qBitTensor Labs has returned with a detailed ecosystem update, offering fresh insight into the development of its Bittensor subnets and its broader outlook for 2026.

The update was delivered during the 8th edition of qBitTensor’s live show with Bob Wold leading the session on behalf of the team. After a brief end of year pause, the livestream focused on concrete progress across Subnets 48 (Quantum Compute) and 63 (Quantum Innovate), commentary on Bittensor’s evolving incentive mechanics, and a roadmap centered on real-world utility and sustainability within the Bittensor ($TAO) network.

Subnet 48 Moves Toward Enterprise Use With Private Execution

One of the most significant announcements centered on Subnet 48, which powers OpenQuantum. Bob confirmed the launch of private execution, introducing a paid-tier designed for users working with sensitive data or proprietary research.

Previously, OpenQuantum operated entirely through public execution, where anonymized user data could be aggregated for research purposes.

While effective for open experimentation, this model limited participation from enterprises and professional researchers.

Private execution changes that dynamic by:

a. Ensuring data isolation,

b. Introducing direct revenue generation, and

c. Opening access to enterprise level users.

According to Bob, all private execution is paid, marking a clear shift from experimentation toward sustainable infrastructure.

Academic Validation Through arXiv Publication

qBitTensor also plans to publish a formal research paper on arXiv, a widely recognized academic repository.

Once published, researchers using OpenQuantum’s public execution tier will be required to cite the paper in any resulting publications. The team views this as a way to formalize OpenQuantum’s role within the scientific community while increasing visibility through legitimate research channels.

This move positions Subnet 48 not only as a crypto-native product, but as a tool designed to integrate into existing academic and industry workflows.

Linking Subnet Ownership to Platform Utility

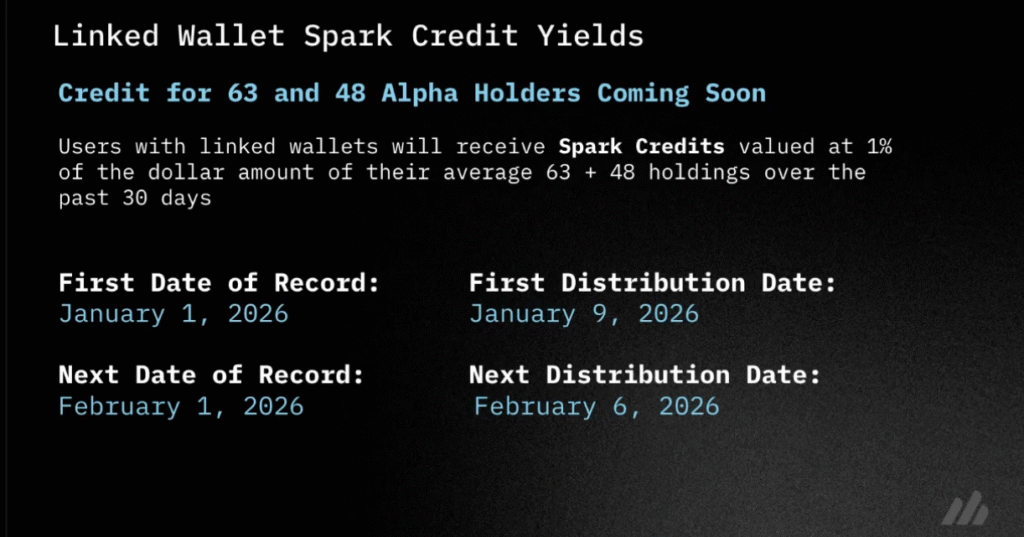

Another key update involved the rollout of linked wallet credits.

Under this system, holders of Subnet 48 and Subnet 63 ‘$ALPHA’ tokens will receive recurring OpenQuantum credits based on the median USD value of their holdings over a defined period. The current monthly yield is set at 1%.

Bob explained that the mechanism is intended to:

a. Align long-term holders with platform usage,

b. Incentivize participation beyond speculation, and

c. Reduce reliance on short term trading dynamics.

Credits are calculated with a review window prior to distribution to detect anomalies or potential exploits.

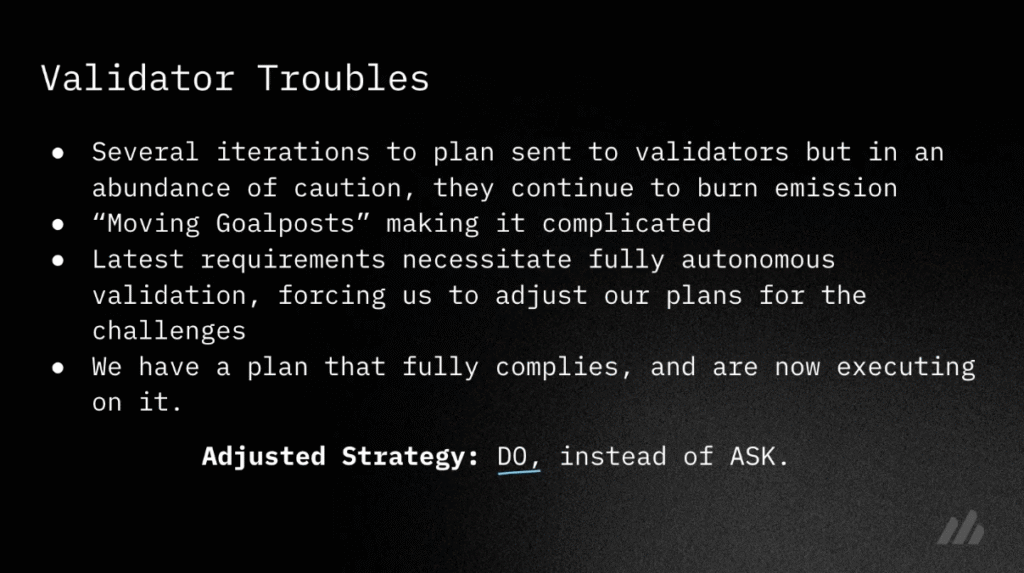

Subnet 63 Advances Despite Validator Challenges

Progress on Subnet 63 continues, though Bob acknowledged ongoing friction with validators. He explained that the team has iterated multiple times on subnet design in response to validator feedback, often encountering shifting requirements.

The current strategy is to build and deploy compliant systems directly rather than seeking repeated pre-approval.

Planned challenges for Subnet 63 include:

a. Classical factoring benchmarks,

b. Peak circuit challenges recognized within the quantum research field, and

c. Docker-based submissions evaluated directly by validators.

Participants will be able to submit through OpenQuantum or as native Bittensor miners, with rewards paid in subnet $ALPHA or USD.

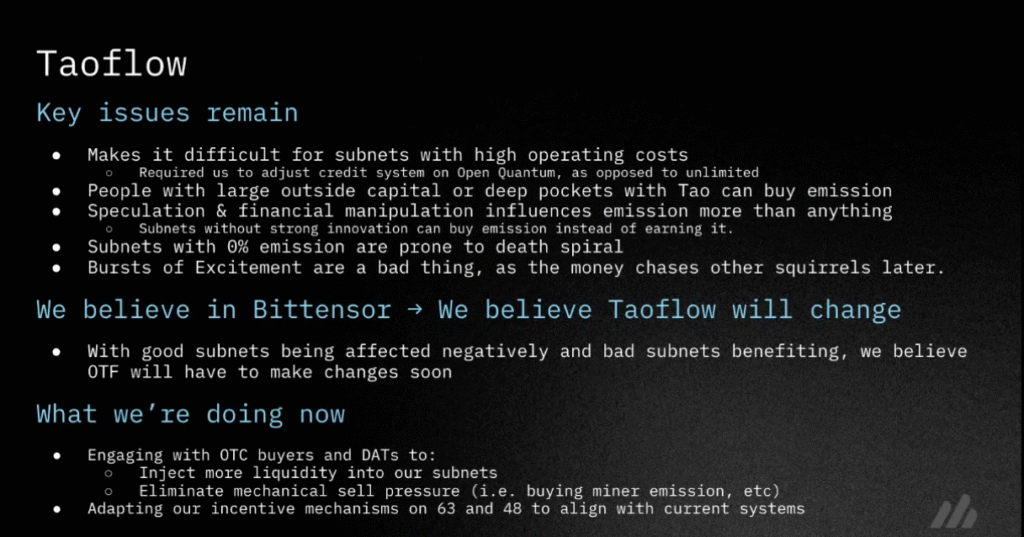

A Measured Perspective on Taoflow

Bob also addressed broader concerns around Taoflow, Bittensor’s incentive mechanism. While describing Taoflow as imperfect, he emphasized confidence in the ecosystem’s ability to iterate and improve.

He noted that Taoflow can be of disadvantage to subnets with higher operating costs and may amplify speculative behavior, but framed these issues as part of the network’s learning process.

In response, qBitTensor Labs is focusing on:

a. Longer term aligned liquidity sources,

b. OTC (Over-the-Counter) engagement to reduce mechanical selling pressure, and

c. Incentive structures designed to function within existing Taoflow constraints.

The goal, according to Bob, is to build resilience rather than chase short-lived attention.

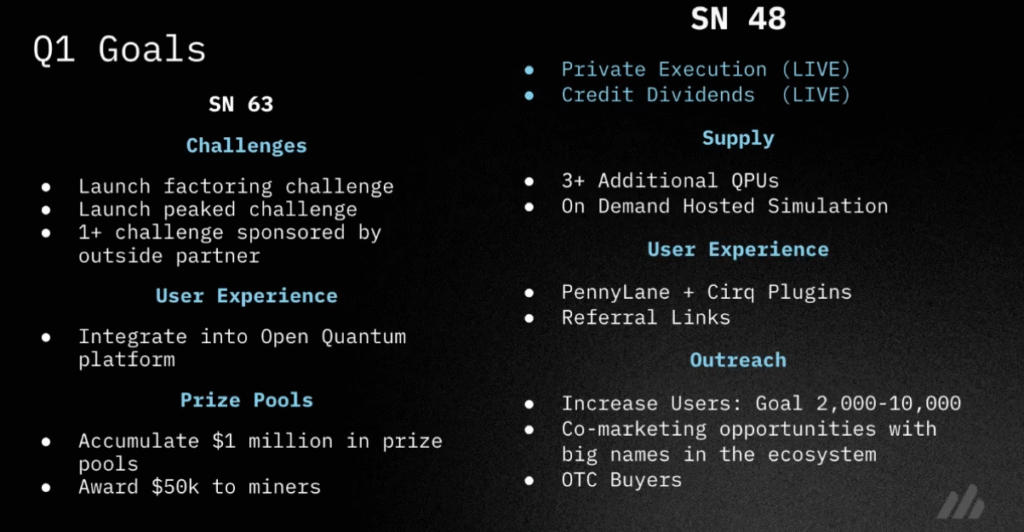

Q1 Priorities Centered on Execution

Looking ahead, Bob outlined clear execution focused goals for the first quarter of 2026.

For Subnet 63:

a. Launch of factoring and peak circuit challenges,

b. External sponsorship for challenge programs, and

c. Full integration into the OpenQuantum platform.

For Subnet 48:

a. Expansion of available quantum processing units,

b. On-demand hosted simulation,

c. Referral-based credit incentives, and

d. Gradual, deliberate user growth.

Communication, Bob noted, will remain measured to avoid volatility driven by speculative inflows.

What This Signals for Bittensor ($TAO)

This episode of qBitTensor live show highlighted a broader shift taking place across the Bittensor ($TAO) ecosystem. As the network matures, subnets are increasingly judged on their ability to generate real usage, revenue, and long-term value rather than narrative alone.

The session emphasized execution, discipline, and alignment with Bittensor’s evolving incentive landscape.

For $TAO holders and ecosystem participants, the message is that infrastructures that survive market cycles will be built deliberately, not rushed.

Be the first to comment