The Bittensor ecosystem keeps expanding into new frontiers—and Subnet 46 (Resi Labs) is targeting one of the largest of them all: real estate. During a recent two-hour AMA with Sebyverse, Chief Architect at Resi Labs, community member Mariuszek took detailed notes that highlight RESI’s bold vision.

From dismantling outdated middlemen to building an AI-driven execution layer, RESI is positioning itself to disrupt property technology on a global scale.

What is RESI Labs?

RESI is building the Real Estate Oracle—an AI-driven intelligence layer designed to replace bloated middlemen like Realtors, investors, lenders, lawyers, and title companies.

Its mission is ambitious: become the MLS killer and create an execution system that runs transactions end-to-end, powered by Bittensor’s $TAO.

Why a Real Estate Oracle?

The current real estate system is broken.

- Data is gatekept by MLS, Attom, and CoStar.

- Available datasets are shallow, providing only property info and sales history while missing ownership, mortgage, and behavioral context.

- Without a robust dataset, it’s impossible to build fractional property markets, DeFi mortgages, or autonomous real estate agents.

AI agents drafting contracts, coordinating inspections, or managing investments all require a reliable foundation of intelligence. RESI wants to provide it.

Why Bittensor (TAO)?

Traditionally, building an oracle of this scale would cost millions of dollars and take years. With Bittensor’s decentralized incentive model, RESI can aggregate trillion-dollar datasets in months, not years.

As Sebyverse put it:

“Uber was not possible without GPS, mobile, and AWS. RESI is not possible without $TAO.”

How It Works

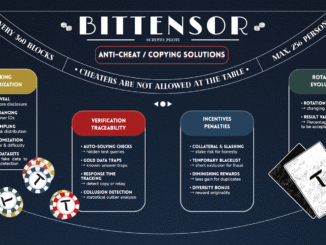

RESI (Subnet 46) is a fork of Subnet 13 (data scraping).

- Miners focus on pulling and collating real estate and adjacent data—ownership, mortgages, consumer signals, and behavioral patterns.

- This becomes the foundation layer for real estate apps, AI agents, and fractionalized exchanges inside the $TAO ecosystem.

Predict.Casa Foundation

RESI builds on Predict.Casa, a platform already in use nationwide by Realtors and investors.

- Users upload raw lead databases (numbers, credit profiles, motivations).

- RESI fine-tunes and outputs ranked lists of motivated sellers.

- Execution happens through telemarketing or lookalike audiences, performing 8x better than traditional marketing.

Every user action—opt-in, hang-up, or feedback—loops back into RESI, training what the team calls an industry super intelligence.

So far, Predict.Casa has already driven over $1B in real estate volume. With $TAO incentives, RESI plans to scale globally.

Growth Phases

- Information → Build a nationwide property database (current stage).

- Insights → Consumer and behavioral enrichment through Predict.Casa and partner apps.

- Execution → Full autonomy with contracts, inspections, mortgage validation, and closings.

Revenue Model

RESI’s target customers evolve as it grows:

- Phases 1 & 2 → Proptech app builders, Realtors, investors, hedge funds, REITs, brokerages, iBuyers.

- Phase 3 → Consumers directly (homeowners, buyers, mortgage seekers).

Revenue streams include:

- Subscription and access fees for the Oracle.

- Execution fees for autonomous transactions.

- Data licensing and platform integrations.

Cost savings will come from leveraging other $TAO subnets like Chutes.

Alphanomics

- Users pay for RESI’s data and AI services.

- Revenue funds alpha buybacks.

- Alpha flows into a smart contract to manage supply and sell pressure.

- Over time, Alpha evolves into a governance token, aligning the community.

The Endgame

RESI’s vision is clear:

- Realtors, lawyers, and title companies are middle layers—expensive and replaceable.

- Contractors and inspectors stay, but nearly every other middleman can be replaced by an autonomous AI-driven system running on $TAO.

If successful, RESI could become the intelligence backbone of global real estate markets.

Be the first to comment