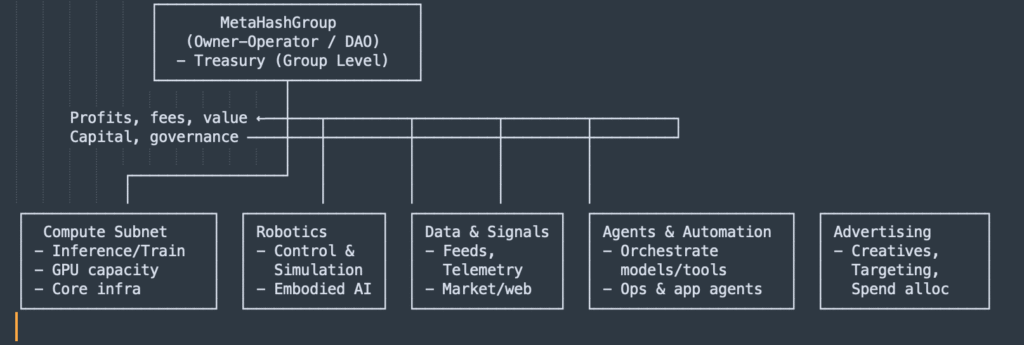

MetaHash, Subnet 73 on Bittensor, has announced a major rebrand to MetaHash Group (MHG) alongside an aggressive expansion strategy. The team plans to acquire and operate five additional subnets focused on compute, robotics, data and signals, agents and automation, and advertising.

The core structure is simple. All profits generated by the acquired subnets will be routed back to Subnet 73, creating a single treasury designed to compound capital and fund further acquisitions. MetaHash stated it intends to begin with reserved subnet slots, starting around slot 109, and to work directly with GPU providers to scale operations.

This positions MetaHash Group as one of the first subnet conglomerate strategies within the Bittensor ecosystem. Rather than operating a single vertical, Subnet 73 would act as a holding layer coordinating multiple revenue-generating subnets.

Community reaction has been mixed. Supporters view the move as a strong post-halving strategy that prioritizes capital efficiency and long-term growth, especially after Bittensor’s December 2025 halving reduced daily emissions. Critics have raised concerns about centralization risk, arguing that one entity controlling multiple subnets and consolidating profits may conflict with Bittensor’s decentralized and competitive design. Some prominent community members have openly questioned governance, trust, and accountability under this model.

If successful, MetaHash Group could emerge as a powerful economic hub within Bittensor, spanning multiple high-value AI verticals under a single treasury. If it fails, it may intensify ongoing debates around decentralization and subnet concentration.

Attention is now on how the plan is executed, whether governance safeguards emerge, and how the market responds to Subnet 73’s alpha token in the coming weeks.

Be the first to comment