Bittensor offers opportunities to earn passive income by staking TAO tokens on validators and subnets. The problem is that doing this well requires constant research, monitoring dozens of validators, tracking over 100 subnets, and manually rebalancing your positions as things change.

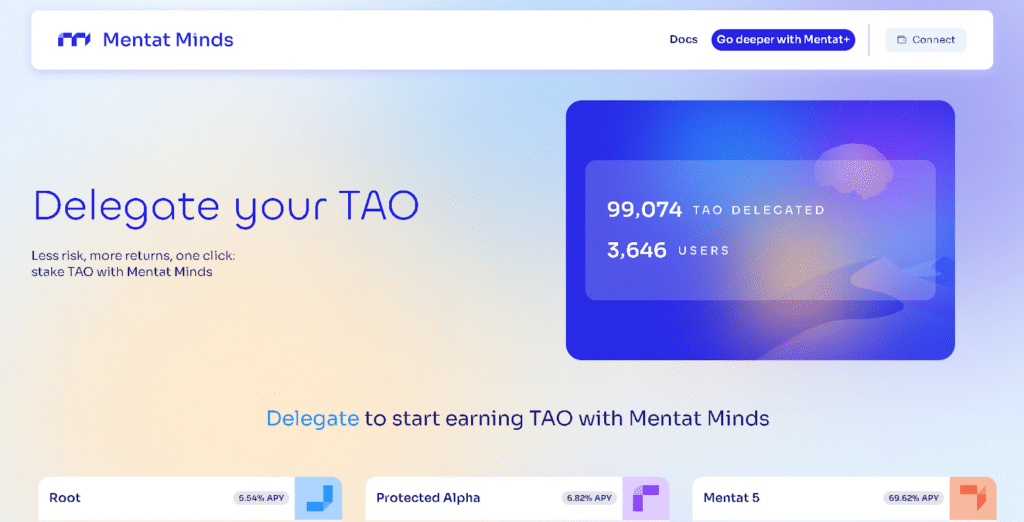

Most people don’t have time for that. Mentat Minds solves this by handling everything automatically. You delegate your TAO tokens to them, they invest across the best validators and subnets, and you earn passive income without lifting a finger.

Think of it like the difference between picking individual stocks versus buying an index fund. You can do all the research yourself, or you can let professionals handle it while you collect returns.

What Mentat Minds Actually Does

Mentat Minds is a delegation service built specifically for Bittensor. They offer several “set-and-forget” investment products that automatically stake your TAO tokens for passive income.

The keyword is “non-custodial.” Your TAO never leaves your wallet. You’re not sending money to Mentat Minds to hold. Instead, you delegate through a staking proxy that lets them manage investments while you maintain full control. You can withdraw at any time with no waiting period.

Here’s what they handle for you. They continuously monitor the Bittensor network to identify the best-performing validators and subnets. They automatically allocate your TAO across these opportunities based on different strategies. They rebalance positions as market conditions change. They manage all the technical complexity, like token conversions, transaction fees, and slippage. And they reinvest your rewards to maximize compounding.

All of this happens without you needing to understand how Bittensor’s validator system works, which subnets are performing well, or when to rebalance your positions. You just connect your wallet, choose a strategy, and earn.

The Different Investment Options

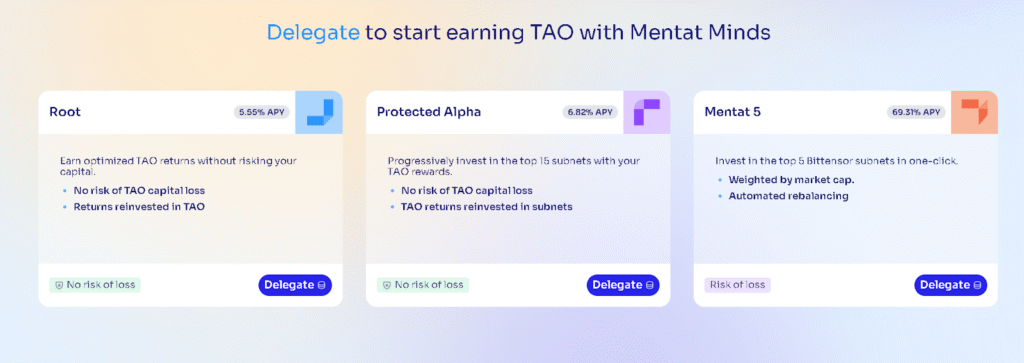

Mentat Minds offers several products with different risk and return profiles.

Root Indexes are the baseline option. Your TAO stays as TAO and gets staked with optimized validators on Bittensor’s root network. This earns around 5-7% APY. The key advantage is no capital risk, because your principal amount of TAO doesn’t decrease. You’re just earning rewards on top of what you already have. This is similar to earning interest in a savings account but with higher returns.

Protected Alpha Indexes offer a balanced middle ground. Your original TAO stays safe, but the rewards you earn get progressively invested into the top-performing subnets. This lets you gain exposure to higher-yield subnet tokens without risking your initial investment. You earn around 6-7% APY, and if subnet tokens appreciate, you benefit from that upside too.

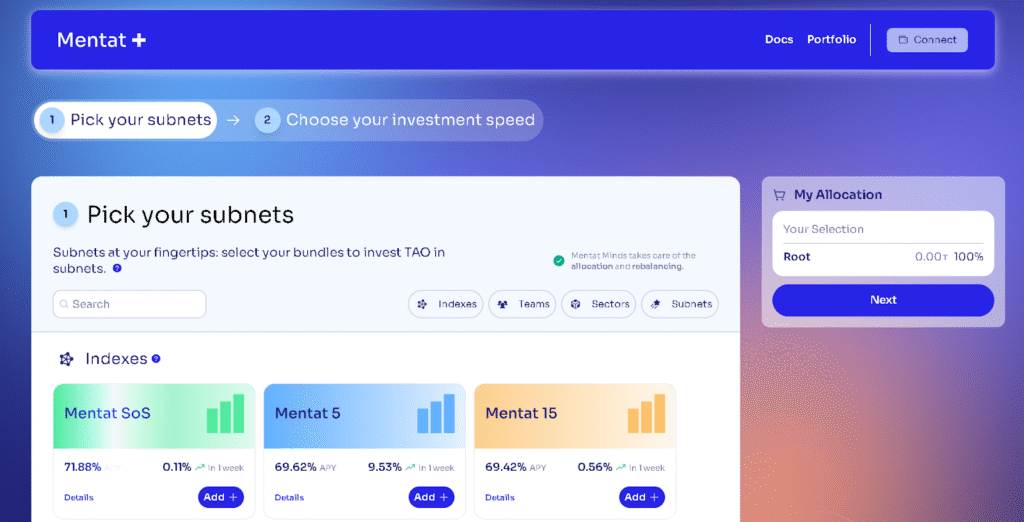

Mentat 5 is the high-yield strategy. This invests your TAO across the top five subnets by market cap, automatically rebalancing as rankings change. Current yields are around 70% APY. The catch is that your TAO gets converted to subnet alpha tokens, which means your principal can fluctuate with market prices. Higher returns, higher risk.

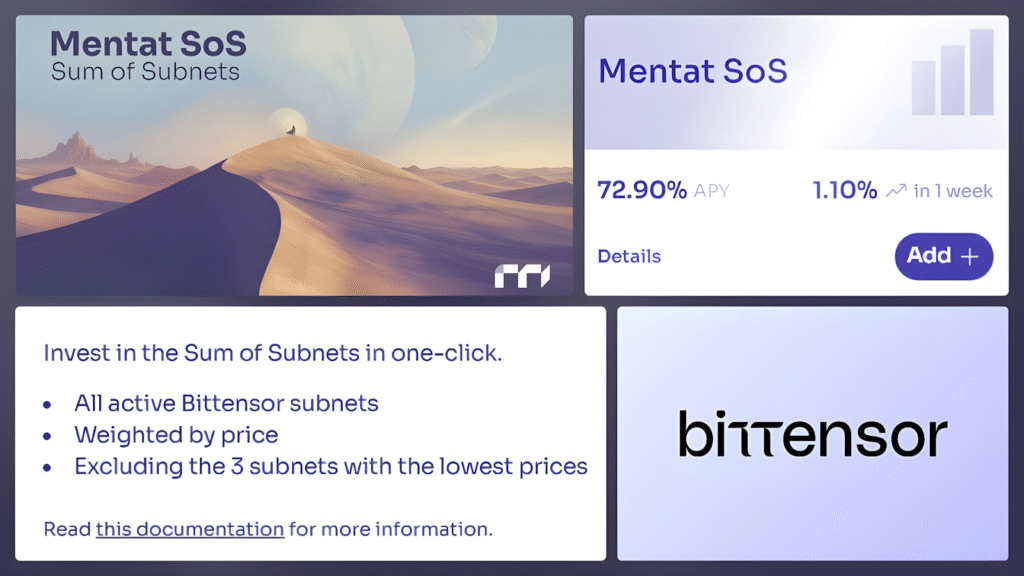

Mentat SoS (Sum of Subnets) is their newest product. This invests across all active Bittensor subnets except the bottom three by price, giving you maximum diversification. It’s price-weighted, meaning you have more exposure to established subnets but still capture upside from smaller ones. Current APY is around 72%. This is for people who believe in Bittensor’s overall growth but don’t want to bet on specific subnets.

Why Sum of Subnets Is Interesting

Since its launch in late January 2026, the SoS product has been getting attention because it solves a specific problem. With Bittensor, you’re basically betting on which AI subnets will succeed. But nobody really knows which ones will win. Some will do amazing, others will fail completely.

Rather than trying to guess winners, SoS bets on all of them. If Bittensor as a whole succeeds and adoption grows, you benefit regardless of which specific subnets lead the way.

It’s like buying a mutual fund of all tech stocks instead of trying to pick whether Apple or Microsoft will do better. You get the whole market in one investment.

The 72% return comes from subnet rewards. As subnets earn TAO for their work, some of those earnings flow to people who invested in them. Mentat Minds collects these rewards for you, handles all the conversions between different tokens, and rebalances everything automatically.

To use the Sum of Subnets strategy, you won’t find it on the basic home dashboard. You need to navigate to the “Mentat+” tab after connecting your wallet. Mentat+ is their advanced suite designed for diversified bundles.

Once there, simply locate the “Sum of Subnets” strategy card, which is pre-configured to track the market. From this same interface, you can also build your own custom index if you prefer to hand-pick specific subnets.

How This Beats DIY Investing

You could do all of this yourself manually. Bittensor is open and decentralized; anyone can stake directly. But it’s incredibly tedious.

If you wanted to replicate what Mentat SoS does, you’d need to research over 100 active subnets to understand what they do and how they perform. You’d need to decide how much to put in each one, figure out how to buy each subnet’s specific token, monitor everything constantly to see which subnets are doing well, manually sell losing positions and buy winning ones, deal with transaction fees and timing, and handle all the technical aspects yourself.

Most people don’t have time to become Bittensor experts. Even if you have time, there’s a learning curve. Making mistakes, like staking with bad validators or buying into failing subnets, can cost you money.

Mentat Minds handles all of this automatically. Their team monitors the network full-time. They’ve built automated systems that react faster than any individual could. They have data and analytics that most users don’t have access to. And they manage risk across portfolios in ways that would be complicated to replicate manually.

The cost for this service comes from the fees they charge, which are built into the APY numbers shown. So if they say 70% APY on Mentat 5, that’s your net return after their fees are deducted.

The Risks You Should Understand

Nothing in crypto is risk-free, and Mentat Minds is no exception. The biggest risk is market volatility. When you use strategies like Mentat 5 or SoS, your TAO gets converted to subnet alpha tokens. If those tokens lose value, your principal decreases even though you’re earning high APY. You could earn 70% APY but lose more than that if the tokens crash.

This is less of an issue with Root Indexes, where your TAO stays as TAO. The tradeoff is lower returns.

There’s also smart contract risk. While Mentat Minds is non-custodial, you’re still interacting with their staking proxies and systems. If there’s a bug or vulnerability, it could affect your funds.

Bittensor itself is an evolving technology. The network could change in ways that affect returns. Subnets can fail or lose value. Validators can have issues.

And like all crypto, regulatory uncertainty exists. Laws around staking and DeFi vary by jurisdiction and could change.

The key is only investing money you can afford to lose completely. Treat this like high-risk investing, not a savings account. Start with smaller amounts to understand how it works before committing large sums.

Who This Is Actually For

Mentat Minds works best for specific types of users. If you believe in Bittensor long-term but don’t want to actively manage investments, this is ideal. You can gain exposure to the ecosystem without becoming an expert.

If you have TAO sitting idle in your wallet, staking through Mentat Minds puts it to work earning passive income rather than just holding.

If you want high yields but don’t have time to research and monitor subnets yourself, paying for professional management through built-in fees makes sense.

If you’re risk-averse, the Root Indexes option gives you steady returns without the volatility of subnet tokens.

If you’re willing to take risks for higher returns, the aggressive strategies offer yields that beat traditional finance by massive margins.

What it’s not good for is people who want maximum control and enjoy actively managing their investments. Manual staking lets you make every decision yourself, but requires constant attention.

It’s also not good for people who don’t understand crypto risk at all. You should at least know that crypto is volatile, and you could lose money before using any staking service.

Getting Started

You can get started by buying TAO tokens on an exchange. Then, set up a TAO wallet, visit mentatminds.com, and connect your wallet. Review the different strategy options and their current APYs, choose one that fits your risk tolerance and goals, delegate your TAO through their platform, and monitor your earnings through their dashboard.

The whole process takes maybe 30 minutes if you’re starting from scratch with no existing wallet or TAO. If you already have TAO, it’s more like 10 minutes.

From there, it’s truly passive. Check in whenever you want to see earnings, but no action is required unless you decide to change strategies or withdraw.

For people who’ve been interested in Bittensor’s high yields but put off by the complexity, Mentat Minds removes the main barrier. You get professional management, automatic optimization, and competitive returns without needing to become a Bittensor expert yourself.

Website: mentatminds.com

Check out their documentation at gitbook.io/mentat-minds

Follow @mentatminds on X

Be the first to comment