If you have a powerful gaming computer with a good graphics card, it probably sits idle most of the day. What if that idle time could earn you money? That’s exactly what Nodexo does. It lets you rent out your GPU to people who need computing power for AI work.

On the flip side, if you’re training AI models or running large-scale computations, you normally pay companies like Amazon or Google Cloud enormous fees. Nodexo offers the same computing power for up to 80% less by connecting you directly to people with GPUs instead of going through big corporations.

Running as Subnet 27 on Bittensor, Nodexo is basically Airbnb for graphics cards. GPU owners make money when their hardware would otherwise sit unused. People needing computing power get cheaper access. And everything happens through a decentralized marketplace instead of one company controlling it all.

What Nodexo Actually Does

Nodexo is a marketplace that connects two groups of people. On one side are individuals and companies with powerful GPUs that they’re not using all the time. On the other side are developers, researchers, and companies who need massive computing power to train AI models, run simulations, or process large datasets.

The platform handles all the complicated parts automatically. GPU owners install software that makes their hardware available for rent. People who need computing power browse available GPUs, pick what they need, and start using it within seconds. Payment happens automatically through the system.

The key innovation is verification. When you rent computing power, how do you know you’re actually getting what you paid for? Nodexo uses something called Proof-of-GPU, which cryptographically proves the hardware is real and actually doing the work you requested.

This matters because, without verification, someone could claim to have a powerful NVIDIA H100 GPU but actually be running much weaker hardware. Or they could charge you for time they’re not actually providing. Proof-of-GPU makes cheating impossible because the system constantly checks that the claimed hardware matches reality.

Everything runs on Bittensor’s blockchain, which coordinates payments, tracks who’s providing what, and distributes rewards. This decentralized approach means no single company controls the marketplace or can shut it down.

How This Beats Traditional Cloud Services

When you need computing power for AI work, you typically rent it from Amazon Web Services, Google Cloud, or Microsoft Azure. These services are reliable but expensive because you’re paying for massive data centers, corporate overhead, and profit margins.

Nodexo changes the economics by cutting out the middleman. You’re renting directly from individual GPU owners who were going to own that hardware anyway. They’re happy to earn money when it would otherwise sit idle. You get the computing power you need for a fraction of the normal cost.

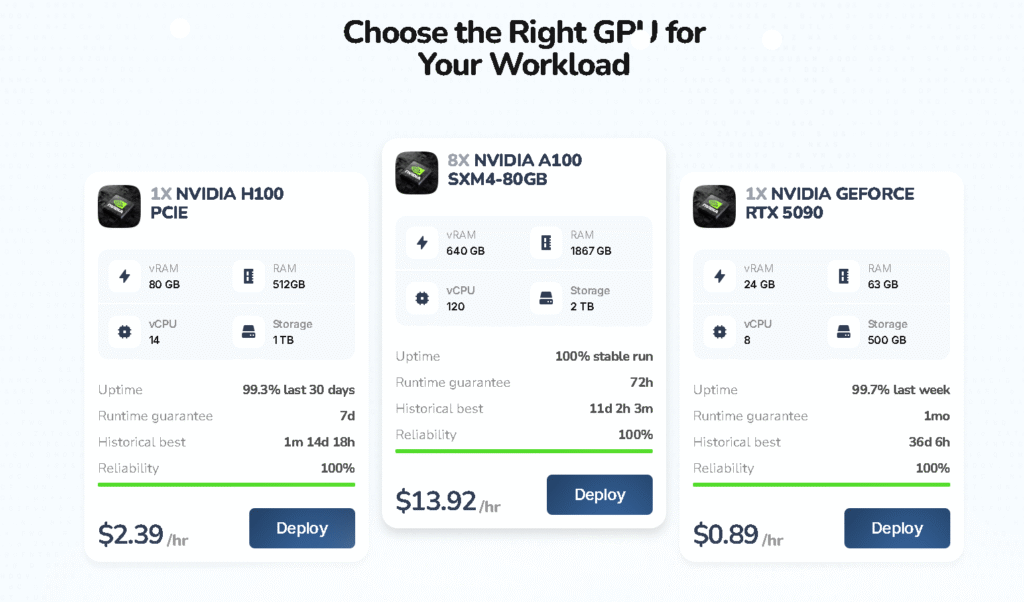

The platform claims up to 80% savings compared to traditional cloud providers. A high-end NVIDIA H100 might cost you $2.39 per hour on Nodexo versus $10+ per hour on AWS. For someone training large AI models that need days or weeks of computing time, those savings add up to thousands of dollars.

Speed is another advantage. With traditional cloud services, you often wait for provisioning, deal with minimum commitments, or navigate complicated setup processes. Nodexo lets you deploy AI models in seconds with instant access to computing power.

The verification aspect also matters. Traditional cloud providers are black boxes, because you trust they’re giving you what you paid for, but can’t verify it independently. Nodexo’s proof system lets anyone audit what’s actually happening. Everything is transparent and verifiable on the blockchain.

What Makes Nodexo Different From Centralized Options

The fundamental difference is centralization versus decentralization. Amazon, Google, and Microsoft own their data centers. They set prices. They decide who gets access. They can shut down your account or change the terms whenever they want.

Nodexo doesn’t own any data centers. It’s a peer-to-peer network where GPU owners and renters connect directly. No single company controls pricing or access. The rules are set by open-source code that everyone can see and verify.

This creates advantages beyond just cost. There’s no single point of failure, so if one GPU provider goes offline, others are available. No company can censor what you’re working on or decide your use case isn’t allowed. You’re not locked into one vendor’s ecosystem.

The open-source nature means innovation happens faster. When issues come up, the community can fix them. When improvements are needed, anyone can contribute. Traditional cloud providers move at corporate speed with corporate priorities. Decentralized platforms move at internet speed with user priorities.

Security works differently, too. Traditional clouds require trusting the company with your data and code. Nodexo uses encryption and isolated environments so GPU providers never see what you’re running. Your intellectual property stays protected even though you’re using someone else’s hardware.

Why Anyone Would Invest in the Alpha Token

The most obvious is utility value. As more people use Nodexo to rent GPUs, demand for alpha tokens increases because that’s how you pay for computing power. More usage means more token demand, which should drive prices up.

There’s also the buyback mechanism. Revenue from GPU rentals goes into a treasury that buys back tokens. This removes tokens from circulation, creating scarcity. Fewer tokens plus steady or growing demand equals upward price pressure.

If you’re providing GPUs or validating the network, you earn alpha tokens as rewards. This creates passive income opportunities. Your idle GPU earns you tokens that have market value. Or you can stake TAO tokens to support the network and earn a share of emissions.

The broader bet is on decentralized AI compute overtaking traditional cloud services. If that happens, if more people choose Nodexo-style platforms over AWS and Google Cloud, early token holders benefit tremendously. You’re essentially investing in infrastructure for the decentralized AI economy.

There’s also the Bittensor ecosystem effect. When Bittensor’s TAO token rallies (like the 27% gain in early 2026), successful subnets like Nodexo often benefit. Strong performance attracts more stakeholders to the subnet, which increases rewards, which attracts more participants, creating a growth cycle.

How Regular People Can Use Nodexo

Nodexo is designed to be accessible to regular people, not just tech experts, and here are the easiest ways to participate.

Renting GPUs for Your Projects is the simplest if you need computing power. Go to console.nodexo.ai and sign up for free. Browse the available GPUs; everything from gaming cards like RTX 5090 at $0.89 per hour to professional hardware like NVIDIA H100 at $2.39 per hour.

Pick what you need, provision it with one click, and start working. The system comes with tools like PyTorch and TensorFlow already installed. You can train machine learning models, run AI inference, generate images, or do any compute-heavy task. Pay with alpha tokens or stablecoins like USDC. No contracts, start and stop whenever you want.

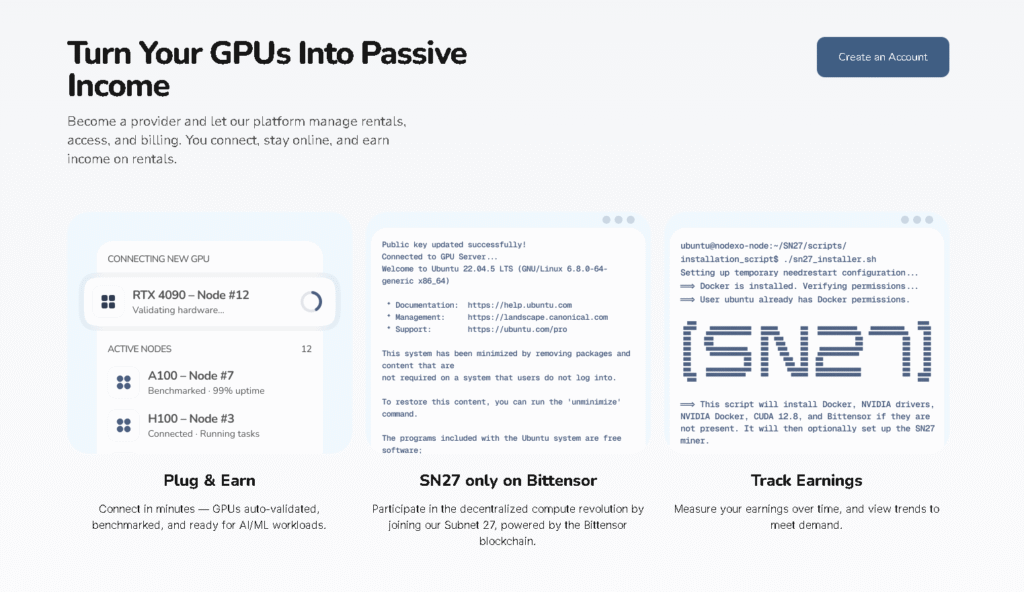

Providing your GPU to earn money works if you have decent hardware sitting idle. This is ideal for gamers whose expensive graphics cards only get used a few hours a day, or anyone with professional GPUs they’re not using full-time.

Download the miner software from GitHub, install it on your computer, and create a Bittensor wallet. The software automatically validates your GPU using Proof-of-GPU verification, benchmarks its performance, and lists it for rental. When someone rents your GPU, you earn payments automatically.

You get paid in two ways: directly from people renting your hardware, and through TAO token emissions as rewards for providing quality service. The platform tracks everything and handles payments, even converting to your local currency if you want. All you do is keep your computer running and connected.

Staking for Passive Income is the option if you don’t have GPUs but hold TAO tokens. You can stake your TAO on Subnet 27 to support the network. This is completely passive, so you’re not running any hardware or managing anything.

Stakers earn a share of the subnet’s emissions based on how much they’ve staked. The more successful Nodexo becomes, the more valuable those emissions are. It’s like earning dividends from the network’s activity without active participation.

All three options have detailed guides in Nodexo’s documentation. The setup is more technical than using a regular website, but the community helps newcomers and there are step-by-step instructions for everything.

The Bigger Picture for Decentralized AI

Nodexo represents a shift in how computing power works. Right now, a handful of massive corporations control access to the GPUs needed for AI development. They set prices. They decide who gets access. They can cut you off whenever they want.

This centralization creates problems. Small companies and individual developers can’t afford the computing power they need. Researchers in countries without access to these services are locked out. Anyone working on controversial topics risks losing access if the corporation disapproves.

Decentralized compute markets like Nodexo change this dynamic completely. Computing power becomes a commodity that anyone can provide and anyone can access. No gatekeepers. No arbitrary restrictions. Just a market where supply meets demand.

The economic implications are significant. All those idle gaming GPUs and spare professional cards could become productive assets earning their owners money. The total computing power available for AI work could increase dramatically without building any new data centers.

For AI development, democratizing access to compute means more innovation from more diverse sources. A researcher in Africa with a great idea but no budget can access the same GPU power as a well-funded Silicon Valley startup. The playing field levels.

Whether Nodexo specifically becomes the dominant platform matters less than the model proving viable. If decentralized GPU marketplaces work, more will emerge. Competition will drive improvements. And the stranglehold big cloud providers have on AI compute will weaken.

The project is still young; it launched in late 2024 and has continued improving with updates like Proof-of-GPU v3 in January 2026 and Nodexo 2.1 with better payouts and onboarding. Challenges remain around scaling, maintaining quality, and competing with the convenience of established cloud providers.

But the core value proposition is solid: cheaper compute for users, income for GPU owners, and no central authority controlling access. That’s compelling enough to drive real adoption if the execution continues improving.

Website: nodexo.ai

Check out their GitHub at github.com/neuralinternet

Follow @nodex0_ on X

Be the first to comment