by James Altucher.

The below press release describes how a publicly listed company IN NORWAY is now pursuing a strategy of buying Alpha tokens and they already have 1,000 TAO on their balance sheet.

You can read the press release below but a couple of things I find interesting.

A) Every country is going to have to have at least one public company devoted to buying $TAO.

People are going to want exposure to TAO on a secure regulated equity market. As much as I am a believer in DeFi, its still too complicated for the average retail investor. Hence the need for these treasury companies that are public.

If you want exposure to TAO in whatever the equivalent is of a 401k in each country, you’ll have to do it through a public company.

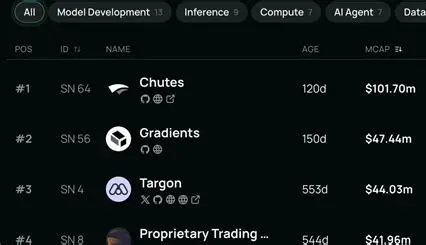

B) They are buying Alpha tokens.

I think this is the FIRST public company that has announced in their initial press release that they will not only be buying TAO but buying the subnet tokens as well.

C) They are also doing this as a service for hedge funds.

This is very interesting. NBX is in the business of buying crypto for institutions. So their interest in TAO comes not from any philosophy about decentralized AI but because large financial institutions ARE ASKING THEM TO BUY TAO.

And what’s interesting is, not only are they buying TAO, but the institutions are asking them to buy Alpha tokens.

This is a very interesting development and I am sure its not unique to Norway. I’ll keep following what is going on.

Here is the press release they just released:

https://www.nordnet.no/market/news/faf2860e-8d50-48d8-aa93-5152e1d5e3da

NBX: Norwegian Block Exchange (NBX) Establishes TAO Treasury Strategy to Facilitate Trading of Subnet tokens

i går kl. 10:30 ∙ Oslo Børs

OSLO, NORWAY - August 20, 2025 - Norwegian Block Exchange AS (NBX), a leading

Nordic crypto service provider and first Norwegian listed active Bitcoin

treasury company, has obtained TAO to hold on its balance sheet.

Being the first publicly listed active Bitcoin treasury company in Norway has

been a strategic enabler and the proof-of-concept is generating revenue for the

company that will increase in the second half of the year. Consequently, the

company announced today that is has obtained 1000 TAO from associated owners and

board members Vegard Kristiansen and Ingvild Kjerkol (Per Øyan AS). The TAO will

improve NBX' operations within the Bittensor ecosystem and provide income.

NBX is already custodian and main trader for several hedge funds that operates

in the digital asset space. Some has recently approached NBX to buy and hold TAO

on our insured and secured OTC / custodian platform, in addition to the native

Alpha tokens associated with the subnets operating within the Bittensor

ecosystem. NBX is in the process of facilitating the first purchase of alpha

tokens for these funds and will be a trusted, secure, efficient low-cost entry

into various subnets. Being a publicly listed Norwegian company with an E-money

licence, NBX can provide a regulatory safe on-ramp and off-ramp for subnets that

leverages decentralised AI to solve real-world issues such as inference and

weather prediction. Subnets and institutions are encouraged to reach out to

participate in the proof-of-concept.

The company is dedicated to evaluating these initiatives in a responsible

manner. As decentralised AI evolves into a more social and desirable alternative

to centralised AI, institutions will follow in allocating to TAO and Alpha

tokens. A listed, secure and regulated custodian is essential. NBX operates in

all countries not on a sanction list.

Be the first to comment