Project Rubicon is shaping up to be one of the most important infrastructure layers in the Bittensor ecosystem. It introduces a simple idea with far-reaching consequences for subnet liquidity: native staking without losing access to your tokens.

With Rubicon, subnet assets finally become usable inside broader multichain DeFi flows.

What Project Rubicon Aims to Solve

The Bittensor ecosystem has grown rapidly, yet subnet ‘$ALPHA’ tokens often remain locked inside the network with limited access to real liquidity. Rubicon approaches this challenge with a clean model that gives stakers both security and flexibility.

Project Rubicon is a cross-chain liquid staking infrastructure built by GTAO Ventures in collaboration with Base and Chainlink. It allows anyone to stake native $ALPHA while receiving a liquid staking token (LST) called xALPHA on the Base network.

In simple terms, you keep your stake and still get a liquid representation of it. This creates the foundation for a liquid staking layer that benefits the entire TAO ecosystem.

How Rubicon Works

The mechanics are intentionally simple to encourage adoption.

1. Deposit $ALPHA

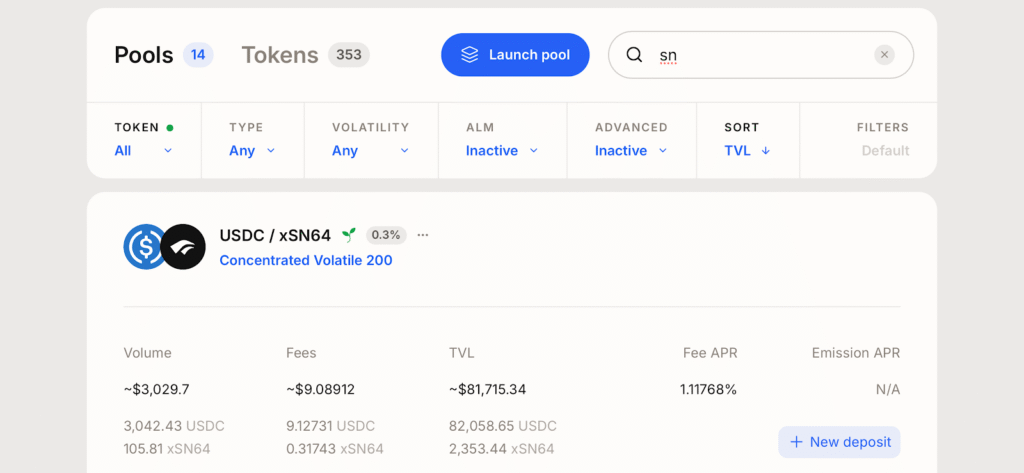

Users send their $ALPHA into pooled smart contracts via Aerodrome.

2. Validator routing

The system batches deposits and routes them to validators inside the subnet.

3. Receive $xALPHA

In return, users receive $xALPHA on a one-to-one basis at the beginning. These $xALPHA accumulate staking rewards over time as validators earn.

This turns staking into something liquid and composable. Your tokens continue earning yield while also becoming usable across DeFi on Base.

Support for $TAO staking through a future xTAO model is already planned and will extend this framework even further.

$xALPHA’s Economic Design

Staking $ALPHA converts it into a yield bearing asset, an LST. Here is what $xALPHA can be used for.

1. Trading

$xALPHA can be freely traded on Base.

2. Collateral

It can serve as collateral inside lending and liquidity markets.

3. Yield positions

It can be inserted into DeFi strategies to stack additional returns.

4. Protocol fees

Deposits, withdrawals and internal tax flows help sustain the system.

The model works because $xALPHA appreciates naturally through validator accumulated rewards. This gives $ALPHA a predictable and useful presence in external DeFi environments.

Why Rubicon Matters

$ALPHA are powerful but they sit behind walls that limit liquidity. Most subnet owners cannot tap into deep markets and everyday users cannot deploy $ALPHA to earn outside rewards. Rubicon removes that barrier.

The real win is not only liquid staking. It is the bridge from the TAO ecosystem to the wider liquidity of multichain DeFi. Once subnet assets can move freely, value can circulate instead of remaining siloed.

The community has needed a solution like this for a long time, and Rubicon arrives exactly when adoption is accelerating.

Initial Subnet Lineup

The first batch of supported subnets cover a wide slice of the Bittensor landscape.

These include:

12. Lium (Subnet 51)

15. RESI (Subnet 46)

16. TAO Private Network (Subnet 65)

This diverse selection ensures that liquidity does not concentrate in one corner of the ecosystem. Every subnet gains a pathway to new users, deeper capital and more stable participation.

Final Thoughts

Project Rubicon is a turning point for the TAO ecosystem. By allowing $ALPHA to flow into the world of Base and EVM (Ethereum Virtual Machine) DeFi, it unlocks participation that was previously impossible.

Stakers gain liquidity, subnets gain reach, and the entire ecosystem gains momentum. If Rubicon becomes widely adopted, it may evolve into the default liquidity layer that connects all subnet tokens to global markets. And for a network built on distributed intelligence, that kind of financial mobility can accelerate everything else that follows.

Be the first to comment