Full Article Source: Sapho Report

This Sapho Report highlights a fresh market breakdown, exclusive indicators, and a spotlight on Lium’s (SN51) burn strategy.

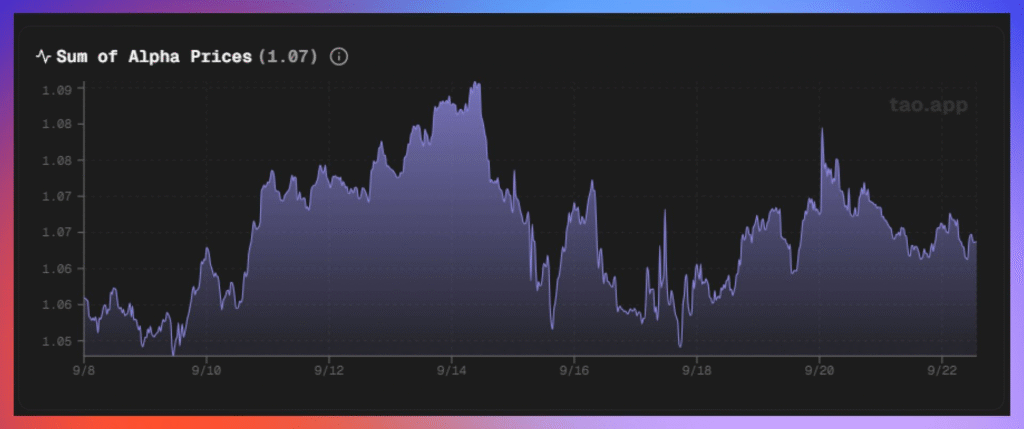

Bottom confirmed?

The sum of alpha prices seems to have confirmed the bottom reached on September 4th at 1.02.

It’s now holding steady between 1.05 and 1.09 — a healthy signal after months of volatility.

The indicator will need to break out of this range to the upside in order to confirm this new uptrend. Dropping below 1.02 would be a warning sign.

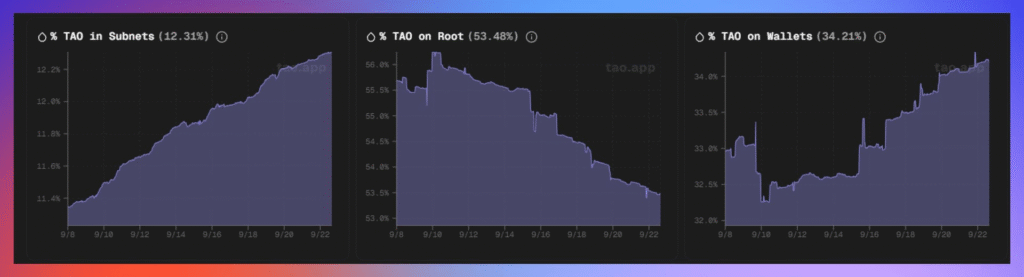

In line with the last edition, TAOs keep flowing out of the Root, mostly landing in private wallets.

TAO on Root and TAO on wallets shows an inverse correlation, as if members of the ecosystem were leaving the Root and waiting for the right moment to invest in subnets.

On the side of TAO in the subnets, this continues to increase linearly, driven more by network emissions than by new TAOs arriving on the market.

Highest market caps are more resilient

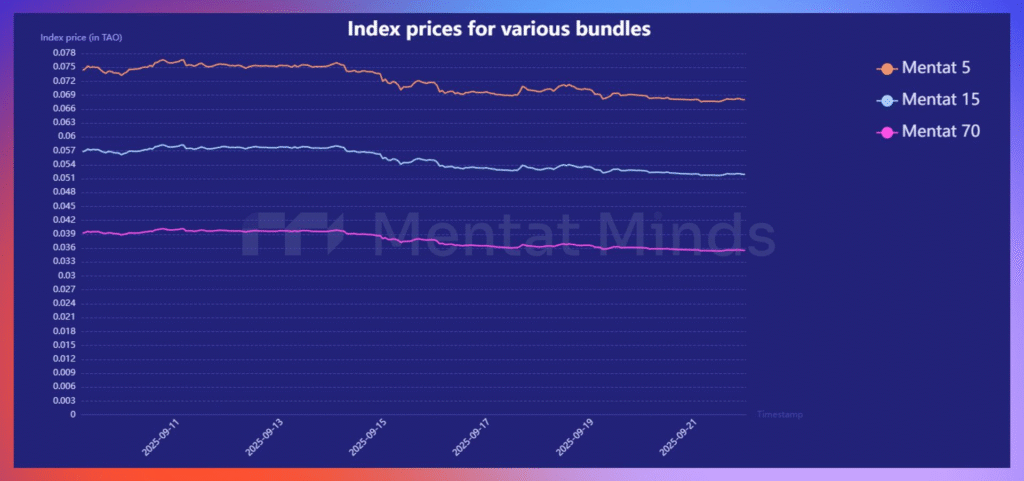

The Sum of Alpha prices range is particularly noticeable in the Mentat 5, 15, and 70 price indexes.

All three have been highly correlated recently, with performances of -4% for Mentat 5, -5.3% for Mentat 15, and -7.7% for Mentat 70.

We use Mentat Minds indexes. Details on calculation are on this page. Mentat 5 and Mentat 15 cover the leaders, while Mentat 70 gives a wider picture of the subnet market.

Mentat 5 remains a good performing index during periods of growth, and the most resilient during periods of decline. Mentat 15 is more volatile and Mentat 70 is still lagging behind (Recap of the performance we saw in our last newsletter between September 1 and 8: Mentat 15 +10.7%. Mentat 5 +8.3%, while Mentat 70 +6.3%.)

We’ll keep tracking these index differences in future editions. This will show if a market recovery spreads to more subnets or stays focused on the biggest players like those in the Mentat 5 index.

Lium, the first subnet to burn its tokens

Ready for takeoff?

Lium has been in a rather poor position over the last few months, with a clear downward trend since early May 2025.

Even though Lium is emerging from this period, the subnet has been fairly resilient, with a decline of 53% between May 5 and September 10. Over the same period, Mentat 70 (the market) suffered a decline of 69.2%.

However, since September 10, the trend seems to have reversed, with the first signs of an upward trend characterized by a higher high than the previous one.

This reversal in the trend seems to have been driven by the burn mechanism implemented by the subnet and who have been making a lot of noise recently. We’ll break down how it works later in the section.

The cheapest GPU provider?

Lium.io is a decentralized platform where anyone can rent or provide GPU power for AI and computing tasks, offering lower costs than traditional cloud providers, with instant access and no KYC required.

The subnet currently ranks 4th, with a market cap of $47.1 millions, a volume of $678.5k in the last 24 hours, making it the 17th most traded token. This is not a good position compared to its market cap.

The subnet is not emerging from its best phase and needs to encourage new investors to take an interest in it.

A subnet owner who believes in their project.

Among the largest wallets, only one will catch our attention: the first one.

Fish, Lium’s subnet owner, currently holds 14.4% of the token supply. This percentage is very high and may represent a risk in the event of massive sales. In general, the three largest wallets in a subnet do not own more than 17-18% of the supply.

However, Fish has never sold a single token from his subnet and continues to accumulate them. An attitude that demonstrates a long-term vision and sufficient resources to absorb selling pressure.

How effective is Lium’s burn mechanism?

In addition to accumulating and retaining its tokens, Fish has implemented a burn system for Lium.

A burn is when the subnet permanently destroys a portion of its tokens. This process reduces the circulating supply, with the goal of making the remaining tokens scarcer and potentially more valuable.

20% of miner rewards are distributed directly to miners. The remaining 80% go to addresses controlled by the subnet owner. Then, 80% of the revenue from GPU rentals is redistributed to miners, using the 80% of emissions previously set aside. Any unused balance is periodically burned on-chain.

This setup both incentivizes miners and reduces token supply, and all burns are fully transparent and verifiable via the blockchain on this coldkey: 5G694c15wAu1LKi9rpSQqJjpBfg4K1oiBxEm5QSVdVZAfp9f

Since the implementation of these burns, more than 30k TAO worth of Alpha have been burned.

The last burn took place on September 18, when 8,500 TAO were burned.

The only real drawback of Lium’s burn system is the lack of automation. There is no scheduled or on-chain process. Everything depends entirely on Fish’s decisions and actions. Investors have to trust him to execute burns and buybacks. In the past, these actions have not always been regular or consistent, which creates a real risk.

Moreover, the latest burn appears to have been prompted by a published thread pointing out these concerns just before the burn occurred.

More and more subnets are deploying mechanisms to maintain their token price. High emissions can push prices down, so investors are increasingly drawn to subnets with systems in place to manage supply and protect value.

Another very popular mechanism is buyback. It will be interesting to discuss this in a future edition in order to compare it with burn and determine which mechanism is the most efficient for subnets and the most attractive for holders.

This is becoming a real selling point, a trend that will shape the future of subnet token trading.

Be the first to comment