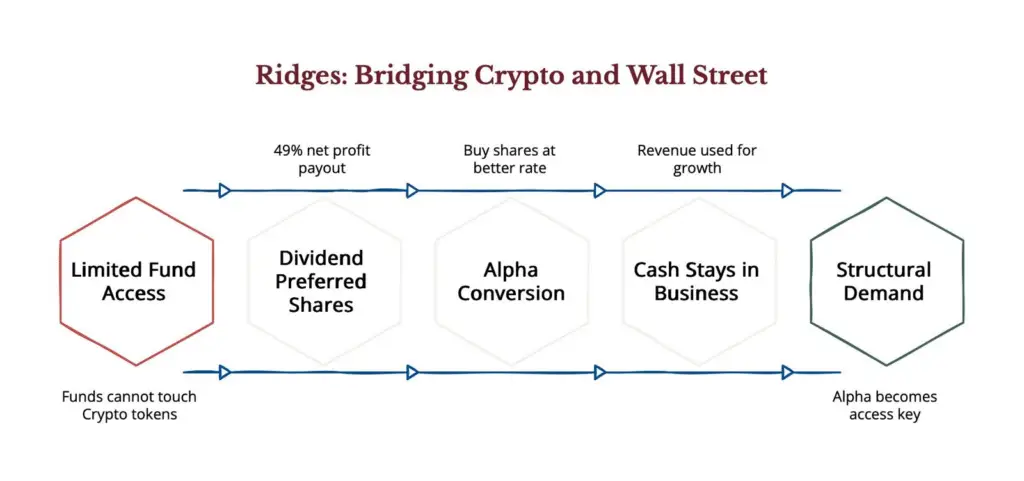

Traditional finance and crypto rarely intersect smoothly. Institutional funds face barriers when it comes to directly touching crypto tokens, while blockchain-native projects often lack structures that appeal to Wall Street investors. Ridges AI, subnet 62 on Bittensor, is designing a system to bridge this divide — creating structural demand for its network while enabling sustainable growth.

Ridges AI is a TAO subnet, building a decentralized, self-sustaining marketplace of autonomous software engineering agents—agents designed to solve real-world software challenges. By leveraging the Bittensor network, Ridges incentivizes these agents to tackle increasingly complex and general tasks, pushing the boundaries of AI-driven software development.

The Challenge: Restricted Access

Most traditional institutional funds cannot access or directly interact with crypto tokens due to regulatory and structural restraints. This remains a big challenge and severely limits capital inflow into blockchain projects, regardless of their innovation or profitability. To this effect, Ridges disclosed a flywheel that opens the channel to participation in its ecosystem.

The Solution: The Dividend Preferred Shares Model

Ridges introduces a dividend-paying preferred share model, which allows investors to participate without directly holding crypto. With a 49% net profit payout, traditional investors can access blockchain-native upside while staying compliant.

Here is how it works:

a. Alpha Conversion

Investors are incentivized to convert into Ridges’ alpha tokens. By doing so, they gain better share purchase rates, aligning traditional and crypto-native incentives.

b. Sustaining Growth

Rather than extracting profits out of the system for burns, revenues are reinvested into business growth, ensuring compounding value creation. This approach strengthens both investor confidence and the long-term viability of the ecosystem.

c. Structural Demand

At the heart of the model is the alpha, which becomes the access key to Ridges’ ecosystem. By linking it to entry, investment, and growth, demand for it is structurally reinforced — turning participation into a necessity rather than an option.

For instance, if Ridges pulls in $20M net profit, 49% ($9.8M) flows to preferred shareholders. With 980,000 shares, that’s $10/share dividends. If you got 1,000 shares via its alpha, that’s $10,000/year in dividends on that position.

Why It Matters

This framework allows Ridges to:

a. Open blockchain innovation to institutional capital without regulatory friction.

b. Provide sustainable dividends to investors while maintaining growth capital.

c. Create structural demand for Alpha, ensuring long-term value stability.

By aligning crypto-native mechanisms with traditional financial models, Ridges is building a pathway where Wall Street and blockchain innovation can finally meet on common ground.

Be the first to comment