By: CryptoZPunisher

Introduction – Why this wallet exists

Bittensor is not a static protocol. It is not simply a collection of subnets placed side by side. It is an adaptive system, where value emerges through selection, not narrative.

This wallet was born from a simple question:

What if a wallet could evolve alongside Bittensor, without being constantly modified?

In my previous experiments, wallets were largely static, only adjusted when a subnet was deregistered from the network. This new approach introduces a deliberate evolutionary dimension, while remaining strictly constrained.

The goal is not constant movement, but slow, measured adaptation driven by data.

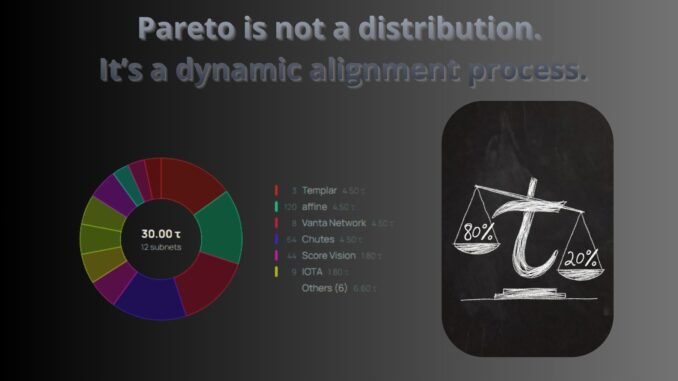

The principle: Pareto as a method, not a dogma

Pareto is not a magic number (80/20). It is a process.

In complex systems:

- a minority of structures produces the majority of value,

- but we do not know which ones in advance.

Bittensor operates in exactly this way:

- dozens of subnets explore,

- a few will survive,

- even fewer will become structural.

This wallet does not try to predict winners. It aims to let the market reveal them.

A living wallet, under constraints

An adaptive system needs constraints in order to learn.

From the start, I set simple and explicit rules:

- Initial capital: 30 TAO

- Maximum number of positions: 12

- No future TAO injections

- Any entry implies an exit (SN)

- Slow rebalancing (maximum once per month)

The wallet is alive, but disciplined.

The data used (and what will come next)

At this stage, the wallet mainly relies on:

- emission capture (market signal),

- relative stability,

- observable real activity (code, product, execution).

Additional data will be integrated over time:

- revenues,

- real usage,

- stake concentration,

- resilience beyond emissions.

This wallet will evolve with data, not against it.

Initial selection: 12 subnets

The initial selection is based on a simple threshold:

subnets capturing more than 1% of emissions in a meaningful way.

This does not mean all of them will survive. It simply means they are audible to the market today.

These 12 subnets form the wallet’s active universe.

Capital allocation: controlled asymmetry

The 30 TAO capital is allocated following a simple Pareto logic:

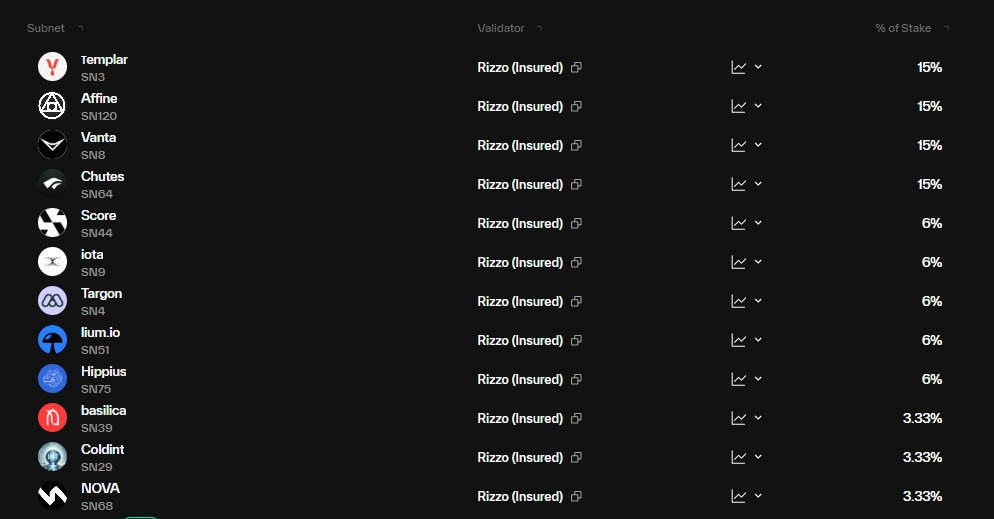

🟢 Core — 60% (18 TAO)

Subnets that appear the most structural today:

- SN 64 Chutes — 4.5 TAO

- SN 120 Affine — 4.5 TAO

- SN 8 Vanta — 4.5 TAO

- SN 3 Templar — 4.5 TAO

🟡 Growth — 30% (9 TAO)

Strong signals, but still more cyclical:

- SN 4 Targon — 1.8 TAO

- SN 9 Iota — 1.8 TAO

- SN 44 Score — 1.8 TAO

- SN 75 Hippius — 1.8 TAO

- SN 51 Lium io — 1.8 TAO

🔴 Options — 10% (3 TAO)

Asymmetric, experimental exposure:

- SN 29 Coldint — 1 TAO

- SN 68 Nova — 1 TAO

- SN 39 Basilica — 1 TAO

This allocation is not fixed. It is designed to evolve slowly.

Validator choice

The wallet is delegated to Rizzo.

This choice is not driven by promises of maximum performance, but by deeper criteria:

- intellectual honesty,

- transparency,

- explicit commitment not to copy weights,

- alignment with the spirit of Bittensor.

For my previous wallet, I chose Round Table 21 for similar reasons. This continuity is intentional.

A fully assumed experiment

This wallet is not a product. It is not financial advice. It is not a promise of returns.

It is an experiment.

As often, I am the test subject of my own thinking.

This will likely be the last wallet of this kind that I build. It brings the total number of experiments to five since the end of November.

A follow-up covering all five experiments will be published once per month.

What this wallet is not

- This is not investment advice

- This is not a performance guarantee

- This is not an attempt to beat the market

Do your own research. Make your own choices. Take responsibility for your own decisions.

Conclusion – Aligning instead of predicting

Bittensor explores. Subnets explore. Validators explore.

This wallet explores too.

Not by trying to outsmart the market, but by attempting to move at its pace.

If this wallet succeeds, it won’t be because of a brilliant intuition. It will be because it let the system decide.

And if it fails, that failure will be part of the learning.

That is precisely why it exists.

Be the first to comment