Contributor: Crypto Pilote

I. The sleeping giant market

1) Post-war rush to real estate

Since the 1980s and the end of the gold standard, real estate has been viewed as a hedge against FIAT inflation and for most younger generations, as a life goal.

After the post-war boom, which lasted for roughly thirty years and saw economies rebuilt and technology dramatically boost productivity, real estate became the preferred investment of baby boomers. They were at the right age, with the right means, to take advantage of a market that seemed to only go up.

During this period, living standards rose quickly, and property ownership expanded beyond primary residences, vacation homes and rental properties became common. What might have already looked like a generational privilege was, in fact, only the beginning.

2) Low Rates and the Rise of Debt Money

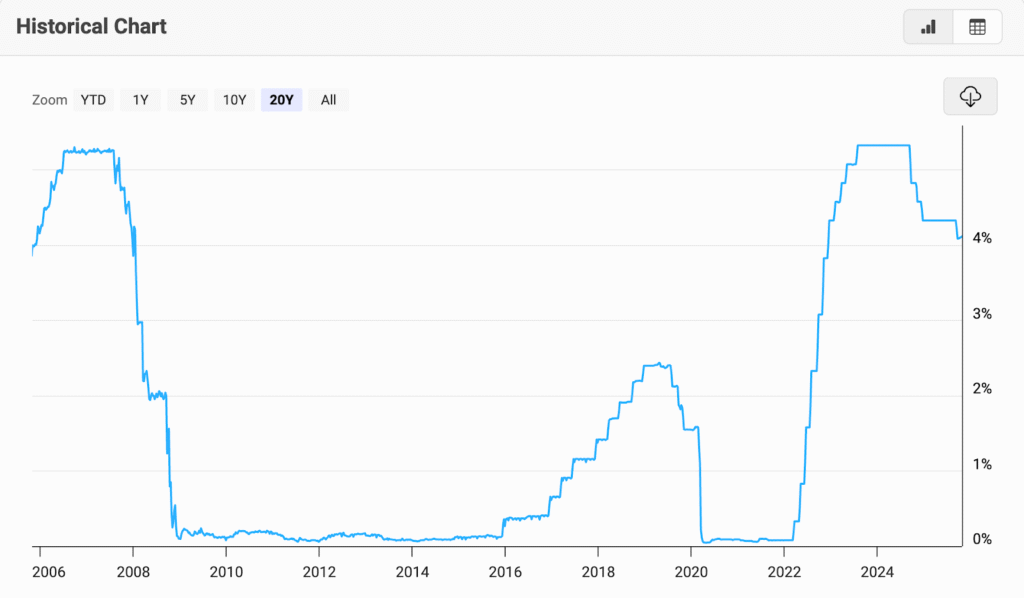

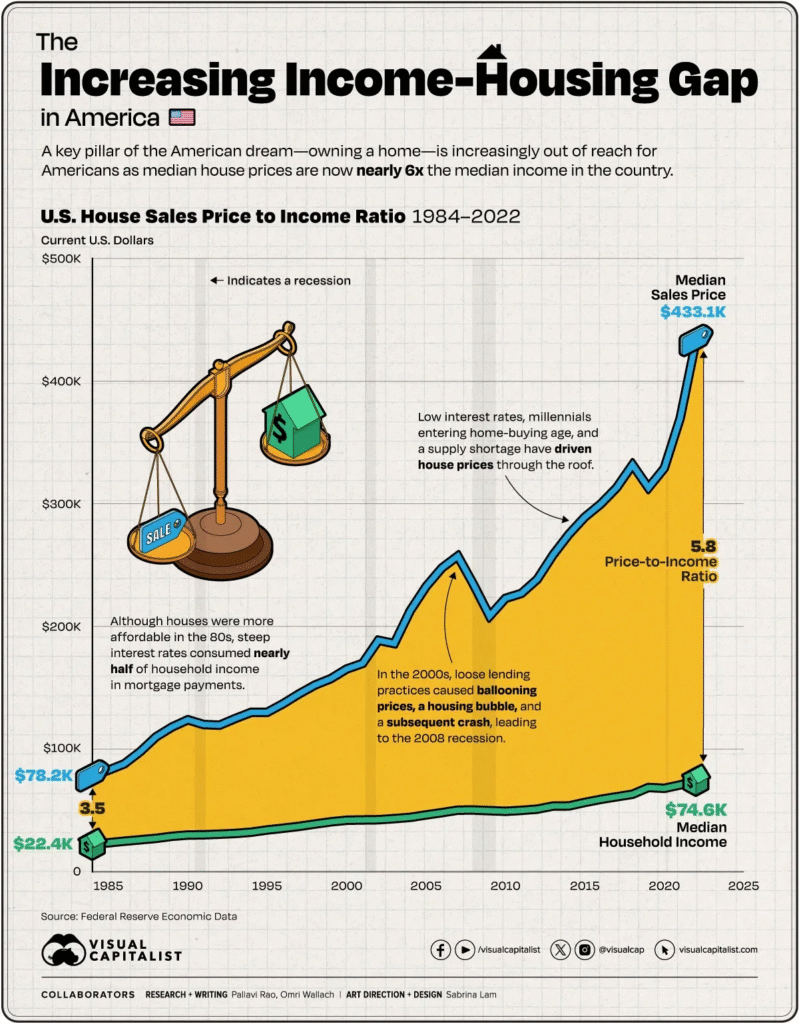

This dynamic drove real estate prices to skyrocket and gradually disconnect from average incomes. The cycle was further inflated by near-zero-interest mortgages introduced after the subprime crisis and reinforced during the COVID-19 years, creating a bubble sustained more by monetary policy than by real economic fundamentals.

Today, as central banks tighten their policies and interest rates return to historical norms, real estate returns have naturally adjusted downward. The yield on property investments tends to converge toward central bank rates, as both are driven by the same underlying forces: the cost of money and investors’ appetite for risk. When money is cheap, property speculation thrives; when capital becomes expensive, prices stagnate and only yield-driven assets remain attractive.

3) Income and Price Divergence

This dynamic drove the real estate market to skyrocket and gradually decouple from average incomes. Ultimately, the bubble was fueled by near-zero-interest mortgages introduced after the subprime and COVID crises, creating artificial demand, devaluing money, and pushing house prices even higher.

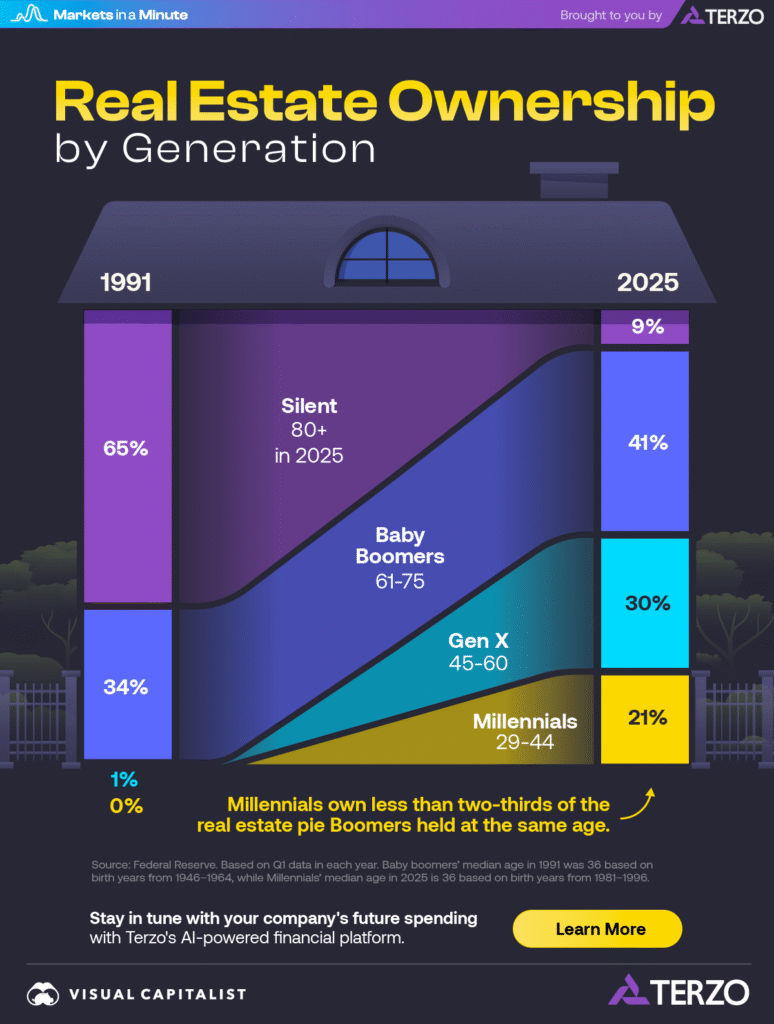

As a result, baby boomers are now sitting on a gold mine: those aged 60 and above own more than 50% of the entire real estate market, representing around $19.7 trillion in value.

This accumulation of wealth has made baby boomers the most affluent demographic in the Western world. During that same period, healthcare and living conditions also improved dramatically, meaning that people over 60 are not only wealthier but also healthier and therefore staying in their homes much longer than previous generations. Many of these properties will soon require extensive renovations to remain livable or to be passed down.

4) The Incoming Silver Tsunami

The real estate market today is highly distorted, over-concentrated in a single generation’s hands, and those hands are about to open.

However, there’s one thing they still can’t afford: eternity.

With an average life expectancy of 79 in the U.S., a massive transfer of wealth is expected within the next decade, from baby boomers to Gen X, and increasingly, directly to millennials.

Millennials are set to inherit the largest wealth transfer in modern history, often referred to as the “Silver Tsunami.”

5) Homes will change hands for the first time in decades

Yet, millennials are also the generation most affected by inflation and stagnant wages, struggling to improve their living conditions in a competitive job market. Many were forced to move into high-density cities to earn a decent income, where higher living costs make homeownership almost unreachable.

So what happens when they inherit old, sometimes outdated properties far from major urban centers?

They’ll sell ! To improve their lives, to relocate, or to invest elsewhere. As a result, the real estate market could face a massive reshuffling in the coming years. Countless properties will change hands for the first time in decades, potentially marking the end of the current housing bubble and triggering strong selling pressure.

Prices will adjust quickly, and the sheer volume of transactions will overwhelm traditional real estate agents. Meanwhile, millennials, digital natives by nature, expect fast, simple, and transparent solutions, ideally accessible through a well-designed app.

AI can solve this.

Imagine getting, in just a few minutes from your phone, an accurate and fair valuation of your property, factoring in previous sales, natural risks, location, and real-time market conditions.

That’s exactly what Resi (SN46) is building.

II. Resi, the next-generation real estate agent

1) Bittensor Synergies Are Building the Future

Resi is the 46th subnet on Bittensor designed to reinvent the real estate system.

The current system is slow, opaque, and often dependent on intermediaries who can be biased or even corrupt. This structure creates ideal conditions for unnecessary fees and inefficient transactions.

Think about it, we’re still at a point where someone physically comes to your house to tell you how much it’s worth. Their assessment is subjective, and the process hasn’t evolved in decades. This system needs to change.

An original fork of the excellent Data Universe (SN13), Resi showcases how subnets can collaborate effectively within Bittensor. It leverages Chutes (SN64) for Natural Language Processing (NLP), Gradient (SN56) for inference, and Hippius(SN75) for data storage. What a perfect demonstration of the power of subnet synergies.

To see how synergies shaped Bittensor in October ’25, check out this other tweet:

This interconnected architecture enables brilliant teams to focus on their core mission, relying on highly specialized subnets to handle everything outside their area of expertise.

2) Roadmap

The Resi roadmap is built around three key phases:

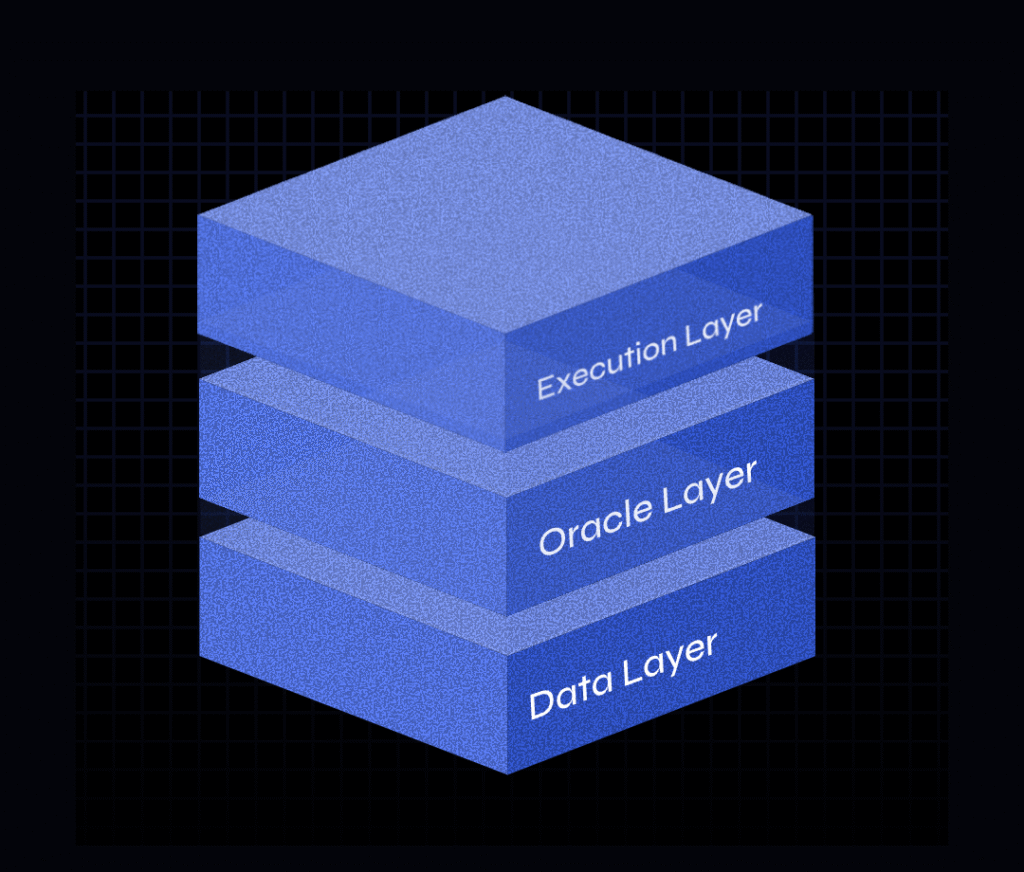

1. Construct the database – Data Layer

Miners collect and structure data from across the U.S. real estate market, creating a comprehensive, real-time database. This phase is almost done.

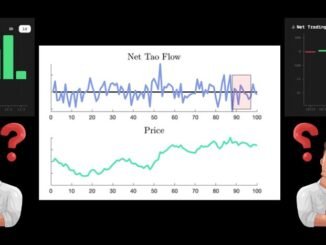

2. Understand the market – Oracle Layer

This stage connects the dots: interpreting data, generating insights, and identifying emerging trends.

3. Improve it – Execution Layer

This is where it gets truly interesting. The collected data and insights will power a DeFi protocol that redefines how real estate is valued, not just as physical assets, but as digital, tradable commodities.

Thanks to Resi, investing in real estate could soon become simpler, more transparent, and more liquid: enabling shared ownership, collateralized lending, and smoother transactions with fewer intermediaries.

3. A project surrounded by great minds

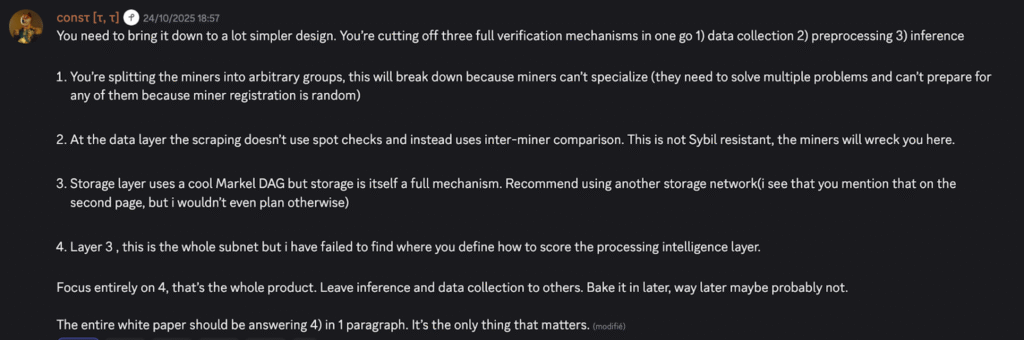

The team initially planned to progressively build their own inference and storage models to reduce costs and capture more value. However, Const advised them to continue leveraging existing subnets — as they do now — and focus their efforts on their core mission.

This shared expertise strengthens the overall network, helping to make the market more efficient and ultimately reducing costs for end users.

To build this new system, the team is now forming strategic partnerships. So far, they have secured two major collaborators:

• NextGen Digital, the first public $TAO DAO, which invested $300K;

• Comertize, a new platform specializing in real estate tokenization with $600M in assets under management.

Comertize also partners with Chainlink and PropyInc, collaborations that could directly support Resi’s future DeFi ambitions.

In addition, DSV Funds is backing the project with $200K in OTC alpha.

Altogether, the protocol currently covers an estimated $76 million in real estate value, a promising start for a few weeks old project that aims to reshape how property is valued and exchanged.

4) Alphanomics

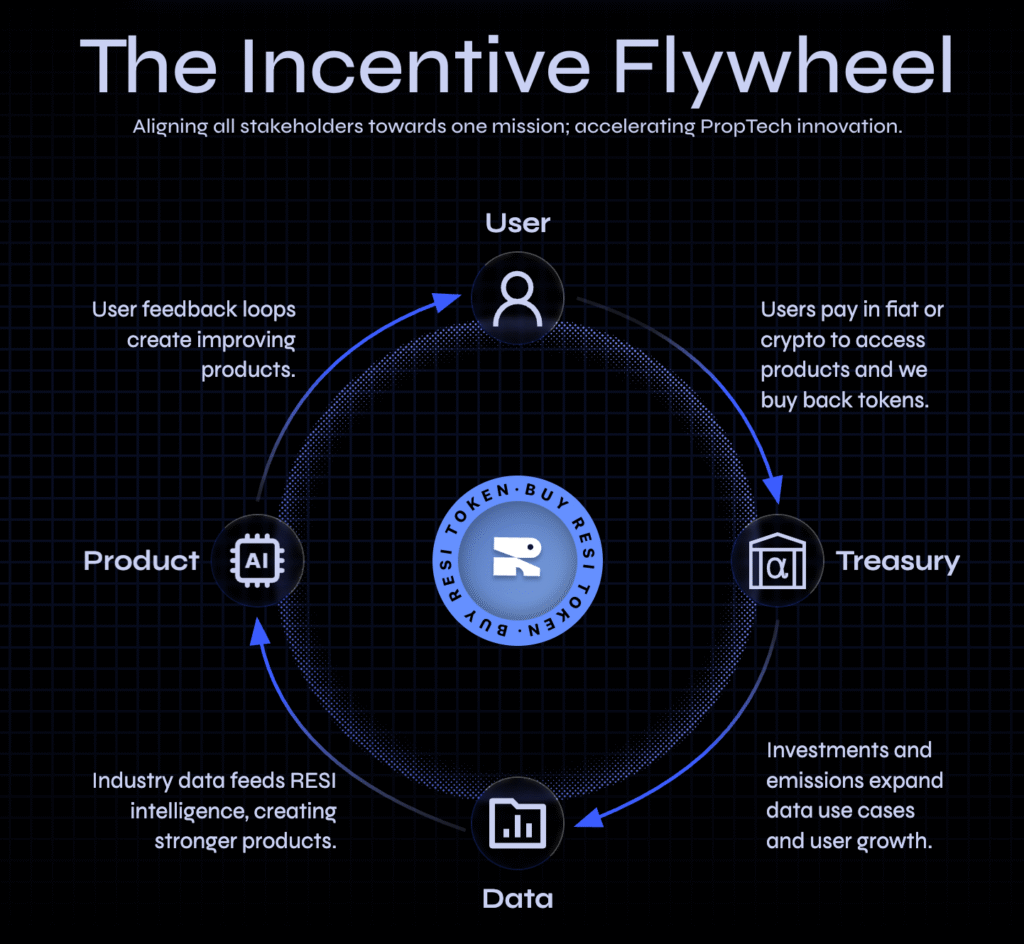

Users will pay in fiat for a wide range of services, depending on the level and quality of data they require.

Pricing tiers:

• Quick Estimate ($50) – 2–5 min | Cached data and market overview

• Soft Appraisal ($250) – 10–30 min | Pre-purchase research

• True Appraisal ($500) – 30 min–2 hrs | RESI-certified, suitable for lending

• Human Verified ($1,000) – 4–48 hrs | Legal-grade, human-reviewed

Fiat payments will be used to purchase alpha and submit requests to miners, ensuring that value flows directly back into subnet activity.

The team aims to capture 1% of the U.S. real estate market, targeting approximately $40 million in annual revenue within three years.

Once the execution layer is fully deployed, additional revenue streams could emerge — such as commissions or transaction fees generated from Resi’s future DeFi products.

Conclusion

The real estate market today is clearly overvalued, and prices are likely to shift quickly once baby boomers begin transferring their properties to younger generations.

Beyond the upcoming wave of property revaluation, a deeper transformation is on the horizon. Millennials and Gen Z (unlike their parents) will demand digital, data-driven, and transparent solutions instead of relying on traditional real estate agents.

This generational shift represents a massive opportunity. If executed properly, AI can absorb a large portion of the market’s inefficiencies: automating valuations, streamlining transactions, and restoring fairness to an industry long distorted by opacity and speculation.

Resi is positioning itself at the forefront of this revolution, harnessing the collective power of Bittensor and its subnet synergies to redefine how we perceive, value, and exchange real estate.

More than just a technological innovation, Resi opens the door to a new way of thinking about property, where AI, data, and decentralized finance could eventually give birth to entirely new classes of financial products.

Be the first to comment