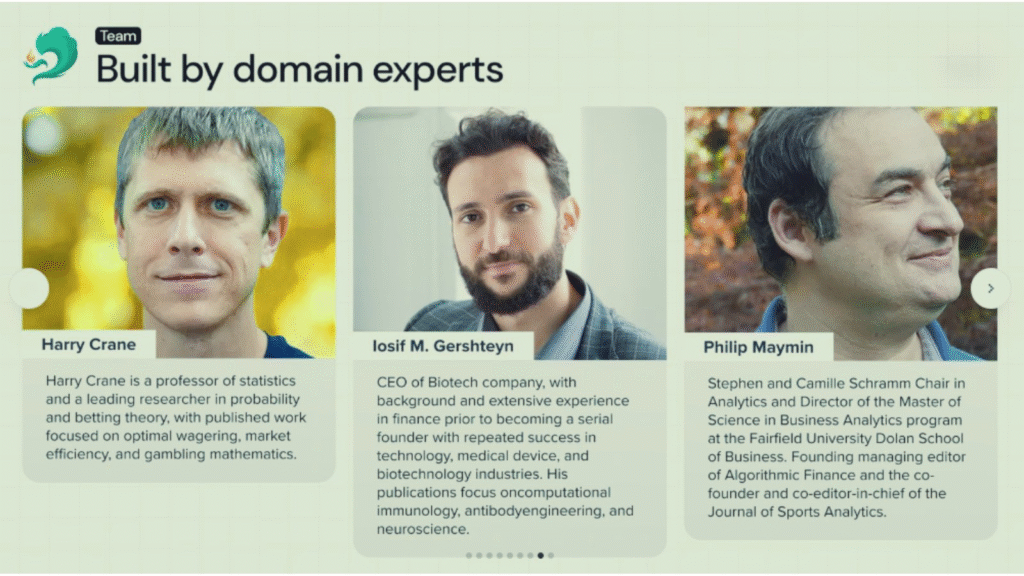

9. Team – domain expertise over crypto noise

Djinn is built by the founding team of Analytics.Bet, with more than five years of real-world experience.

Notably:

- Harry Crane — probability theory & market efficiency

- Harry Crane | LinkedIn

- Iosif M. Gershteyn — execution, finance, biotech

- Iosif Gershteyn | LinkedIn

- Philip Maymin — quantitative finance & analytics

- Philip Maymin | LinkedIn

These are domain experts, not crypto influencers.

10. Market opportunity – large, known, inefficient

- $2–3T global annual sports betting volume

- ~500M sportsbook accounts globally

- Top centralized syndicates earn $250–500M annually

- Scaling is limited by trust, leakage, and coordination

Djinn targets coordination inefficiency, not speculation.

11. The Const filter – does Djinn pass?

Using the filter proposed by Const:

- Digital asset? ✅ signals with economic SLAs

- Productive task? ✅ penalized predictions

- Intelligent & complex? ✅ decision-making under uncertainty

- Pyramid scheme? ❌ no promises, no dependency on entrants

- AI-related? ✅ performance-driven, method-agnostic

Structurally, Djinn checks every box.

That does not guarantee success, but it eliminates many common failure modes upfront.

Conclusion – architecture first, outcomes later

Djinn does not promise returns. It does not eliminate risk. It does not chase hype.

What it does offer:

- serious incentive design

- real accountability

- coherent use of Bittensor

- infrastructure that scales intelligence quietly

Whether it succeeds will depend on execution and adoption. But structurally, it deserves attention.

Calmly. Without noise. Without blind faith.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or investment advice. Djinn facilitates information exchange and does not operate or settle bets. Users are responsible for legal compliance in their jurisdictions.

Links

Website: djinn.gg

Whitepaper: djinn_protocol_whitepaper – Google Docs

X account: @djinn_gg

Philip Z. Maymin >> @pmaymin

Harry Crane >> @HarryDCrane

Iosif Gershteyn >> @IMGpf

SN103 has been successfully launched by Bitstarter from a structural and conceptual standpoint.

What comes next will depend on execution and adoption.

Be the first to comment