SIRE, powered by Score Vision on Bittensor Subnet 44, is refining its execution framework as it scales αVault toward more consistent, risk-adjusted performance.

January marks a deliberate shift in how the system captures market inefficiencies, prioritizing portfolio-level stability over isolated outcomes.

Rather than increasing volume for its own sake, SIRE is accelerating the convergence between theoretical positive expected value and realized profit and loss.

How SIRE Generates Edge

SIRE operates a multi-source prediction engine for live markets. Each match aggregates inputs from statistical models, Subnet 44 video intelligence, contextual data, and market odds.

Signals are continuously evaluated against realized performance and reweighted over time, allowing the system to adapt based on outcomes rather than assumptions.

January Execution Snapshot

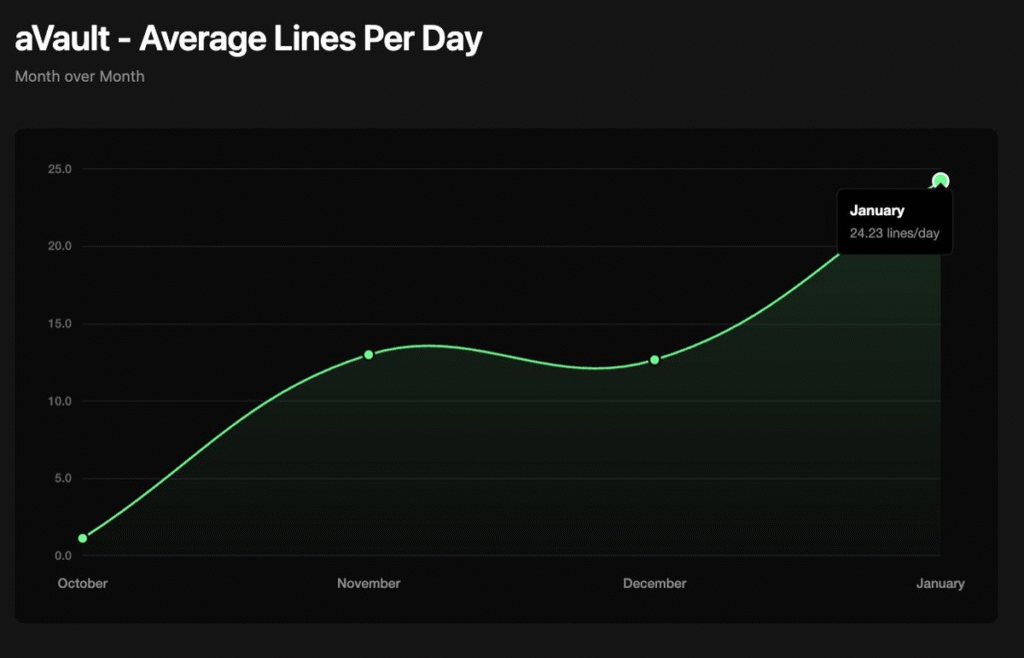

Key execution metrics for January highlight this evolution:

1. 24.2 average lines per active trading day, up 91% from December,

2. Target exposure to long-tail markets in the 3.00x to 15.00x odds range,

3. Risk management via low-correlation diversification and Kelly-optimal sizing, and

4. Variance shifted from individual bets to the portfolio level.

These changes reflect growing confidence in the model’s ability to scale edge without degrading capital efficiency.

Why Line Density Increased

The increase in execution frequency is a direct response to how SIRE identifies positive expected value:

a. Long-Tail Market Focus

The model consistently finds mispricing in higher-odds markets where price discovery is weaker. These include underdogs, niche competitions, and specialized outcomes within major leagues. By operating in these segments, SIRE accesses asymmetric return profiles that consensus-driven markets rarely offer.

b. Portfolio-Level Risk Control

Higher odds introduce higher variance at the single-bet level. SIRE addresses this through breadth rather than avoidance:

1. Low correlation across positions to reduce systemic exposure,

2. Higher trial count to accelerate convergence toward expected value, and

3. Kelly-optimal sizing to protect against outsized drawdowns.

The result is controlled volatility with improved realization of model edge.

Execution in Practice

This framework allows SIRE to capture meaningful tail events while maintaining overall portfolio resilience.

Recent examples include:

1. Nantes vs. Marseille (Nantes): $174 converted into $2,486 through severe underdog mispricing,

2. Sharks vs. Kings (Sharks): $3,500 converted into $11,290 via high-conviction model output,

3. Colossal Gaming vs. HMBLE (Colossal Gaming): $800 converted into $3,809 by exploiting esports market inefficiencies,

4. Napoli vs. Verona (Draw): $500 converted into $2,632 by identifying stalemate probability gaps, and

5. Macclesfield vs. Crystal Palace (Macclesfield+0.5): $600 converted into $2,608 through a successful favorite fade.

These outcomes are not isolated wins, they are the natural result of repeatedly expressing edge across uncorrelated market segments.

Conclusion

SIRE’s January execution upgrade reflects a maturing quantitative framework.

By increasing line density while maintaining strict correlation control and disciplined sizing, αVault trades single-bet volatility for portfolio-level stability. This structure allows edge to compound more reliably as execution scales.

The model identifies the opportunity, diversification controls the risk and mathematics drives the outcome.

Be the first to comment